A massive Nvidia OpenAI investment is in the works as the chip giant is reportedly finalizing a $30 billion investment. This comes after a $100 billion multiyear partnership framework that never fully materialized. Sources say negotiations are in their final stages and could conclude imminently, signalling one of the largest direct strategic investments yet between a hardware supplier and an AI model developer.

Also Read: Trump Orders UFO Disclosure, Putting Defense and Aerospace Stocks in Focus

How the Nvidia OpenAI Investment Signals a Major AI Funding Shift

This new agreement is set to replace a more ambitious but ultimately stalled $100 billion megadeal. While the original $100 billion deal was envisioned as a multi-year partnership tied to massive physical milestones, investor jitters regarding AI ROI grew, and the complexity of this deal became a hurdle. Instead, the new proposal simplifies Nvidia’s commitment to a $30 billion investment.

Also Read: White House Sets March 1 Deadline in Stablecoin Rewards Dispute as XRP, Coinbase Attend

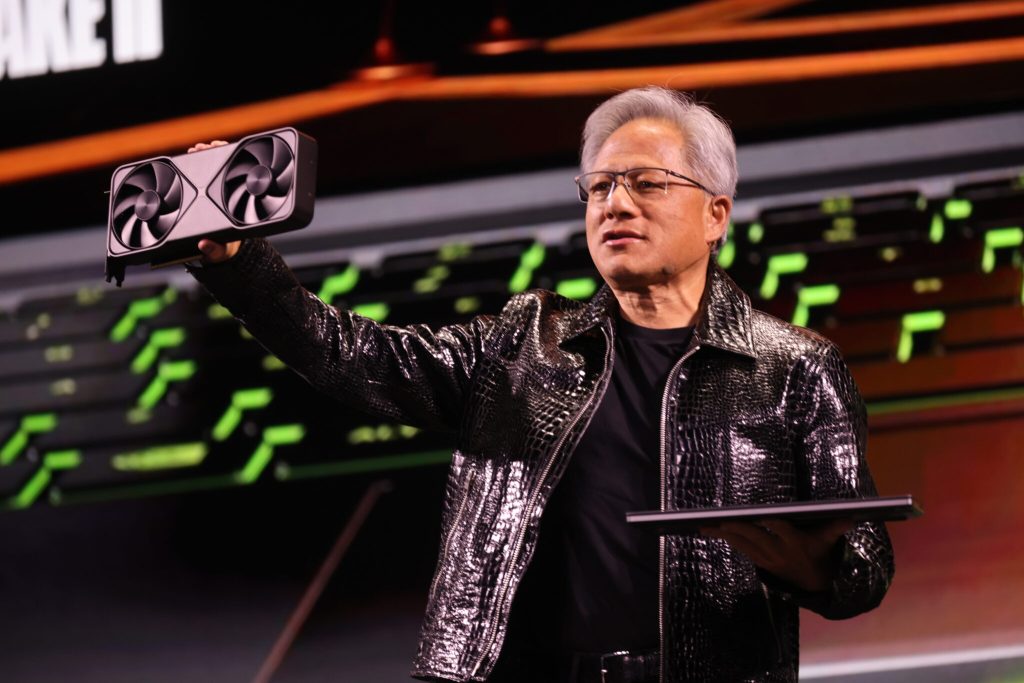

After all, the $100 billion was never a commitment. CEO of Nvidia, Jensen Huang, stated that:

“They invited us to invest up to $100 billion and of course, we were, we were very happy and honored that they invited us, but we will invest one step at a time.”

A key feature of the Nvidia OpenAI deal is its reinforcing nature. OpenAI is expected to reinvest a significant portion of this fresh capital back into Nvidia hardware. Nvidia (NVDA) joins other giants like Amazon (AMZN), Microsoft (MSFT) and Softbank in the OpenAI investment deal, which is now edging toward $100 billion. Sources have disclosed that the pre-money valuation is about $730 billion.

The reduction to a $30 billion investment signals an AI funding shift among investors. It’s somewhat risk-mitigated because while Nvidia isn’t committing too much, it’s still putting in a significant investment portion. This is what investors are largely doing in the AI space because they’re growing wary of the AI bubble and don’t want to over-leverage their balance sheets without a promised ROI.

A New Funding Trend

OpenAI’s long-term plans reportedly include spending hundreds of billions on AI infrastructure. If it hits its target, it could strengthen confidence among backers and encourage investors to deepen their commitments in the next funding round.

Also Read: Deutsche Bank Backs Ripple as JPMorgan Helps SWIFT Build Rival Blockchain Rails

For now, the deal signals that the AI race is shifting from ambitious headline megaprojects toward structured financing designed to deliver measurable returns.