The sentiment in the cryptocurrency market has shifted again. The urgency to buy every dip is gone. Volumes have slowed, and prices are moving lower. According to Arkham Intelligence, this marks the return of a full-scale crypto bear market. This phase has defined most of crypto’s history as much as its rallies have.

Also Read: $2.5B Bitcoin Options Expiry Looms as Huge $40K Put Signals Volatility Risk

Master Crypto Bear Market Strategies and Key Indicators for Cycle Survival

Arkham describes a bear market as a prolonged decline where assets lose at least 20% of their value and continue trending downward. In the cryptocurrency market, those losses tend to be far more severe. The firm notes that drops of 70% to 90% from peak valuations are common during extended downturns. This extreme volatility is one of the defining traits of the crypto cycle itself.

Bitcoin’s own history reflects this pattern. After reaching nearly $20,000 in late 2017, it fell to around $3,200 the following year, a decline of roughly 83%, according to data from CoinGecko. Similar downfalls followed the 2021 peak. These resets are harsh, but they have also preceded some of crypto’s strongest recoveries.

For instance, BTC gained more than 700% from its most recent bear market lows to the next cycle peak. In an earlier cycle, the recovery moved past 2,100%.

Bear markets are uncomfortable, but they are predictable in structure. Arkham outlines several bear market strategies that can help traders and investors navigate the downturn and improve their chances of long-term crypto cycle survival.

1. Short selling to profit from declines

One of the most direct strategies is short-selling crypto. This involves borrowing an asset and selling it at the current price, and buying it back later after the price falls. The difference is the profit. The Arkham report highlights this strategy and said,

“Short selling is available on most cryptocurrency exchanges via margin trading. This strategy profits directly from declining prices but carries significant risk, as losses can exceed initial capital if prices rise unexpectedly. As such, traders should practise proper position sizing and utilize stop-loss orders to limit their risk.”

Also Read: SHIB Price Prediction 2026: What $1,000 in SHIB Could Be Worth at ATH

2. Use options and inverse products

Some traders prefer put options or inverse products. These instruments gain value when prices fall and offer more controlled risk when compared to direct short positions.

4. Accumulating slowly

Instead of trying to trade every move, they gradually accumulate assets they believe will survive the cycle. According to research from Fidelity Digital Assets, bear markets have historically created strong entry points for long-term investors.

5. Trading within ranges

Even in a downtrend, prices move up and down in smaller ranges. Some traders focus on purchasing near support levels and selling near resistance.

6. Holding stablecoins

Moving funds into stablecoins is a defensive move. It protects capital while keeping traders ready to re-enter when conditions improve.

7. Watching for bottom signals

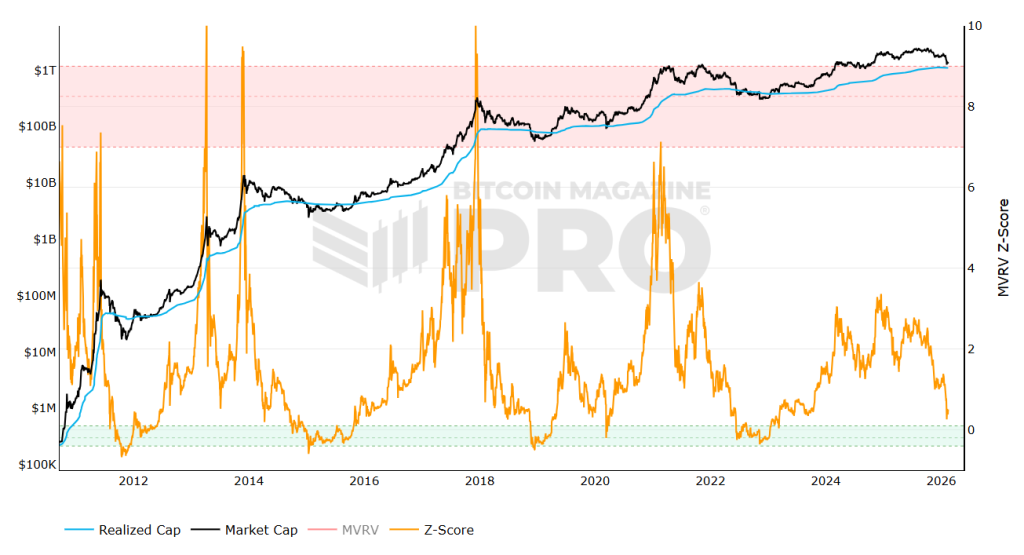

Traders also monitor market bottom indicators, including reduced selling pressure and increased accumulation. Arkham shows on-chain signals like MVRV Z-score as useful tools for spotting potential turning points.

Bear markets tend to test patience more than anything else. But these periods have been a major part of the overall market cycle. While newbies sell out of fear, seasoned traders buy the dip or at least hold on to their stash patiently.

Also Read: Nvidia Nears $30B OpenAI Investment After $100B Funding Deal Stalls