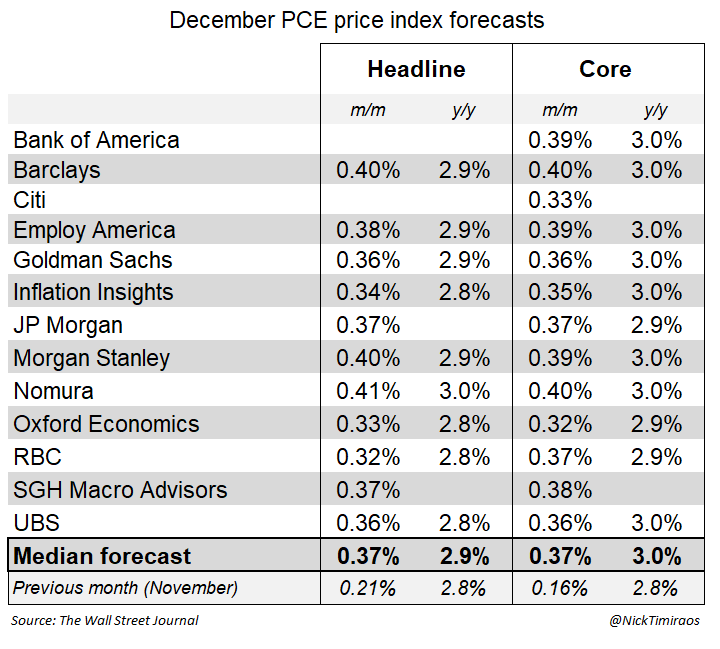

A new Personal Consumption Expenditures (PCE) inflation forecast from Nick Timiraos suggests that core and overall will increase by 0.37% month-on-month. According to Timiraos, this could be the highest inflation rate yet. If this materialises, it would push core PCE to around 3% annually and lift headline inflation close to 2.9%.

Also Read: IMF Warns China’s Industrial Machine Is Reshaping Dollar Dominance

How the PCE Inflation Forecast and Timiraos Prediction Shape Fed Outlook

Nick Timiraos’ prediction carries immense weight because he’s been widely known as the Fed Whisperer. In his outlook, it points to hotter-than-expected price pressures. This translates to a macro shock that rewires the market’s internal logic. When the PCE index comes in higher than expected, it triggers a chain reaction that moves through expectations, sentiments and finally volatility. In such cases, traders frequently adjust rate expectations even before official data is released.

What captures the attention most is the trajectory of underlying inflation, which even heavyweights like JP Morgan and Morgan Stanley seem to agree with. Timiraos emphasises the 0.37% month-on-month surge, which suggests the central bank may be preparing the public for a more hawkish tone in upcoming communications.

Also Read: $2.5B Bitcoin Options Expiry Looms as Huge $40K Put Signals Volatility Risk

Inflation had been predicted to ease from the beginning of the year to lows of 2.6, and the trade deficit had expanded, easing the erratic policies. However, this PCE forecast changes everything. Traders are now shifting their focus from when the Fed will cut rates to whether they can afford to cut at all this year.

A core PCE at 3% signals that the government is losing the battle in fighting inflation. This means that hopes for Fed rate cuts are also growing slim. For crypto markets, they thrive on liquidity and low rate cuts, and in such conditions, traders should brace for a volatile crypto market.

The Bigger Picture

With markets already sensitive to policy uncertainty, even a modest upside surprise could set off a fresh round of volatility. Now, with Timiraos’ prediction, volatility returns to the forefront.

Also Read: SHIB Price Prediction 2026: What $1,000 in SHIB Could Be Worth at ATH

The Fed inflation outlook is now shifting from cautious optimism back toward vigilance. Eyes are now fixated on the official data release to see if it confirms these claims.