The US Treasury Department has issued a sweeping new Venezuela oil license, authorizing general oil and gas exploration as well as production activities in Venezuela. These operations were previously frozen under years of restrictive measures. This move represents the most significant US sanctions easing in nearly a decade amid broader efforts to encourage foreign investment and stimulate output in Venezuela’s energy sector.

Also Read: Robinhood Chain Launches Ethereum Layer 2 for Tokenized Real‑World Assets

US Venezuela Oil License Opens Door for Exploration and Production

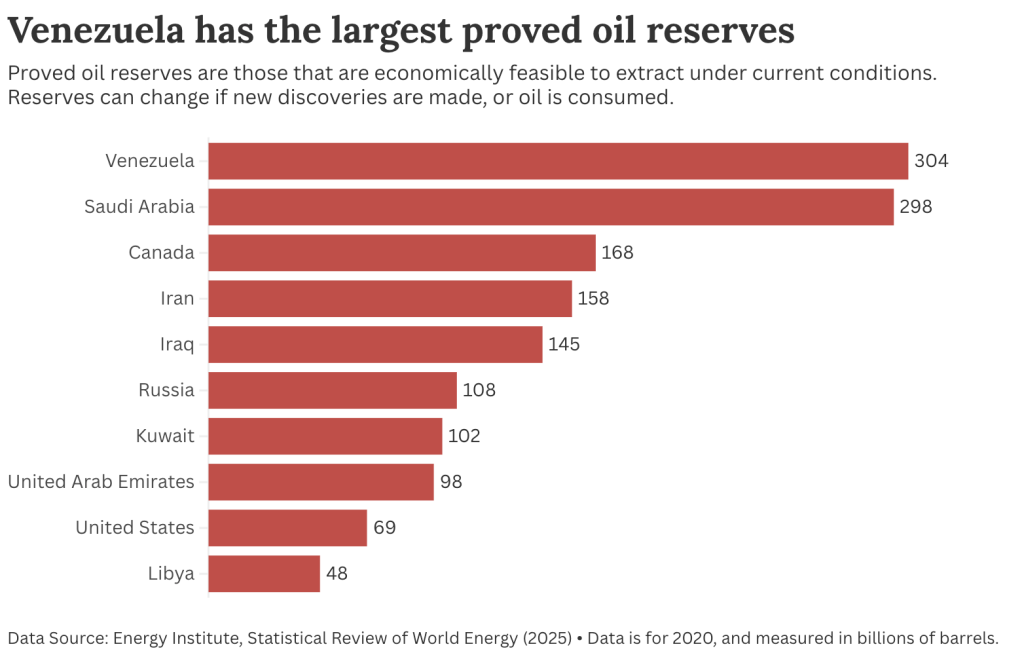

This development follows a series of policy moves by the US government geared toward relaxing restrictions on Venezuela’s oil industry. Venezuela is home to the world’s largest verified crude oil resource base. These oil reserves are more than five times the size of those held by the United States.

Also Read: Backpack Token Nears Unicorn Status After $50M FTX-Linked Raise

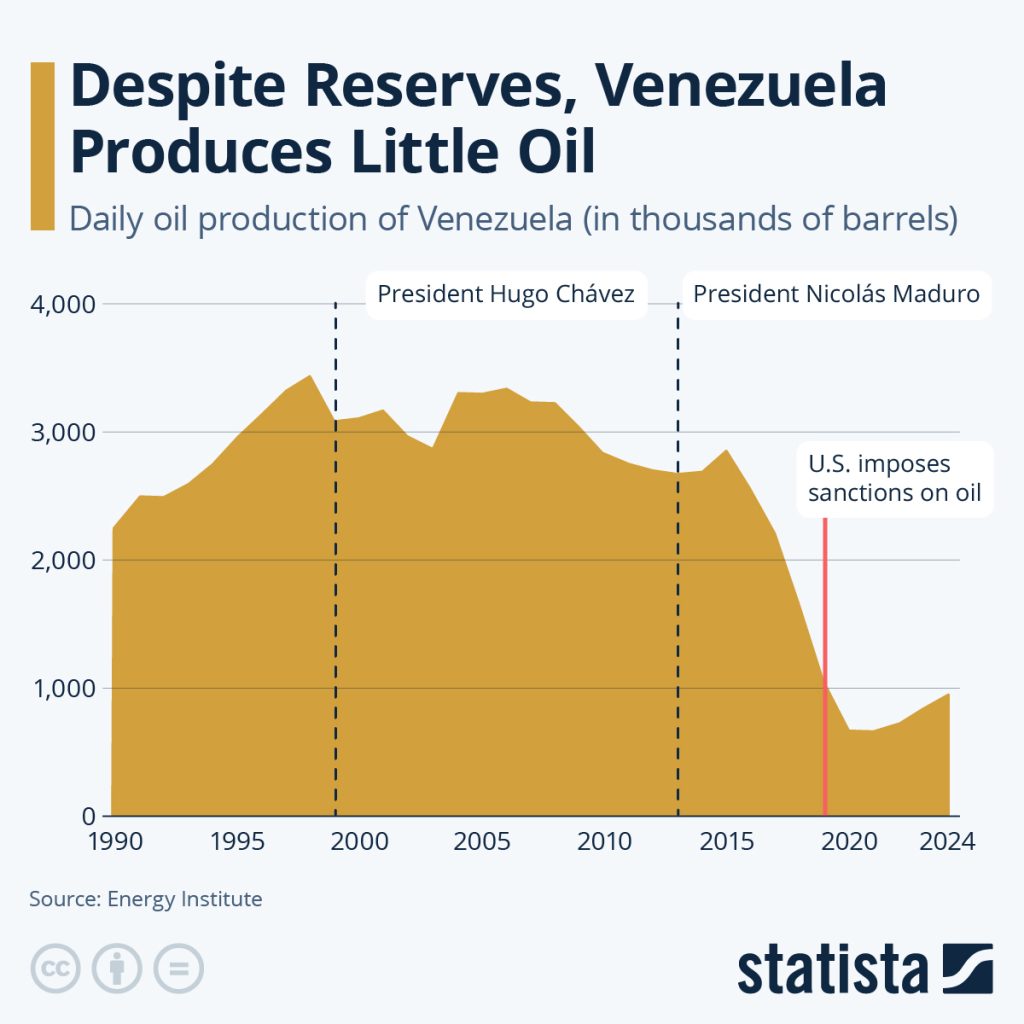

Despite being home to the largest oil reserves, its production fails to meet its full potential, constrained by years of underinvestment, sanctions, and deteriorating infrastructure. With the license, the US Energy Information Administration projects that Venezuela’s crude production, currently near 1 million barrels per day, could rise by up to 20% in the coming months as a result of the licensing and associated reforms.

The timing couldn’t have been more opportune as global markets grapple with supply uncertainties in key markets.

Implications for US–Venezuela Relations

The US is aligning its economic interests since it is no longer just sanctioning Venezuela. It is effectively overseeing its most critical industry. This means it holds the purse strings to Venezuela. With reduced reliance on other oil refineries, the birth of a Western-led energy corridor is inevitable.

Darren Woods, CEO, ExxonMobil said that:

If we look at the legal and commercial constructs—frameworks—in place today in Venezuela, today it’s uninvestable. And so significant changes have to be made to those commercial frameworks, the legal system, there has to be durable investment protections, and there has to be a change to the hydrocarbon laws in the country.

And if there are to be any changes, the US Treasury license requires that all contracts be governed by US law and all disputes be resolved in US courts. Critics argue that this undermines Venezuela’s long-term institutional development, making its recovery entirely dependent on Washington’s regulatory whims.

Also Read: Billy Markus Mocks Strategy’s Bitcoin Purchase as BTC Breaks 10 Year Trend

Will the laws change? Who knows. But for now, Venezuela is on the road to recovery.