Who owns the most Bitcoin? Great question. The landscape of the largest Bitcoin (BTC) holders continues to evolve. From the legendary creator of Bitcoin, Satoshi Nakamoto, to corporations accumulating BTC as treasury assets, the distribution of the world’s largest cryptocurrency reveals how power in the digital asset economy is shifting.

Also Read: Ethereum RWA Market Surges 315% as Tokenized Assets Break $17 Billion

Inside the Largest Bitcoin Holders and Top BTC Wallets of 2026

When discussing the top BTC wallets, one name remains untouchable. Satoshi Nakamoto, the creator of Bitcoin, remains the largest single holder. According to Arkham, Nakamoto controls roughly 1 million to 1.1 million BTC, mined during Bitcoin’s early years. At 2026 valuations, this hoard is worth an estimated $75 billion, representing roughly 5.5% of the total supply.

After Nakamoto, the biggest BTC concentrations belong not to individuals, but to custodial platforms holding assets on behalf of millions of users. The rise of Bitcoin Spot ETFs has centralized massive amounts of BTC under institutional custody. Coinbase (COIN) follows a close second. Next is BlackRock (BLK), the world’s largest asset manager. Through its iShares Bitcoin Trust and other vehicles, BlackRock controls 761,801 BTC.

While these wallets rank among the top BTC wallets globally, it’s important to note that exchange holdings represent pooled customer assets rather than a single owner’s personal fortune.

Also Read: Bank of America Upgrades Nvidia Stock Forecast, Hidden Surge Ahead

National governments also rank among the largest Bitcoin holders due to seizures, strategic reserves, and mining initiatives. The US and UK governments are at the top with 1.95% share collectively.

Bitcoin Ownership is Expanding

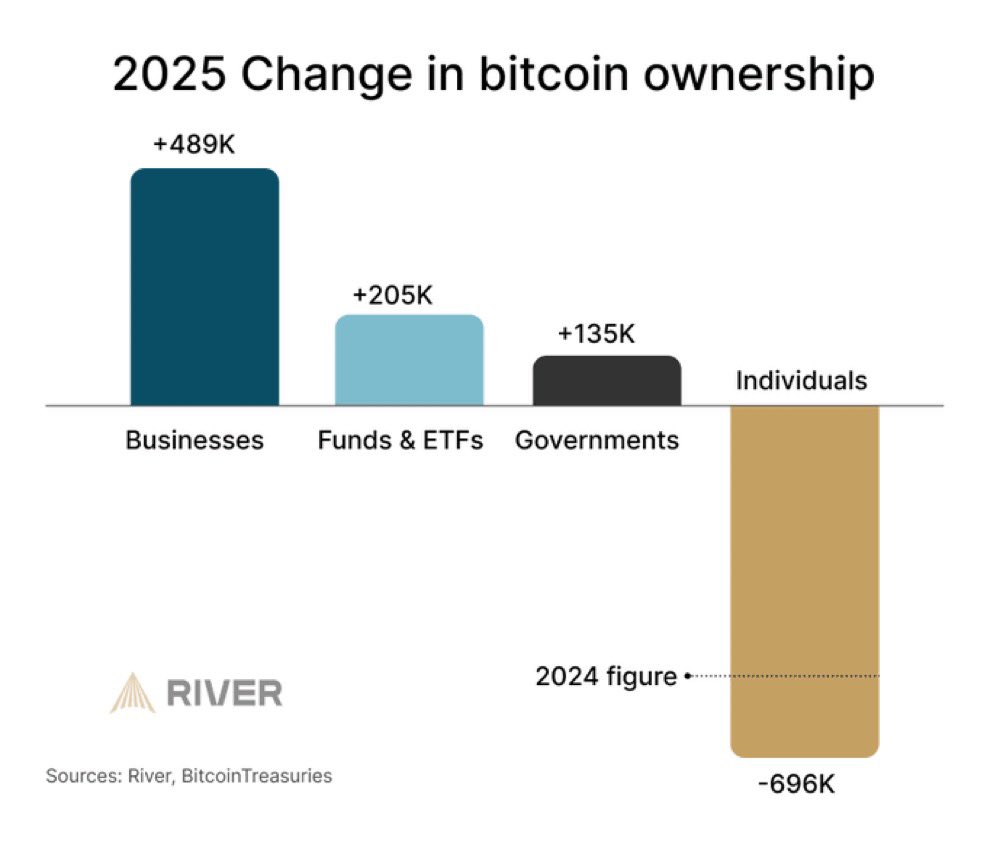

Despite the dominance of a few massive wallets, Bitcoin ownership is simultaneously becoming more distributed worldwide. The supply is moving from individuals into the vaults of long-term conviction players.

The chart below shows how the Bitcoin ownership in 2026 has evolved from individuals to institutions and sovereign reserves.

Exchanges, ETFs, corporations, and sovereign entities now collectively control a large share of circulating BTC, while millions of retail users hold smaller balances across self-custody wallets.

Also Read: Stripe’s Bridge Secures OCC Stablecoin Charter in Major Regulatory Breakthrough

This trend defines Bitcoin ownership in 2026. Still, with an estimated 3.7 million BTC lost in inaccessible wallets, the battle for ownership is only intensifying.