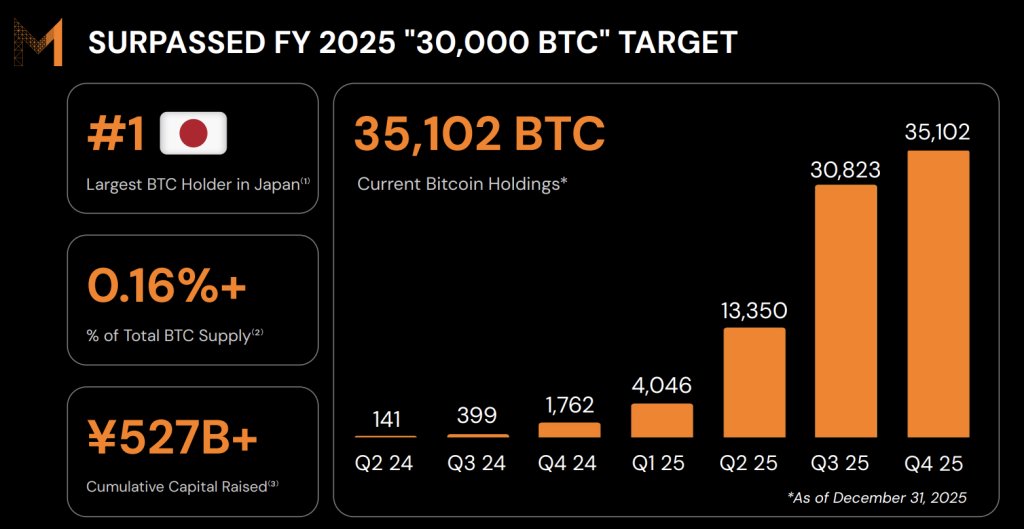

Tokyo-listed investment firm Metaplanet has pushed deeper into Bitcoin. The firm revealed that it now holds 35,102 BTC, cementing its place among the largest public companies holding Bitcoin across the globe. The expansion comes even as Metaplanet reported a massive $665 million net loss. This is primarily driven by BTC’s sharp valuation loss following the king coin’s pullback from late-2025 highs.

Also Read: Logan Paul Sells Pokémon Card for $16.5M and Boosts His 2026 Net Worth

Inside Metaplanet’s Bitcoin Holdings and Treasury Strategy Amid Major Losses

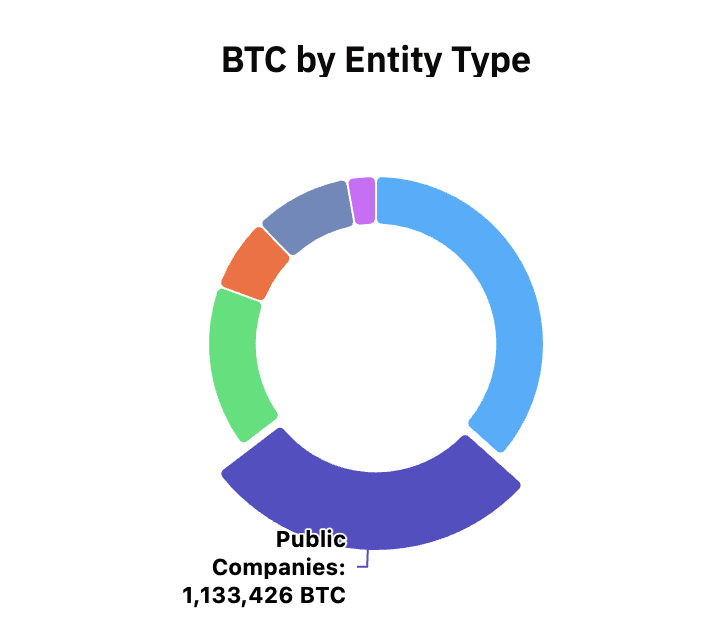

The scale of Metaplanet Bitcoin holdings is significant. With more than 35,102 BTC on its books, the investment giant now controls about 0.16% of Bitcoin’s circulating supply. This is the result of an aggressive accumulation push that started back in April 2024. Corporate ownership of BTC has seen a boost in recent years. Public firms collectively hold 1,133,426 BTC.

Despite Metaplanet’s notable Bitcoin holdings, the firm reported a $665 million loss after Bitcoin dipped from its peak. The world’s largest cryptocurrency reached an all-time high of $126,198.07 back in October 2025. At the time of writing, BTC was trading at $68,088.38, marking a 46% downfall from its peak.

Also Read: Ray Dalio Warns the World Order Is Collapsing as BRICS Accelerates De-Dollarization

Metaplanet’s Silver Lining

The accounting hit doesn’t erase Metaplanet’s revenue growth. According to its latest financial report, the firm’s revenue saw a 738% year-over-year increase to $58 million. The operating profits followed suit and climbed to $41 million. The investment giant’s Bitcoin realted operation played a major role as it generated $55.2 million in revenue.

Metaplanet has made it clear that Bitcoin is not a short-term trade. The firm is looking at accumulating BTC as a long-term reserve strategy. The Tokyo-based company has even revealed plans to pocket about 210,000 BTC over time.

Also Read: XRP: Standard Chartered Slashed 65% Target on ETF Fatigue

Lastly, for fiscal 2026, Metaplanet expects revenue to reach $104 million. The operating profit could increase to $74.3 million. This marks a roughly 80% growth year-over-year. The firm’s balance sheet is now deeply tied to Bitcoin’s trajectory. If prices recover, the same exposure driving losses today could see a reversal.