Big tech stocks falling seems to be one of the dominant market themes of early 2026. Major league companies, including Amazon (AMZN), Nvidia (NVDA), and Meta Platforms (META), have lost a staggering $1.3 trillion in market value with a stock drop. The slump emanates from concerns over massive AI infrastructure spending, shifting investor sentiment and earnings uncertainty.

Also Read: Hyperliquid Inflows Hit $12B as HYPE Price Surges 25% YTD

Why Are Big Tech Stocks Falling in 2026?

The AI bubble seems to carry the weight of the big tech stocks falling. For instance, the Amazon stock drop can be seen in its shares, which are 13.85% down since the beginning of the year. This is after the company heavily invested in AI.

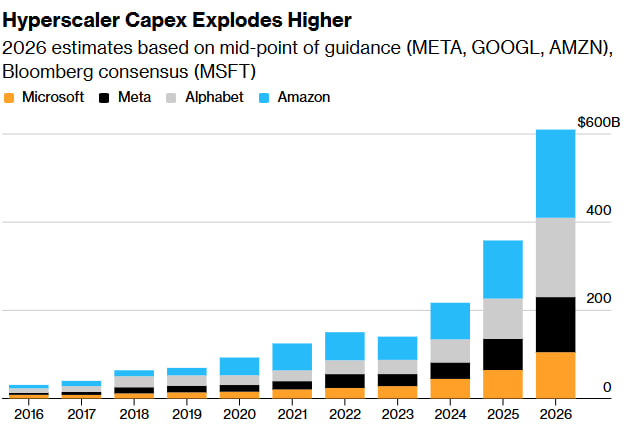

Collectively, the tech giants have invested $700 billion into AI infrastructure. Analysts point out that their current capital expenditure (capex) on AI infrastructure is becoming a major issue for cash flow.

From the chart below, each tech company is set to spend more than it has ever spent and cumulatively $650 billion in 2026.

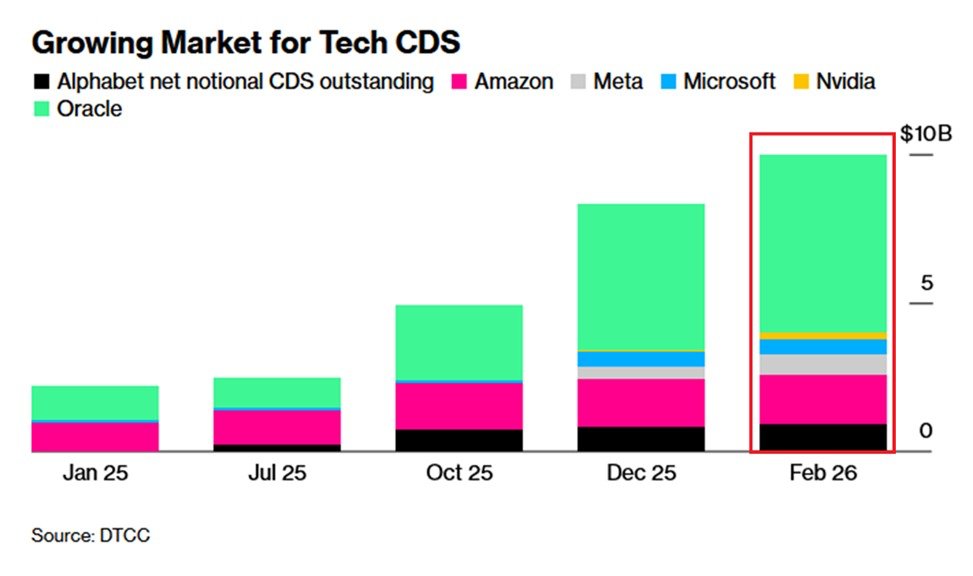

Historically, companies like Meta, Amazon, and NVIDIA were highly liquid and light on debt. Now, they are capex-heavy. Investors now seek downside protection because these companies are no longer just spending their own cash; they are borrowing heavily to fund the AI arms race.

Also Read: Russia’s $648M Crypto Explosion Just Hit Europe’s Sanctions Wall

With such sentiments as the broader market sentiment, it’s no wonder tech has been listed as the worst-performing sector. Further, the outstanding value of single-name CDS on big tech has hit record highs of $10 billion outside the financial sector. And the shocking news is that these debts are a recent accumulation, as a year ago, some of these companies did not have CDS contracts.

Is This a Buying Opportunity?

Analysts are quick to point out that while the hundreds of billions invested in AI infrastructure by software titans is causing short-term pain, these companies remain the backbone of the digital economy.

Jim Masturzo (CIO, Research Affiliates) stated:

“The right reason to sell these expensive companies is that there are other opportunities in things that are better valued… not because you’re panicking about a crash.“

Also Read: Harvard’s $86.8M Ethereum ETF Move Follows 21% Bitcoin Reduction

There is the undeniable potential of AI, but also the cold reality of the balance sheet. For now, we wait and see.