Prominent cryptocurrency exchange, Coinbase, has quietly expanded the doors to its lending desk. U.S. customers can now access Coinbase crypto loans using XRP, Cardano (ADA), Dogecoin (DOGE), and Litecoin (LTC) as collateral. Through this, the community can now employ the market’s most widely held tokens to unlock cash without selling crypto. This can be benefical especially during uncertain market conditions.

Also Read: Clarity Act Crypto Hearing Set for Feb. 20 as Polymarket Odds Drop to 56%

Coinbase Crypto Loans: XRP, Cardano & Litecoin Collateral Explained

This latest addition is quite simple to access. Users will have to deposit crypto, and in return, borrow up to $100,000 in Circle’s USDC stablecoin. The borrowed funds arrive without pushing investors to exit positions they may want to hold long term. All of this will be run through Morpho, a decentralized lending protocol integrated with Coinbase’s base network. It should be noted that the exchange itself isn’t acting like a traditional lender. But it is positioning itself as a gateway to an on-chain credit system. A report from blockchain analytics firm IntoTheBlock says,

“The inclusion of high-profile assets like XRP and Dogecoin as loan collateral is a logical step toward mainstream financial integration.”

The addition of XRP stands out for a lot of reasons. Coinbase revealed in its annual filing that it holds around $17.2 billion worth of XRP on behalf of customers. This makes it one of the largest assets sitting on the platform. That scale alone reveals why XRP collateral on Coinbase lending was almost inevitable.

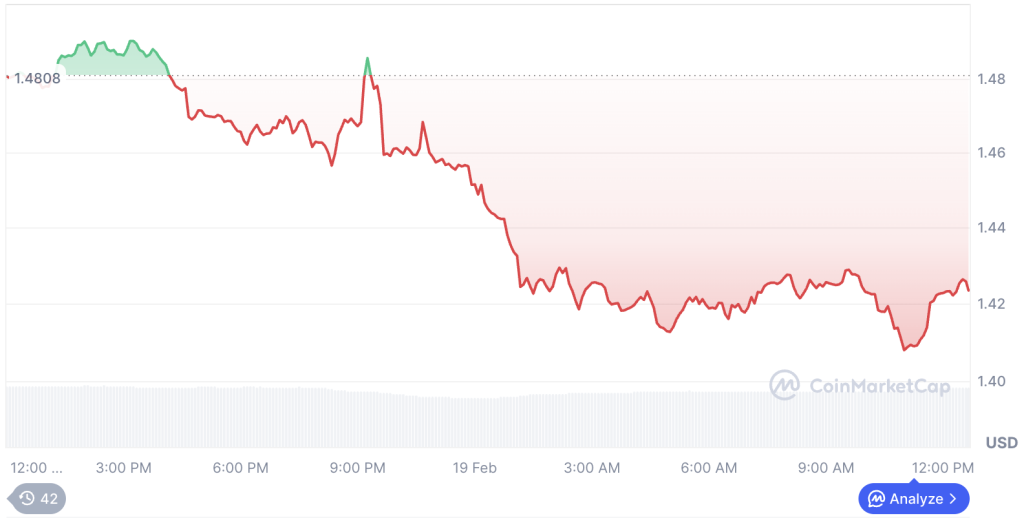

In addition, at press time, XRP was trading at $1.42 following a 3.84% drop over the past 24 hours.

Also Read: Wells Fargo Says $150B Tax Refunds Could Spark a Bitcoin YOLO Trade

Cardano’s role is slightly different. ADA already has staking, which gives holders passive rewards. But, staking doesn’t solve the liquidity issue. The new Cardano loan Base option gives holders another lever to pull. This is particularly for those who want access to cash while keeping their ADA exposure intact.

Similar to XRP, Cardano holders were in a rut after the asset plunged by 2.38% during the past day. At press time, the altcoin was priced at $0.2757.

Lastly, Litecoin and Dogecoin fall into a rather quieter category. It doesn’t have staking built into its design. The yield opportunities in this network have been limited. Therefore, the latest Litecoin crypto-backed loan is one of the few ways LTC holders can pocket money without exiting completely.

At press time, Litecoin and Dogecoin were trading at $53.27 and $0.09824, respectively. LTC recorded a daily drop of 1.71%, DOGE lost 2.55% in value during the same period.

The latest expansion shows where cryptocurrency exchanges are heading. Holding digital assets is becoming less passive.

Also Read: Abu Dhabi Bitcoin ETF Allocations Surpassed $1B in BlackRock’s Fund in 2025