Traders welcome SOL recovery as the token surges 8% in the last 24 hours on February 14. This represents a good start of the weekend with solid momentum after February’s sharp market crash. Strong and consistent transaction volume has been reflected on its recent price surge. At the same time, improved market sentiment returns despite earlier liquidations. With support at $80, traders are waiting for a surge above $100 in the coming days.

Also Read: Ethereum Foundation Leadership Shift: Tomasz Stańczak Steps Down

SOL Recovery Positions for Potential Weekly Rally

SOL recovery holds currently steady close to $87 on February 14 after a strong 8% surge in the last 24 hours. This follows flat weekly performance after the early February crypto crash. Buyers defended support levels near $80 during the recent dip and prices could move higher in the coming days.

According to crypto trader BitGuru, SOL remains in a clear downtrend. He mentioned that if the current levels hold, a short-term bounce could push the cryptocurrency towards $100. However, if SOL loses support, then downside continuation remains a possibility.

Furthermore, this price action has triggered the largest trading volume in recent days. If market sentiment improves, a continuation rally seems possible. A decisive move above $100 could attract new buyers and strengthen the recovery.

Also Read: FOMC Minutes 2026: What Markets Are Watching

Source: TradingView

Transaction Volume Drives SOL Recovery Optimism

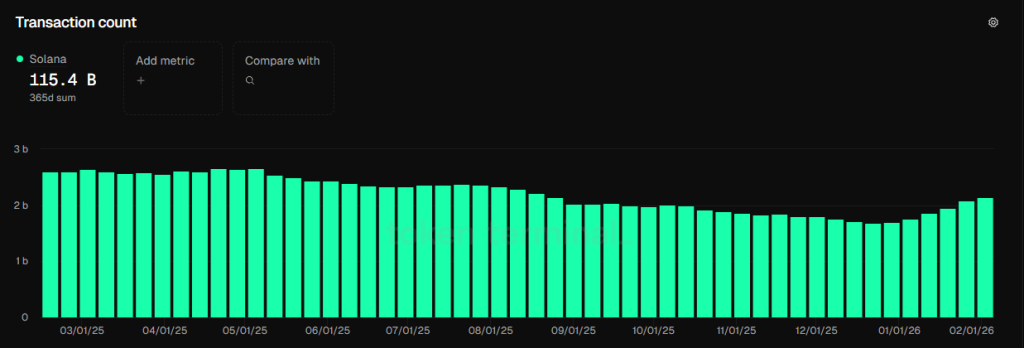

Transactions on the Solana network have also been growing in the last weeks. Transaction volume reached a peak not seen since August 2025, with the total now hitting 2.1 billion transactions. This is a clear rise from the 1.8 billion transactions recorded in the first week of the year. Steady growth in transaction volume continues to fuel optimism around the ongoing SOL recovery.

Source: TokenTerminal

This growth in transaction volume reflects strong real-world usage across different DeFi platforms. Despite earlier liquidations, renewed market sentiment grows, similar to what on-chain activity demonstrates.

Looking at next week, key support levels have proven resilient during this recent downtrend phase. Traders emphasize that these support levels prevent a deeper pullback in the next few days. Thanks to this growing transaction volume, market sentiment could propel SOL toward higher targets. That may happen if momentum sustains throughout the week. Nevertheless, a dip below key support levels could affect SOL recovery and revive bearish views.

Also Read: Bitcoin’s Realized Cap Turns Negative as Long-Term Holders Slow Demand