A massive Bitcoin options expiry worth roughly $2.5 billion is set to hit crypto markets today. The settlement also includes Ethereum, and, with these being the two most prominent cryptos, there could be a spike in crypto market volatility.

Also Read: Nvidia Nears $30B OpenAI Investment After $100B Funding Deal Stalls

Why Bitcoin Options Expiry and $40K Puts Could Trigger Crypto Volatility

Bitcoin options are derivatives that expire. These are basically contracts dependent on a specific price movement and time. Expiration enhances market efficiency because traders can bet on specific events that could drive the prices up pumping liquidity for new contracts.

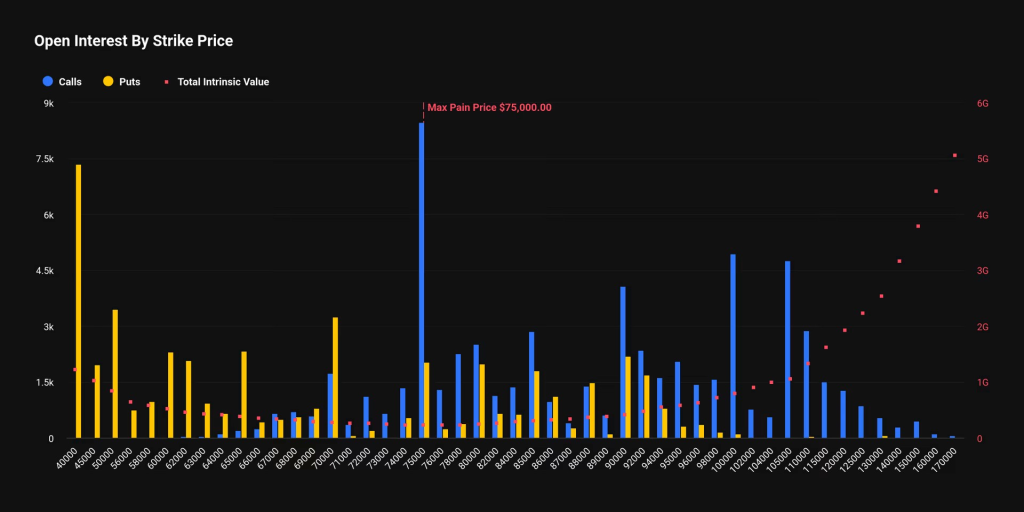

During expiry periods, buyers could experience max pain. This is where sellers push options to an almost worthless price in a bid to minimize payout. The current spot is at approximately $67,000, while the max pain point is $70,000. As it stands, Bitcoin (BTC) dominates the expiring positions with about $7.3 billion in BTC options by February 27.

Also Read: White House Sets March 1 Deadline in Stablecoin Rewards Dispute as XRP, Coinbase Attend

In the chart below, there are 63,547 call contracts versus 45,914 puts. This places the put-to-call ratio at 0.72, and that is almost bullish, but by a long shot.

The $40,000 Bitcoin put has been touted as the second-largest option position, and with Bitcoin having fallen from its peak levels lately, traders see this as a cause for worry. A put option is supposed to act as insurance and only come in if Bitcoin falls below the strike price.

The simultaneous Ethereum (ETH) options expiry adds another layer of market sensitivity. Although it appears more balanced than Bitcoin’s, when BTC and ETH expiries coincide, cross-asset hedging activity often spreads volatility across the broader crypto market.

Calm Settlement or Volatility Spark?

If Bitcoin remains stable near key levels, the expiry could pass with limited disruption. But if macro news, ETF flows, or sentiment shifts collide with derivatives settlement dynamics, today’s Bitcoin options expiry could quickly turn into a short-term volatility catalyst.

Also Read: Trump Orders UFO Disclosure, Putting Defense and Aerospace Stocks in Focus

As the clock ticks toward the expiry, investors should keep a close eye on the $65,000 support level for Bitcoin. A break below this could validate the $40K put fears, while a push toward $70,000 would align with the Max Pain theory, potentially liquidating short-term bears.