The BRICS digital currency is moving from concept to reality. The bloc has launched a cross-border payment system that enables direct settlement between member nations, bypasses SWIFT, and removes the US dollar as the intermediary.

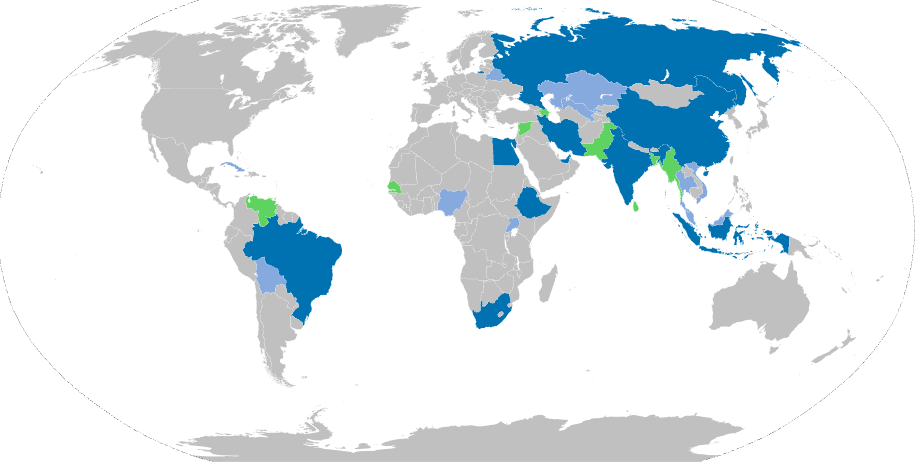

Built on Brazil’s Pix technology and running on a decentralized blockchain architecture, the system connects central banks from China, India, Egypt, and the UAE, and is already processing live transactions. This is the first real infrastructure built to support de-dollarization at scale, and also the foundation on which a future BRICS digital currency is being designed to operate.

Also Read: Ray Dalio Warns the World Order Is Collapsing as BRICS Accelerates De-Dollarization

How the BRICS Digital Currency and Payment System Drive Global De‑Dollarization

The Geopolitical Push Behind It

Years of US sanctions and dollar weaponization have accelerated BRICS cross-border payments from a talking point into an operational network. Russian President Vladimir Putin stated at the Kazan Summit:

“It’s not us who refuse to use the dollar. But if they don’t let us work, what can we do? We are forced to search for alternatives.”

Brazil’s President Luiz Inácio Lula da Silva added:

“We need to work so that the multipolar order we aim for is reflected in the international financial system.”

Over 60% of mutual trade within the bloc is now being settled in local currencies, and demand for alternative settlement rails is only growing.

Also Read: The BRICS Unit: Inside the 40% Gold-Backed Dollar Alternative

Where the BRICS Digital Currency Fits In

The system is being built to integrate with a future BRICS digital currency, including Brazil’s Drex and China’s digital yuan. India’s Reserve Bank has also proposed linking BRICS CBDCs directly, creating a shared digital settlement layer across member states. The Clingendael Institute noted in a May 2025 research paper that BRICS Pay “serves as a defence mechanism against the dominance and weaponisation of the US dollar.”

What It Means for the USD

The USD remains the world’s reserve currency, but BRICS cross-border payments now represent the first functional, operational challenge to dollar-centric trade. Bank of America’s February 2026 FX survey showed net dollar exposure at its most negative level since 2012. BRICS digital currency infrastructure is not replacing the dollar tomorrow, but a long-term shift toward multipolar finance is already underway.

Also Read: Eleanor Terrett: White House’s Third Stablecoin Yield Meeting Today at 9 A.M. ET