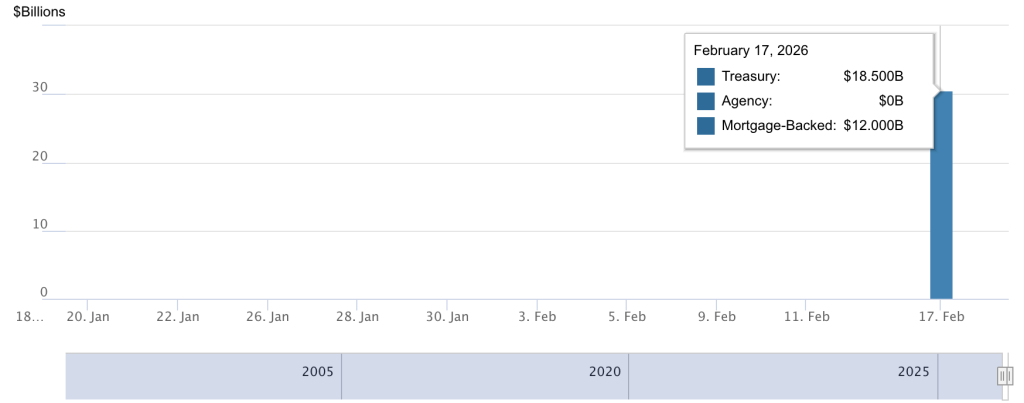

The Federal Reserve has added $18.5 billion into financial markets this week through overnight repo operations. This is reportedly one of the largest short-term liquidity additions since the pandemic. This, however, was carried out quietly without any major public alarm or even policy changes. But the magnitude of this movement in the U.S. banking system stands out.

Also Read: Trump Signals Potential 20% Tax Refunds Under Big Beautiful Bill

Repo injections are the Fed’s way of keeping short-term funding markets running smoothly. Banks hand over Treasuries and receive cash in return. This is usually done overnight. It’s a technical process, but the effect is real. More cash enters the US banking system, easing short-term funding pressure. It even aids in stabilizing interest rates. The Federal Reserve Bank of New York publishes these operations daily, showing how reserve levels shift depending on demand.

The latest Fed liquidity injection stands out in the historical context. Data from the Federal Reserve’s FRED shows repo activity reaching levels that exceed comparable operations during the early-2000s dot-com period. It should be noted that during these times, Fed liquidity injections of this scale were tied to visible financial stress.

Also Read: Coinbase Just Expanded Crypto Loans Using XRP, ADA & LTC as Collateral

Why the Fed’s Liquidity Injection Signals Rising Bank Stress Today

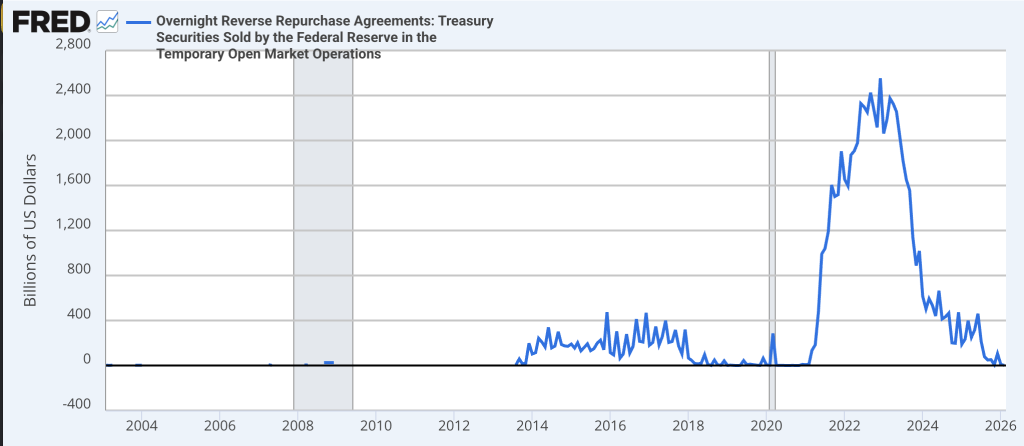

Banks don’t tap into repo facilities for no reason. Demand rises when reserves start to feel tighter than expected. It doesn’t mean banks are failing. It means they want easier access to cash, even temporarily. But this week’s Fed liquidity injection points to growing caution among financial institutions.

The U.S. banking system is operating in a different environment now compared to the post-COVID period. Reserve levels have declined as the Fed shrinks its balance sheet. At the same time, Treasury issuance has increased, which absorbs liquidity and shifts how cash moves through markets.

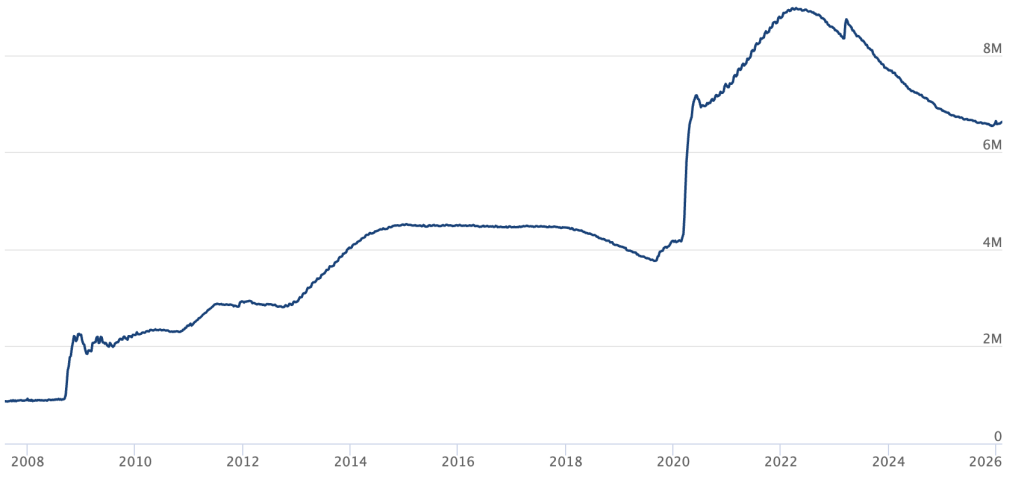

It is worth noting that the Fed’s balance sheet still sits above $7 trillion. Despite this large figure, it is still smaller than it was at its peak, according to data.

Federal Reserve intervention through repo markets has become less about emergency rescue and more about routine maintenance. Each Fed liquidity injection helps smooth short-term funding pressures. This alone shows how the financial system has evolved.

Also Read: Clarity Act Crypto Hearing Set for Feb. 20 as Polymarket Odds Drop to 56%