Berkshire sells Amazon Apple shares and trims Bank of America, yet all three stocks moved higher after the Berkshire 13F filing dropped on February 17. The filing, Buffett’s last as CEO before Greg Abel took over on January 1, 2026, showed Berkshire slashed its Amazon stake by 77%, trimmed Apple for the third straight quarter, and continued offloading Bank of America shares, bringing that position to just below 7% ownership. Warren Buffett stock sales have now been net negative for 13 consecutive quarters, and yet the market shrugged it off across all three names.

Also Read: OpenAI Funding Round Nears Record $100B Raise as Valuation Targets $850B

Why Berkshire Q4 Sales Lifted Amazon Apple and Bank of America and the Buffett Stocks Still Worth Buying

What the Berkshire 13F Filing Revealed

The numbers were hard to ignore. Amazon went from 10 million shares to 2,276,000 in a single quarter, a $1.78 billion reduction. Apple was trimmed by 10.3 million shares, though at $61.96 billion it remains Berkshire’s largest holding at 22.6% of the portfolio. Bank of America saw 50,774,078 shares sold, roughly half of what Berkshire held in mid-2024.

Morningstar senior analyst Gregg Warren had this to say:

“Berkshire has been selling Apple since the start of September 2023 and Bank of America since the beginning of July 2024.”

On the buy side, Berkshire added $1.23 billion to Chevron and $910 million to Chubb, and also initiated a fresh $352 million position in The New York Times, its first media buy since 2020.

Also Read: Ledn Launches $188M Bitcoin‑Backed Bonds in Historic ABS Market First

Buffett Stocks Still Worth Buying After Berkshire Sells Amazon Apple

The Warren Buffett stock sales story is really about rebalancing toward value, not abandoning quality. Berkshire sells Amazon Apple positions because valuations stretched, not because the businesses broke down. Three names in the remaining portfolio stand out right now.

1. Chubb (CB)

Chubb still looks compelling. Management guided for “double-digit growth” in earnings per share and book value in 2026, and the company carries 32 consecutive years of dividend increases.

2. Chevron (CVX)

Chevron is up 20% year-to-date and benefits from long-term production expansion and AI data center energy partnerships.

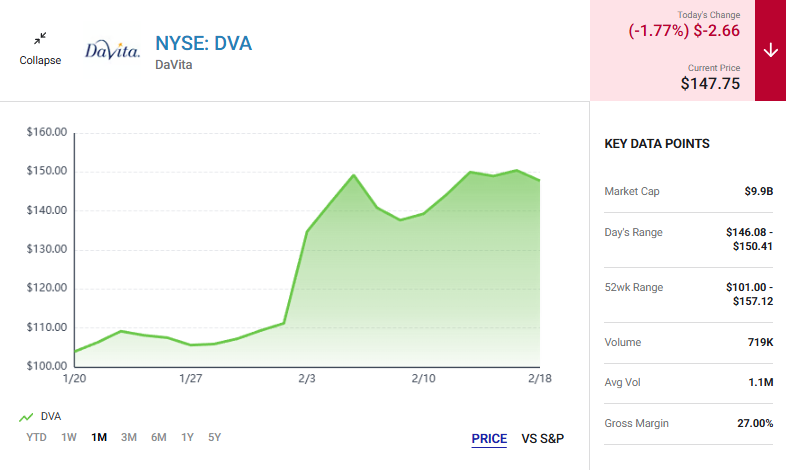

3. DaVita (DVA)

DaVita, still a 45.1% Berkshire holding, is guiding for 25% to 39% earnings per share growth in 2026 after a strong Q4.

The Berkshire 13F filing confirms the portfolio is being repositioned around cash flow and valuation discipline, and the stocks being added to are the ones worth paying attention to now.

Also Read: Gold Hits $5,000 as US–Iran Tensions Spark a Global Market Shock