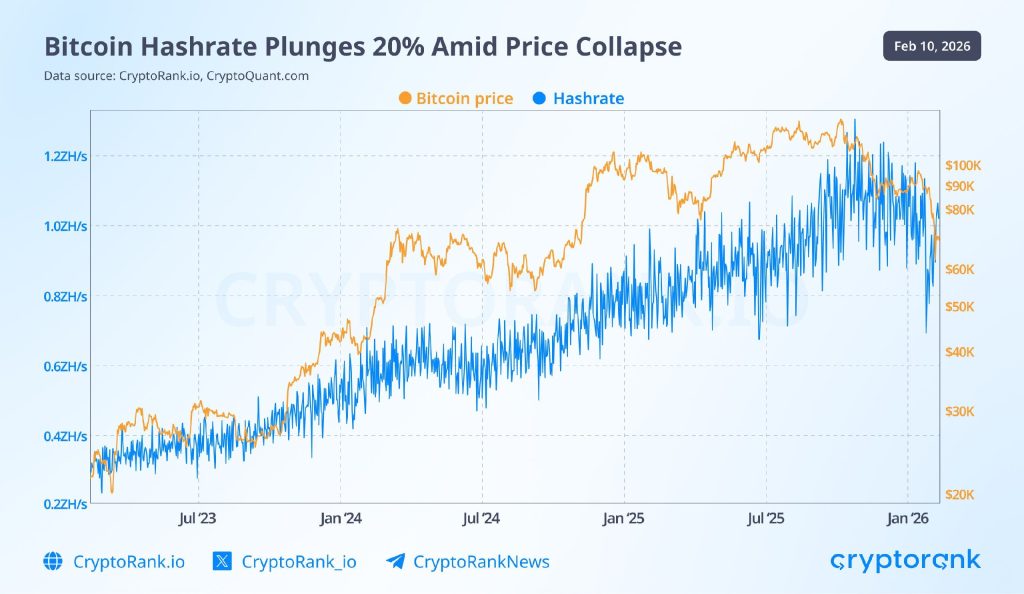

The world’s largest cryptocurrency, Bitcoin (BTC), has been under significant price pressure over the past few weeks. Adding to the strain, Bitcoin recorded the largest mining difficulty adjustment in years. The latest adjustment prompted a fall of nearly 11%. BTC hashrate also noted a nearly 20% drop.

Also Read: White House Held Crypto Market Structure Meeting as Stablecoin Negotiations Advance

How Bitcoin Difficulty Adjustment Impacts Miners and BTC Price Prediction

The latest Bitcoin difficulty adjustment appears to be driven by a sharp contraction in the total network hashrate. Some estimates suggest Bitcoin saw a roughly 20% hashrate drop. Several speculations suggest that this could be due to the plummeting prices of BTC. Following this, miners were forced to either shut down machines or reduce operations.

This, however, doesn’t directly impact Bitcoin’s price falls. But it does highlight stress in the mining sector, which can sometimes lead to short-term selling pressure. In addition, lower difficulty can boost profitability for miners that continue operating in the long run.

Shedding more light on Bitcoin’s latest difficulty adjustment, CryptoRank wrote:

“Bitcoin’s hashrate has dropped approximately 20% as mining profitability collapsed. Crashing BTC prices and Winter Storm Fern across 34 U.S. states triggered the largest difficulty adjustment since China’s 2021 ban. Many miners also shifted to more profitable AI data centers. Bitcoin’s self-correcting mechanism now rewards survivors with higher block rewards as inefficient operators exit.“

Also Read: Robinhood Stock Price Drops 8% After Earnings Growth Miss

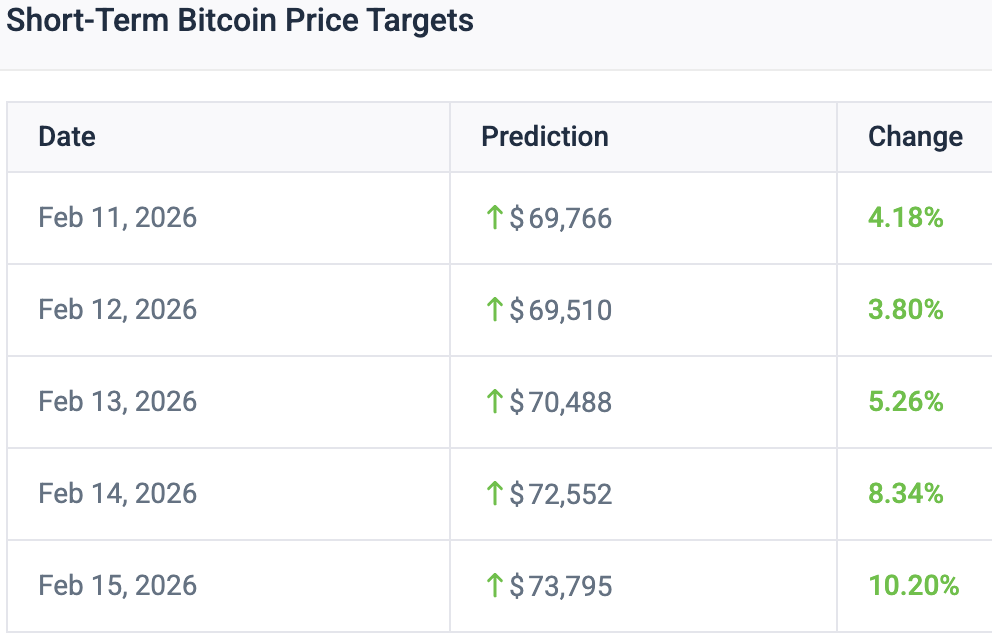

Amidst this, Bitcoin’s price continued to fall. The world’s largest cryptocurrency was trading at $66,913.19 following 2.58% decline in the past 24 hours. Just earlier today, the asset was trading at a high of $69,954.26 before dipping to a low of $66,561.24.

It should be noted that Bitcoin’s value has plummeted by nearly half of its all-time high. The king coin rose to a peak of $126,198.07 back in October, 2025. But the asset trades 47% below this high.

Bitcoin To Break Its Negative Streak

Bitcoin’s negative streak will most likely be disrupted this week. Data from CoinCodex reveals that the king coin will rise by a staggering 10% during the weekend. The asset is expected to trade at a high of $73,795 following a 10.13% increase from its current price level.

Lastly, Fundstrat’s Thomas Lee pointed out that Bitcoin has been a better store of value than gold. He even suggested that gold could underperform Bitcoin in 2026. Lee highlights how BTC has only underperformed inflation only 3% of the time, while gold has done the same 44% of the time. He concluded by saying:

“You don’t want to lose hope in BTC.”

Also Read: US Treasury Issues Venezuela Oil License to Boost Energy Output