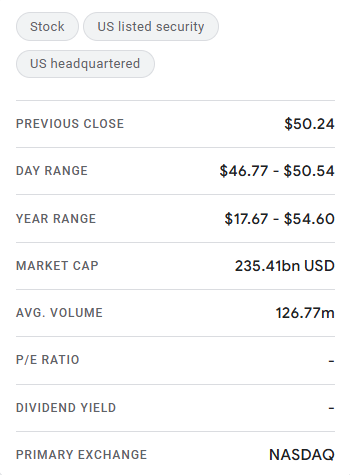

Intel stock price dropped 6.19% to $47.13 on Tuesday, with the intel share price falling from a previous close of $50.24. The decline came after the chipmaker announced a massive $100 billion investment plan aimed at expanding its manufacturing capabilities and AI chip production. Intel stock news today has been dominated by investor concerns over the financial strain this capital commitment could create, particularly given the company’s recent operational struggles.

Also Read: Vatican Launches Catholic Equity Indexes With Morningstar as Tokenized Assets Surge

Why Intel’s $100 Billion Investment Sparked Market Concerns

The announcement was met with immediate selling pressure as traders questioned whether Intel can execute such an ambitious plan. At the time of writing, Intel’s market cap stands at $235.41 billion, making this investment nearly half the company’s total value. The intel stock price has traded between $17.67 and $54.60 over the past year, reflecting significant volatility and also uncertainty about the company’s competitive positioning.

Financial Performance Raises Red Flags

Intel’s December 2025 quarter results paint a concerning picture for investors evaluating the intel stock forecast. Revenue came in at $13.67 billion, down 4.11% year-over-year, with net income swinging to a $591 million loss. The net profit margin collapsed to -4.32%, representing a 390.91% deterioration compared to the prior year period.

Also Read: Robinhood Chain Launches Ethereum Layer 2 for Tokenized Real‑World Assets

Trading Dynamics and Market Reaction

The stock traded between $46.77 and $50.54 during Tuesday’s session, with trading volume reaching 126.77 million shares. This represents significantly elevated activity as institutional investors repositioned their holdings in response to the news and also the latest financial results.

The intel stock analysis from market participants suggests deeper concerns about execution risk. The $100 billion investment plan includes building new fabrication facilities and also developing next-generation AI chips to compete with NVIDIA and AMD, but the timeline for returns spans multiple years.

Also Read: Backpack Token Nears Unicorn Status After $50M FTX-Linked Raise

What’s Next for Intel Stock Price

Analysts are reassessing Intel stock forecast models after the announcement and weak quarterly results. The intel share price faces ongoing pressure from competitive headwinds in the data center and AI accelerator markets, where Intel has lost significant ground to rivals. With no P/E ratio calculable due to negative earnings and also zero dividend yield, investors have limited reasons to hold shares during this uncertain turnaround period. The intel stock news today show that its trajectory will depend heavily on whether management can execute the investment plan without further diluting shareholders or straining the balance sheet.