Ray Dalio’s World Order thesis moved from macro theory to mainstream consensus at the Munich Security Conference in February 2026. The BRICS de-dollarization process also ties into Dalio’s statement. Furthermore, German Chancellor Friedrich Merz stated:

“The world order as it has stood for decades no longer exists”

French President Emmanuel Macron echoed that, warning Europe must prepare for war, and U.S. Secretary of State Marco Rubio confirmed we are in a “new geopolitics era.” For anyone tracking BRICS de-dollarization and the shift toward a multipolar currency system, none of this is new.

Also Read: XRP: Standard Chartered Slashed 65% Target on ETF Fatigue

How Dalio’s World Order Warning Aligns With BRICS and JP Morgan’s APAC Shift

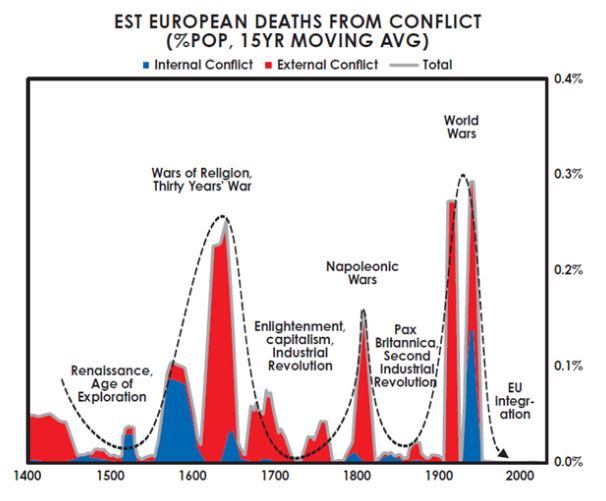

Stage 6 and the Five Types of Conflict

Ray Dalio World Order analysis centers on what he calls Stage 6 of the Big Cycle, a phase where rules collapse and raw power takes over. Dalio identifies five escalating conflict types: trade wars, technology wars, capital wars through sanctions, geopolitical struggles, and military confrontation. His comparison to the 1930s is deliberate, noting that tariff battles, asset freezes, and embargoes preceded the last world war. The most volatile flashpoint right now remains the U.S.-China rivalry over Taiwan.

BRICS De-Dollarization and the Bitcoin Geopolitical Hedge

BRICS de-dollarization is accelerating precisely because capital wars are becoming normalized. When dollar-denominated assets can be frozen overnight, holding reserves in dollars becomes a strategic liability. A multipolar currency system is now being actively constructed, not just discussed.

Also Read: Elon Musk Reveals Cash Holdings Under $850 Million

Bitcoin’s appeal as a geopolitical hedge grows in this environment. Analyst Ted Pillows noted that rising geopolitical risks could bring higher volatility and sharper price swings across markets, and while gold has hit record highs, Bitcoin’s censorship-resistant properties make a stronger case the further financial fragmentation goes.

JP Morgan’s APAC Shift Shows Where Capital Is Moving

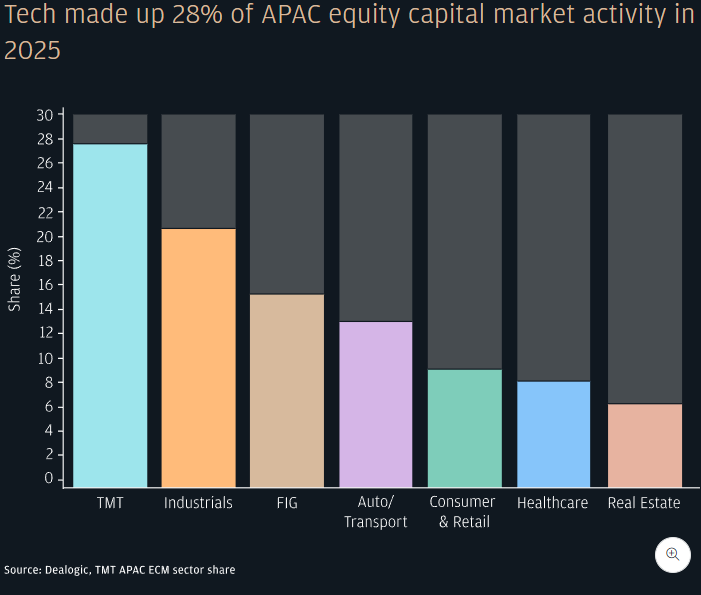

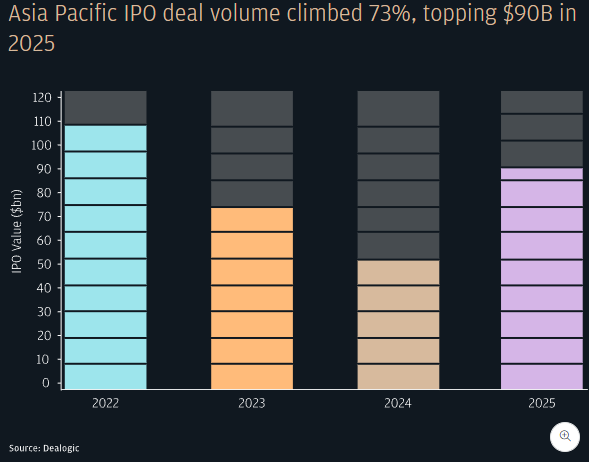

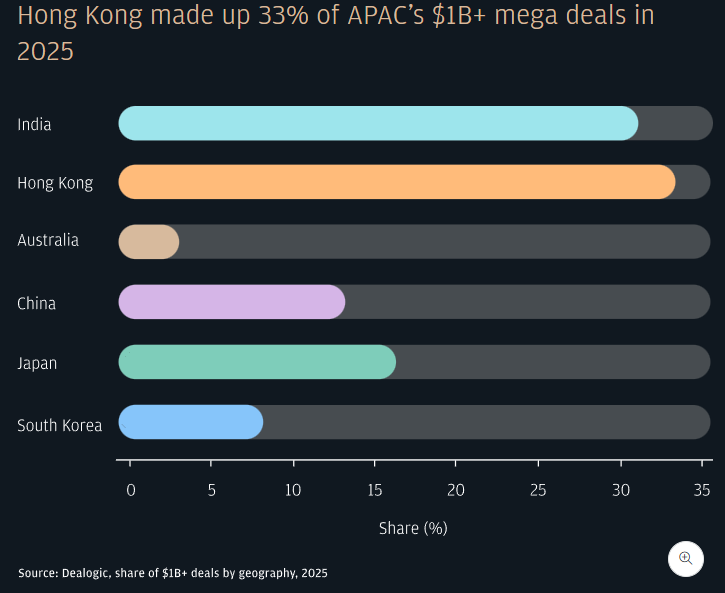

The Ray Dalio World Order warning is already being priced into capital flows. JP Morgan APAC markets data from 2026 shows Asia Pacific raised a record $334 billion in equity capital in 2025, over a third of global volumes.

Peihao Huang, head of equity capital markets for Asia Pacific at J.P. Morgan, said:

“Despite pockets of volatility, we see a strong pipeline carrying into 2026 as increasing interest in broader AI themes, resilient earnings and clearer policy support active IPOs, cross border listings and bespoke financings across the region”

Hong Kong and India are leading that surge. Huang also noted:

“We’re seeing close to half of recent deal flow linked to AI infrastructure, spanning tech, energy, renewables, industrials and software. For global and local investors, Asia Pacific offers compelling exposure across hardware, semiconductors, data center equipment, energy storage and broader industrial solutions”

A multipolar currency system and BRICS de-dollarization are reshaping where money flows, and JP Morgan APAC markets are reflecting that shift in real time. Bitcoin as a geopolitical hedge remains the wildcard in this picture.

Also Read: Precious Metals Price Prediction: Gold Could Hit $7K-$8K by May 2026