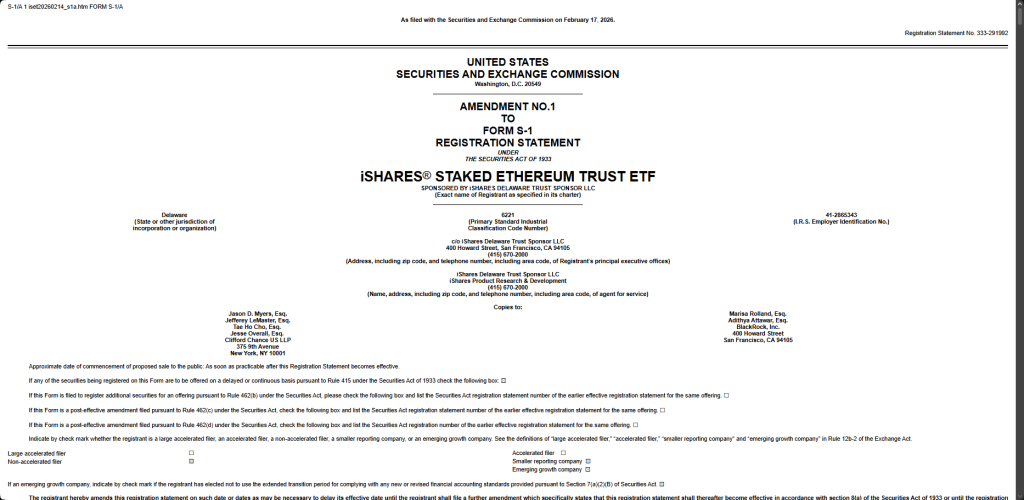

The BlackRock Ethereum Staking ETF is now officially in its seeding phase. On February 17, 2026, BlackRock filed an updated S-1 amendment with the SEC confirming that an affiliate had purchased 4,000 seed shares of the iShares Staked Ethereum Trust at $25 per share, putting $100,000 of initial capital into the fund. The proceeds are being used to buy and stake ETH.

Investors in the BlackRock Ethereum Staking ETF will receive 82% of gross staking rewards, with the Ethereum staking yield estimated at around 3% annually based on early 2026 data. The remaining 18% goes to the fund sponsor and execution partner. A sponsor fee of 0.12% to 0.25% also applies, along with a separate staking fee.

Also Read: Stablecoin Adoption 2026 Surges as 77% of Crypto Users Prefer Bank Wallets

Why BlackRock’s Ethereum Staking ETF Signals Rising Institutional Demand

The iShares Staked Ethereum Trust, by the Numbers

The iShares Staked Ethereum Trust will trade under the ticker ETHB and is designed to stake up to 95% of its assets under normal market conditions. BlackRock first filed for the product in December 2025. The expense ratio, as confirmed in the latest amendment, is set at 0.25%.

Bloomberg Intelligence ETF analyst James Seyffart had this to say:

“NEW: updated filing for BlackRock’s @iShares staked Ethereum ETF. Ticker $ETHB. Filing includes expense ratio which will be 0.25%.”

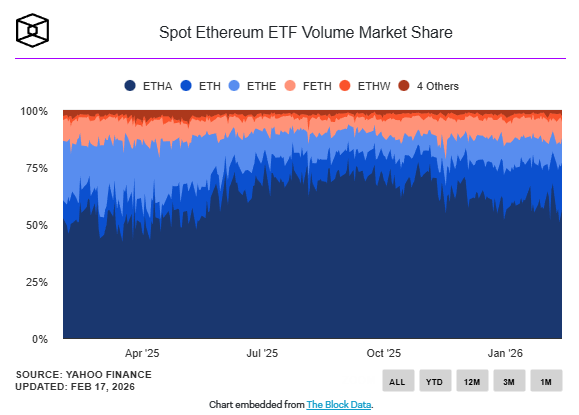

BlackRock’s existing spot Ethereum ETF, ETHA, held around $6.5 billion in net assets as of mid-February 2026. As shown below, ETHA has consistently dominated spot Ethereum ETF volume since launch, which reinforces just how strong institutional Ethereum demand has become around BlackRock products specifically.

Also Read: Big Tech Stocks Are Falling in the US: Amazon, Nvidia, Meta & More

ETH Price Context and What BlackRock’s Accumulation Could Mean

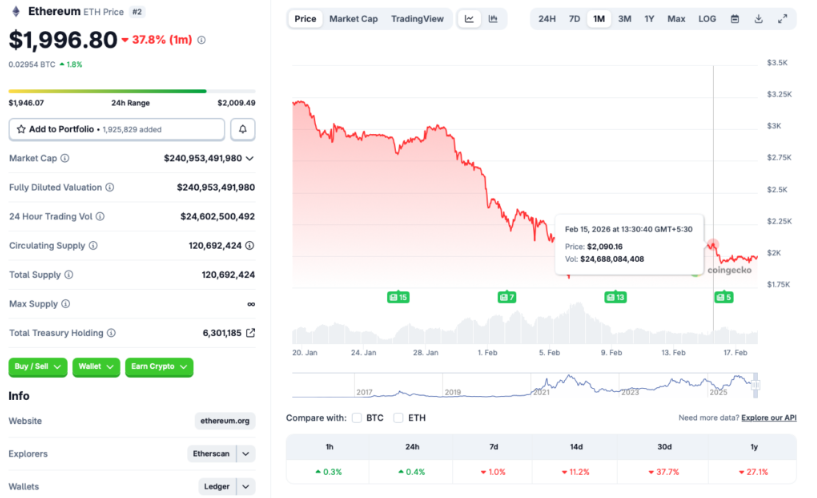

Right now, ETH is trading at $1,996.80, down 37.7% over the past 30 days and also 11.2% over the past 14 days. The asset peaked at $4,946.05 in August 2025 and has since dropped nearly 60% from that level.

BlackRock ETH accumulation through the iShares Staked Ethereum Trust seeding process adds sustained buy-side pressure at a time when retail remains largely on the sidelines. The Ethereum staking yield on offer and the scale of institutional Ethereum demand behind this product could become a meaningful price catalyst once the fund receives SEC approval and goes live.

Also Read: XRP Price Prediction 2026: What 1,000 XRP Could Be Worth