While several were buying the Bitcoin (BTC) dip, Bhutan was on a selling spree. The royal government was previously making headlines for its BTC holdings. But in a new turn of events, Bhutan was in the spotlight for its Bitcoin sale.

According to recent reports, Bhutan’s government sold a staggering $6.7 million worth of BTC. This is part of the country’s continued Bitcoin liquidation strategy, as it is the third such weekly transfer. Bhutan has been sending excessive amounts of BTC to QCP Trading, a firm that is associated with trading and liquidity management.

Also Read: Dow Jones Stock Markets Futures Stabilize After Market Rout

Bhutan BTC Holdings Still Remain Significant

Despite Bhutan’s big Bitcoin sale, the country’s holdings remain substantial. Reports suggest that the royal government continues to hold nearly $372 million worth of Bitcoin. Unlike other nations, Bhutan acquired the king coin through state-backed mining operations and not seizures. Through this, Bhutan became one of the few countries that organically acquired Bitcoin by building reserves.

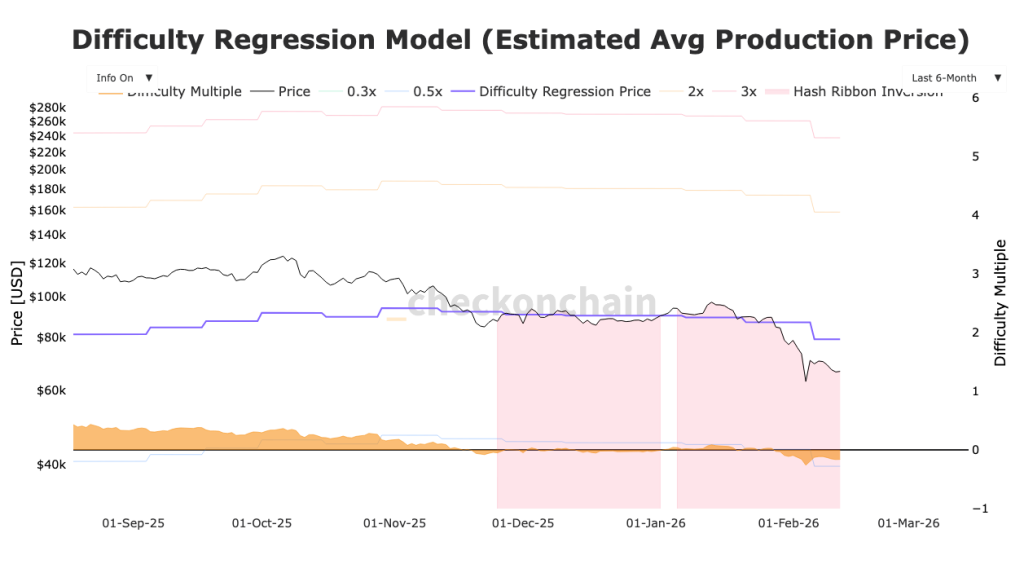

Bhutan’s Bitcoin liquidation plan stems from the post-halving mining slowdown. The April 2024 halving cut block rewards in half, which caused havoc in the market. While Bitcoin was expected to maintain steady growth post-halving, the asset was trading below the estimated production costs. Checkonchain pointed out that average production costs range between $79,000 and $87,000 per coin. This further prompted miners globally to pull back as they faced compressed margins.

In addition, Bhutan previously revealed plans to expand capacity alongside the prominent mining firm, Bitdeer Technologies. They were targeting up to 600MW of power. But things have taken a different turn following the post-halving mining slowdown.

Also Read: World Liberty Financial’s World Swap Enters $7 Trillion Remittance Market

Has Bhutan’s Bitcoin Sale Impacted BTC’s Price?

Amidst Bhutan’s Bitcoin sale, the world’s largest cryptocurrency continued to dip. At press time, BTC was trading at $66,428.09 following a 0.78% fall over the past 24 hours. The king coin recorded a rather dreadful month as it went from trading at a high of $97,860 to a low of $60,074. This marked a nearly 30% drop.

Also Read: CFTC Announces Innovation Advisory Committee, Includes Top Crypto CEOs