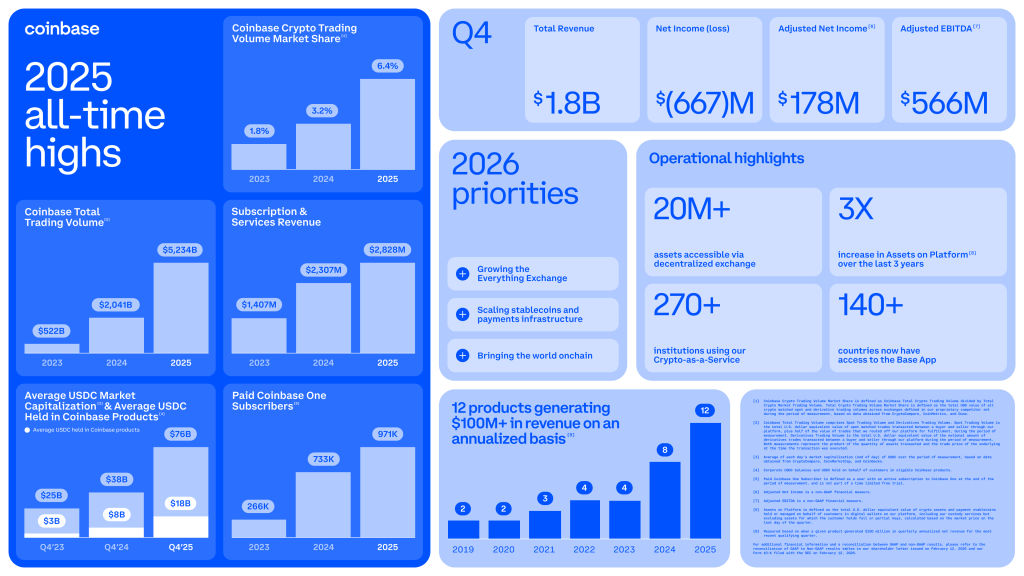

Coinbase Q4 earnings recently released reveal a complex picture of massive growth shadowed by a deep bottom-line deficit. The company celebrated a year of market share dominance and a surge in crypto trading volume and subscription services, but still reported an $842 million net loss for the quarter.

Alesia Haas, Coinbase CFO, stated:

“We executed consistently against our goals, delivering or outperforming our revenue and expense guidance every quarter, and extending our multi-year track record of profitability. We also drove growth and diversification of revenue, reaching 12 products that generate more than $100 million in revenue on an annualized basis.”

Also Read: Bhutan Sells Another $6.7M in Bitcoin as Mining Plans Stall

Inside Coinbase Q4 Earnings, COIN Stock Reaction, and Analyst Downgrades

Coinbase was supposed to reinforce its dominant position in a recovering digital asset market. Instead, the company’s Q4 2025 results triggered renewed volatility in Coinbase (COIN), highlighting a widening gap between top-line growth and bottom-line pressure.

Coinbase successfully delivered its all-time highs, proving its infrastructure remains the gold standard for institutional entry. In fact, its overall 2025 report is sparkling; $7.2 billion in revenue, a 9% increase from the previous year. And with such a clean balance sheet, one wonders how the swing to an $842 million loss came about.

Also Read: Dow Jones Stock Markets Futures Stabilize After Market Rout

This loss can be attributed to increased operational expenses, legal hurdles, and a shift in fee structures designed to maintain market share against low-cost competitors. Seeing the drawdown, analysts were quick to readjust their projections.

From the chart above, Coinbase appears to be well-versed in driving its earnings engine; however, when it comes to translating revenue momentum into consistent bottom-line profitability, the cracks begin to show.

Analysts at JPMorgan downgraded their price estimates for crypto exchange Coinbase. The bank’s analysts had earlier projected a $399 price target for COIN stock by the end of 2026. After the analysts’ downgrade, the stock plunged to 8% in after-hours trading.

Coinbase’s 2026 Outlook

Despite the immediate price correction, the Coinbase 2026 outlook remains focused on the long game. Investor sentiment weakened, which led to Brian Armstrong selling 5% stake of his shares. Asked whether Coinbase was headed for a crypto winter, Brian Armstrong, Co-Founder and CEO, Coinbase, stated:

“So, you know, in general, we don’t try to predict the future too much here. We see our job as just building great products and services for our customers, and then we leave the investment decisions to them. I will say that in general, I kind of enjoy these periods sometimes when the market is down, ironically, just because it allows us to keep building.“

Also Read: World Liberty Financial’s World Swap Enters $7 Trillion Remittance Market

The Q4 2025 results may not signal structural weakness, but they do remind investors of one thing: In crypto markets, momentum cuts both ways.