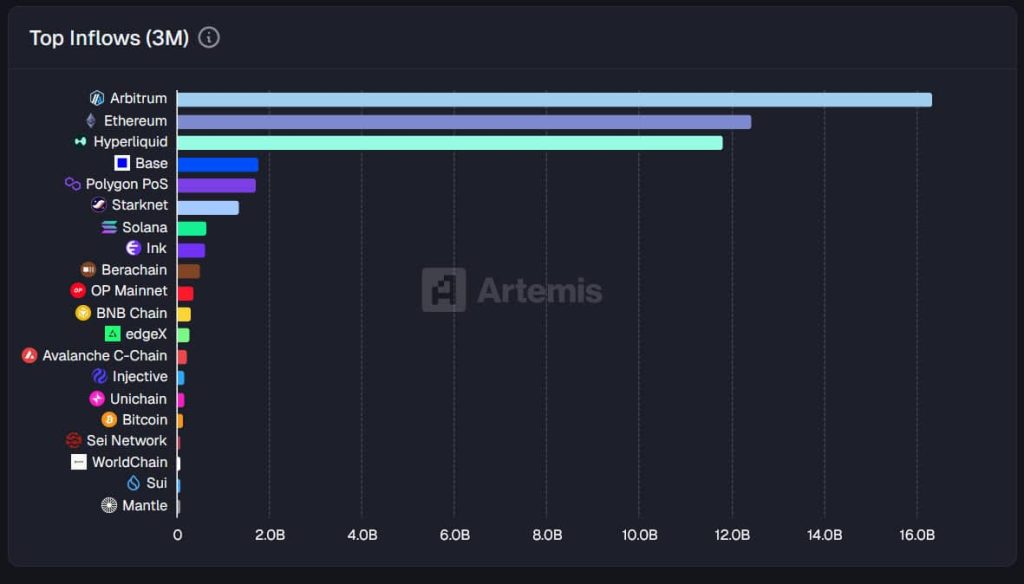

Hyperliquid (HYPE) has entered the crypto big leagues with a staggering $12 billion in hyperliquid inflows over the past quarter. The platform is proving that its decentralized exchange (DEX) model is the new gold standard for traders seeking deep liquidity and high performance.

Also Read: Metaplanet’s Bitcoin Holdings Rocket to 35,102 BTC as Losses Hit $619M

Why Hyperliquid Inflows and HYPE Price Signal Strong Network Growth

It’s no secret that Hyperliquid’s DEX has been gaining ground with record daily revenues, so hitting the $12 billion mark alongside the 2nd largest cryptocurrency, Ethereum (ETH), is no small feat. From the chart below, the difference between ETH and Hyperliquid is negligible.

Also Read: Dubai Greenlights Animoca Brands With Full VASP License

The surge in hyperliquid inflows comes alongside strong token performance. Despite short-term volatility, the native hype price remains up about 25% year-to-date, marking it as one of the stronger performers among major crypto assets in 2026 so far.

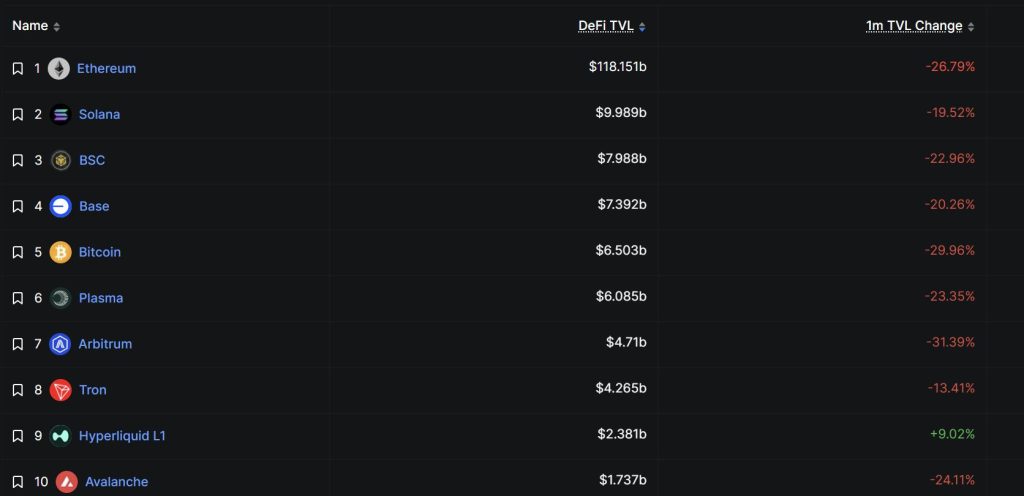

So how is HYPE able to stay at the top? While top cryptocurrencies recorded double-digit drops, Hyperliquid was the only crypto that was in the top 10 that posted positive growth.

When the cryptocurrency market is plagued by uncertainties, liquidity often dries out as investors retreat to safety. Capital inflows tend to slow down, but in the case of Hyperliquid, it is the opposite. Hyperliquid is handling substantial derivatives and steadily capturing market share. Within no time, there will be increased usage, which can translate into stronger token demand and overall ecosystem revenue.

Can Hyperliquid Sustain Its Growth Momentum?

While short-term price swings remain possible, the underlying metrics suggest Hyperliquid’s expansion is rooted in structural adoption rather than temporary speculation. Continued capital inflows, resilient derivatives activity, and expanding market share could keep the platform on an upward trajectory.

Also Read: Logan Paul Sells Pokémon Card for $16.5M and Boosts His 2026 Net Worth

In fact, BitMEX co-founder Arthur Hayes is convinced that the price momentum is here to stay so much that he stated:

“Since you say $HYPE is no good, let’s make a bet. I bet that from 00:00 UTC on February 10, 2026 to 00:00 UTC on July 31, 2026, HYPE’s price increase will exceed that of any shitcoin (in USD) with a market capitalization of over $1 billion on CoinGecko. You choose your favorite coin. The loser has to donate $100,000 to a charity designated by the winner.”

But if the $12B in inflows, rising Hyperliquid TVL and 25% Year-to-date gains are anything to go by, it couldn’t be further from the truth.