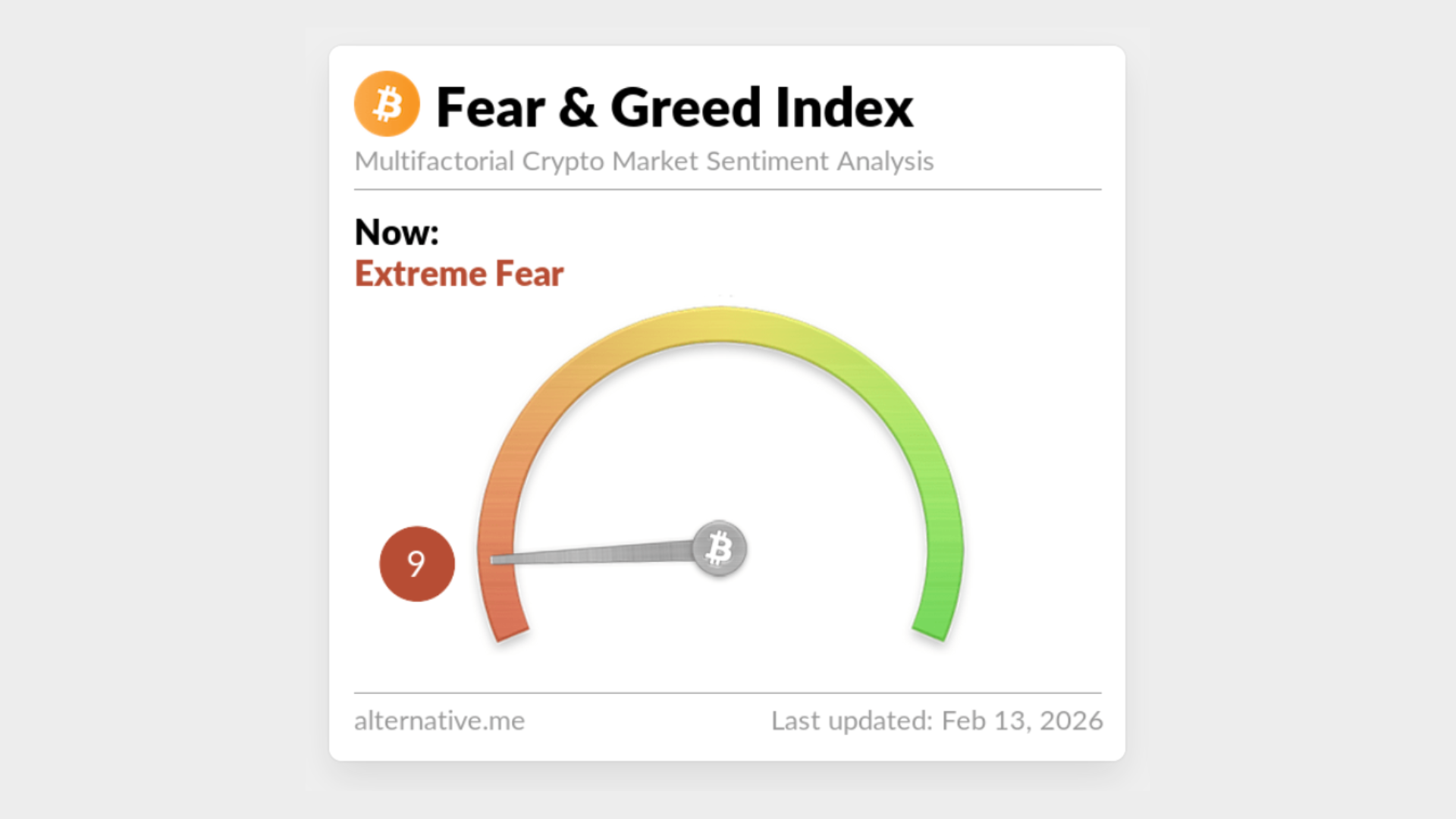

The Crypto Fear & Greed Index dropped rapidly in the past few days, hitting 5. The index is a reflection of the market sentiment, i.e., whether investors are fearful or greedy, which helps gauge the market conditions. It’s measured on a scale of 0-100, where 0 indicates extreme fear while 100 means extreme greed.

At the time of writing, the Crypto Fear & Greed Index has recovered slightly and now sits at 9, which still falls under the extreme fear territory. Factors driving this crypto market panic include economic and political uncertainties, as well as regulatory concerns.

Also Read: Coinbase Q4 Earnings Miss Sparks COIN Stock Sell-Off

Why Crypto Capitulation Creates Panic, Macro Pressure and Smart Money Entry

A crypto capitulation moment happens when traders sell off their holdings at a loss, fearing further price drops. This usually happens when they lose confidence that the market can bounce back.

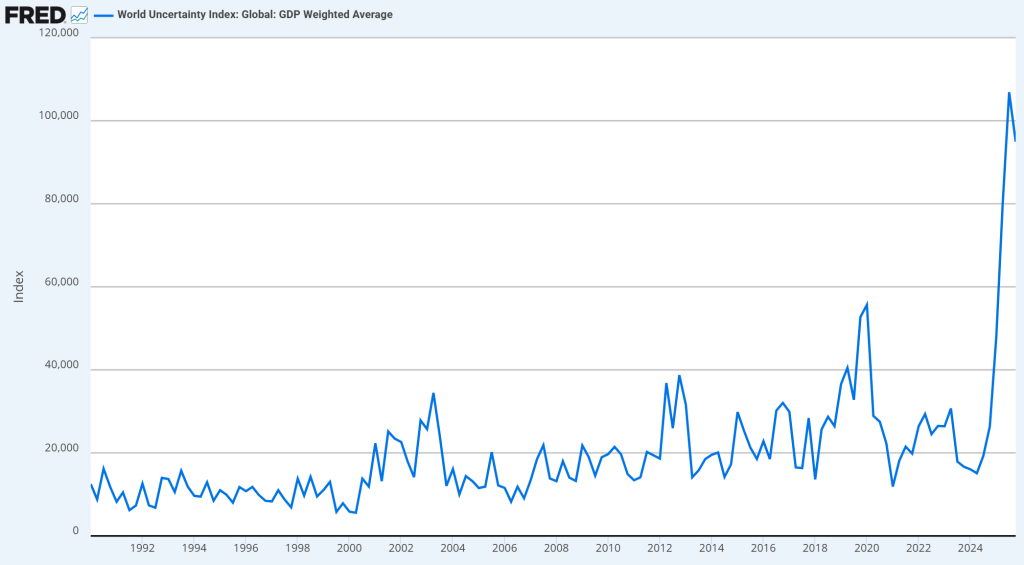

This extreme fear crypto environment is also often linked to geopolitical uncertainties. The World Uncertainty Index, a measure of global uncertainty, has surged to a record high, surpassing even the levels of the 2008 global recession.

According to many analysts, this crypto market panic, followed by sell-offs, is actually an opportunity for smart investors. It also acts as an entry point for smart money accumulation. Kyle Chassé, in a post on X, says,

“We saw single digits in 2018, March 2020, and post-FTX 2022. Every time, it marked a massive opportunity window.”

The Fear & Greed Index printed a 5 over the weekend.

— Kyle Chassé 🐸 (@Kylechasse) February 11, 2026

That’s “crypto was a mistake” fear.

We saw single digits in 2018, March 2020, and post-FTX 2022.

Every time, it marked a massive opportunity window.

No, it doesn’t guarantee the bottom.

But historically, peak fear is where… https://t.co/fs14vO3jpz pic.twitter.com/xNyHszbuSV

While some analysts point to a positive macro crypto outlook, others caution retail investors against investing in assets that don’t show long-term promise, as uncertainty may persist in the near term. A few observers are even predicting sideways price action for months before the market enters a phase of sustained recovery.

Also Read: Cathie Wood Says U.S. Inflation at 0.8% Could Turn Negative

In the past, historic lows in the Crypto Fear & Greed Index have been followed by historic highs. While the crypto market panic will ultimately die down, analysts remain divided on timing. Some reports suggest a recovery in late 2026, but for now, uncertainty continues to dominate investor behavior.