NASA’s 2026 asteroid warning has put planetary defense front and center this week, drawing sharp attention to a very specific group of space defense stocks. At a conference in Phoenix, NASA’s acting planetary defense officer Kelly Fast revealed that around 15,000 mid-sized “city killer” asteroids remain completely undetected right now, and Earth has no active way to deflect one if it were heading our way. That gap is real, and it is exactly what makes Northrop Grumman NOC, Lockheed Martin LMT, and Rocket Lab RKLB worth a closer look at the time of writing.

Kelly Fast stated:

“If any of these ‘city-killer’ asteroids hits a populated place on Earth, it can cause regional damage. It takes time to find them, even with the best telescopes.”

Also Read: Metaplanet’s Bitcoin Holdings Rocket to 35,102 BTC as Losses Hit $619M

How NASA’s Asteroid 2026 Warning Drives Space Defense Stocks

NASA’s 2026 asteroid situation is, at its core, a funding story. Only about 40% of near-Earth objects larger than 140 meters have been located, meaning thousands of potential threats are just out there, untracked, right now. NASA’s NEO Surveyor telescope is scheduled to launch next year and will use infrared detection to spot both bright and dark asteroids that ground-based telescopes simply can’t reach. Ed Swenka, NEO Surveyor’s flight system manager at NASA’s Jet Propulsion Laboratory, described the mission’s purpose plainly:

Ed Swenka stated:

“We are trying to find killer asteroids and protect the planet.”

Richard Binzel, an asteroid expert at MIT, also put NASA’s 2026 asteroid warning in stark terms:

“We’re on the precipice of actually knowing whether there’s an asteroid out there with our name on it.”

Nancy Chabot, the Johns Hopkins University planetary scientist who led the DART mission, the 2022 test where a spacecraft crashed into a small asteroid moon at 14,000 mph, was blunt about what’s actually missing right now:

Chabot stated:

“We don’t have [another] Dart just lying around. If something like YR4 had been headed towards the Earth, we would not have any way to go and deflect it actively right now.”

She also added:

“We could be prepared for this threat. We could be in very good shape. We need to take those steps to do it. If anything keeps me awake, it’s that.”

Also Read: Logan Paul Sells Pokémon Card for $16.5M and Boosts His 2026 Net Worth

That investment gap is, in a real sense, the entire thesis for space defense stocks right now. And three names keep coming up:

1. Northrop Grumman (NOC)

Northrop Grumman (NOC) is trading at $702.57 right now, up 54.4% over the past year and 20.7% over the past six months. The company holds a record backlog of $95.7 billion, and its Q4 net sales came in at $11.7 billion, up 9.6% year over year, with adjusted EPS of $7.23, which beat expectations by 3.3%. For fiscal 2026, analysts project EPS growth of 6.5% to an estimated $28.05.

The 1-year analyst target sits at $724.39, and the Street-high target of $815 represents roughly 16% upside from current levels. Argus has a “Buy” rating on the stock with a price target raised to $785 on February 10. The company also recently announced a cash dividend of $2.31 with an ex-date of February 23, 2026. Add the urgency coming out of NASA’s 2026 asteroid warning and there’s another layer to what is already a fairly solid case here.

2. Lockheed Martin (LMT)

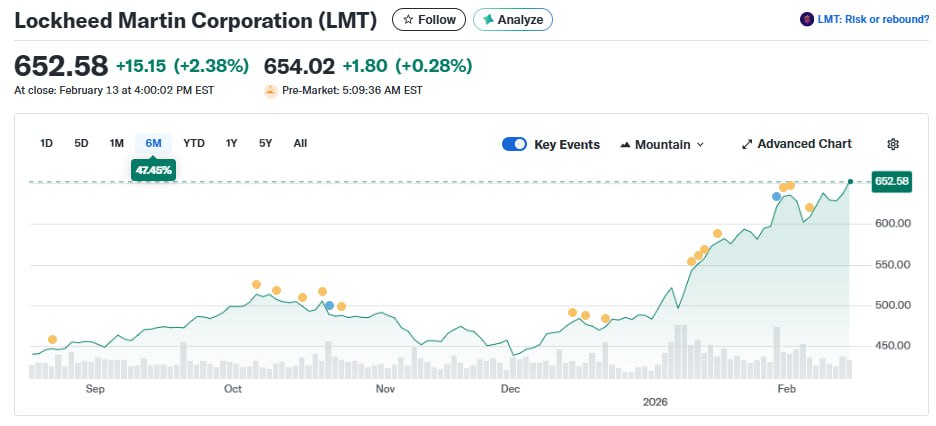

Lockheed Martin (LMT) is up 47.45% over the past six months and has gained roughly 14% in the past month alone, trading at $652.58 at the time of writing, with a market cap of $151 billion. The company recently introduced the Lamprey Multi-Mission Autonomous Undersea Vehicle, a covert autonomous underwater platform, which reinforces Lockheed Martin LMT’s broader push into next-generation autonomous defense technology.

The analyst consensus target sits at $657.58, very close to where shares are right now, so the recent run has largely been priced in. Still, with NASA’s 2026 asteroid warning adding new urgency to planetary detection and deflection funding, the long-term defense spending story here is hard to ignore.

3. Rocket Lab (RKLB)

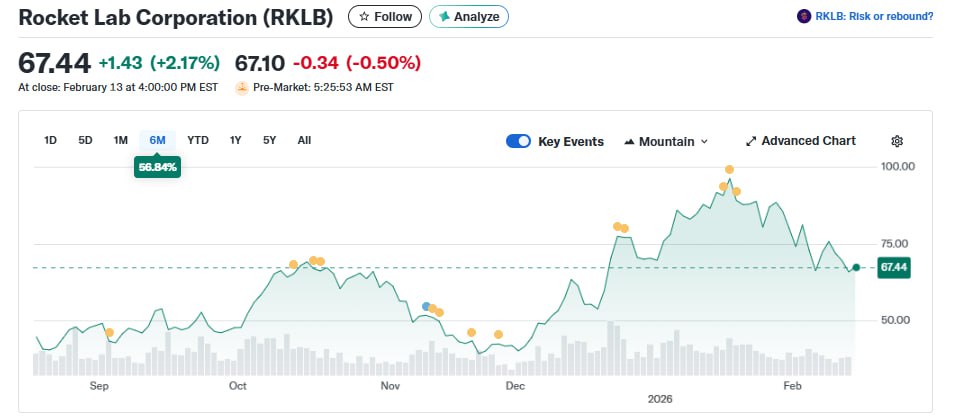

Rocket Lab (RKLB) is the highest-risk name in this group, and also the one with the most room to run if rapid-launch capability becomes a real defense priority. Shares are up 56.84% over the past six months, currently sitting at $67.44, though a pullback of about 26.5% from the recent peak has brought the stock back from highs near $100.

The company is gearing up for its fourth hypersonic test mission and has been moving deliberately toward defense contracts, which aligns directly with the kind of rapid-launch needs that NASA’s 2026 asteroid warning makes harder to dismiss. Rocket Lab RKLB carries a beta of 2.18, reflecting the volatility that comes with a smaller company in an emerging segment, and analysts project a 1-year target of $83.96, which represents meaningful upside from where it trades right now.

Also Read: Dubai Greenlights Animoca Brands With Full VASP License

NASA’s 2026 asteroid warning is, at the end of the day, a policy signal, and one that points directly toward more spending on planetary detection, deflection, and rapid-launch infrastructure. Whether that money moves fast or slow, Northrop Grumman NOC, Lockheed Martin LMT, and Rocket Lab RKLB are the space defense stocks most directly positioned to benefit. Of the three, NOC offers the most defensive profile right now, with a proven earnings record and a dividend on the way.