David Solomon, CEO of Goldman Sachs, revealed he personally holds a small amount of Bitcoin. He stresses that he remains an observer rather than a committed crypto bull. Bitcoin (BTC) is usually seen as the go-to low-risk crypto, so it’s no surprise that, despite the recent BTC price drop, this is the one that caught the CEO’s eye.

Also Read: Amazon, Apple, and BofA Rose After Berkshire Sold: Buffett Stocks Still Win

David Solomon Bitcoin Insight, Tokenization & Institutional Crypto Outlook

The disclosure signals a nuanced shift in Bitcoin adoption Wall Street narratives. First, historically cautious banking leaders are now personally engaging with the asset, albeit modestly. Second, the fear of traditional banking being wiped out is slowly dying. Traditional banks face losing up to $500 billion in deposits by 2028 with the rise in high-yielding stablecoins.

And while there is that fear, Solomon believes the two should not compete. In fact, he thinks that tokens will be extremely important in future. For Solomon, it’s a start and accumulating more Bitcoin could be in the future plan. Bitcoin adoption on Wall Street hangs by a thread, but not a thin one. With the hearing of the Clarity Act coming up soon, institutions often move only after compliance pathways become explicit.

Also Read: Can Apple Stock Recovery Outpace Nasdaq? Experts Weigh In

Over the years, Bitcoin adoption has been surging, especially by institutions. In the latest report of who owns the most Bitcoin, you can see institutions, including banks, have entered the chart.

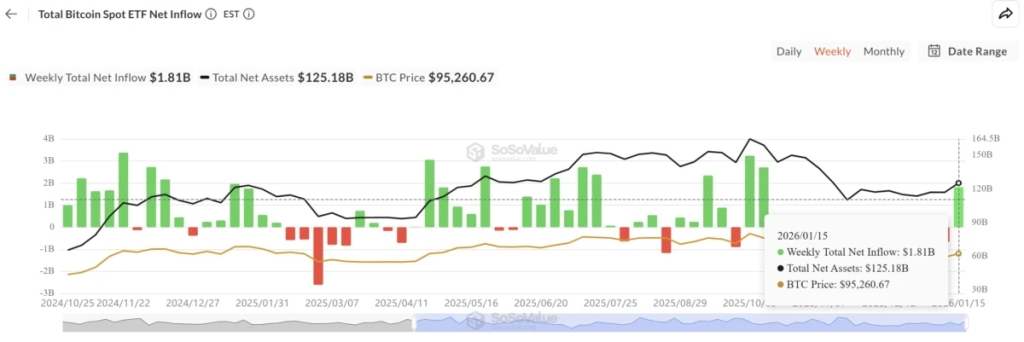

The Bitcoin adoption chart below shows the surge in BTC ETF inflows. This suggests that while Solomon may remain cautious on holding BTC directly, ETF inflows show institutional finance is already committing billions to Bitcoin. In a few years, the Bitcoin adoption chart may reflect broader participation from banks.

Crypto Earns a Seat at the Table

The fact that the head of one of the world’s most powerful investment banks owns any Bitcoin at all and is actively monitoring the space signals that the asset has permanently earned its seat at the table.

Also Read: OpenAI Funding Round Nears Record $100B Raise as Valuation Targets $850B

The issue is no longer whether the Bitcoin price drop settles or deepens. The structural Bitcoin adoption Wall Street story has changed and is no longer about ifs. Now, the bigger question is how Bitcoin will be integrated into the global financial fabric.