Alphabet Inc., the parent company of Google, has kicked off a major debt‑market initiative to secure its dominance in the intelligence age. The company is targeting roughly $15 billion from a U.S. corporate bond sale. This is part of a broader, multi‑currency funding strategy that includes rare 100‑year bonds, as it prepares for unprecedented capital expenditures north of $185 billion in 2026.

Also Read: MrBeast’s Beast Industries Acquisition of Step App Transforms Gen Z Fintech

How Alphabet’s Bond Issuance and 100‑Year Bonds Drive AI Spending

The introduction of rare 100-year bonds is a move that effectively locks in capital for the next century. These ultra‑long maturities are exceptionally rare in the tech sector. However, they show both Alphabet’s confidence in its long‑term business model and investors’ willingness.

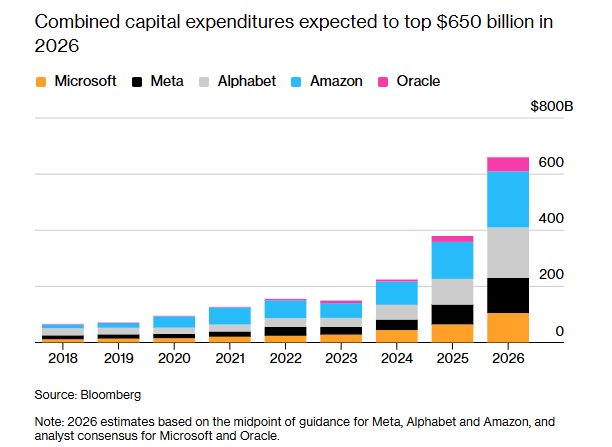

In the chart below, Alphabet’s capital spending will accelerate strongly in 2026. The expenditure will exceed the total of the past three years combined.

Also Read: Ripple’s $50B Valuation Rockets It Into Global Unicorn Elite

Debt issuance of this kind is typically reserved for institutions with unwavering credit stability. However, unlike traditional debt used for stock buybacks, this Alphabet bond issuance is framed as a growth strategy.

Gordon Kerr, European macro strategist at KBRA said:

They want to tap every kind of investor possible from the structured finance investor to the super long-dated investor. The main buyer of the 100-year bond would be insurance companies and pension funds, and the guy who underwrites it is probably not going to be the guy who’s there when it gets repaid.

Analysts expect hyperscalers to borrow $400 billion, up from $165 billion in 2025. This borrowing spree will act as a catalyst, driving total high-grade debt issuance to a projected $2.25 trillion this year, an 11.8% increment from 2025.

Also Read: XRP: Leaked Email Shows How Ripple Caught Top Investors’ Eye

Ultimately, in the race for AI, the winner may not be the one with the best code, but one with the most durable balance sheet. With this massive capital injection, Google is accelerating to the finish line.