Prominent French banking giant Société Générale is taking another step into blockchain infrastructure. This time, it is bringing its euro-backed stablecoin directly into Ripple’s network. Through its crypto subsidiary SG-FORGE, the French banking giant is expanding its EUR CoinVertible stablecoin to the XRP Ledger. The move puts a regulated European bank at the center of XRPL’s institutional push and is already fueling conversations around long-term XRP value.

Also Read: Arkham Says the Bear Market Is Here: Guide to Surviving the Crypto Cycle

How XRP Ledger Stablecoin Adoption Is Driving New XRP Price Predictions

The XRP Ledger stablecoin expansion builds on SG-FORGE’s earlier EURCV launch on Ethereum in 2023. This time, the bank is rolling out the asset on XRPL. This signals growing confidence in Ripple’s infrastructure for regulated finance. SocGen confirmed the stablecoin is designed to meet strict compliance standards while offering transparency and security for institutional users.

XRPL’s appeal to institutions comes down to speed and cost. Transactions typically settle in three to five seconds, and fees are often less than $0.01, according to the XRPL documentation.

Also Read: IMF Warns China’s Industrial Machine Is Reshaping Dollar Dominance

A Look Into XRP’s Price

The EURCV launch has also revived speculation around XRP’s market outlook. Crypto analyst CryptoBull recently pointed to historical chart patterns and suggested XRP could climb as high as $9 in the coming cycle. That kind of XRP price prediction is not unusual during periods of growing institutional adoption.

XRP’s Current Market Position and the Road Ahead

At the time of writing, XRP was trading at $1.42. This comes after a weekly rise of 4.1%. It should be noted that an ascent to $9 from its current price would require a 533% increase. In addition, the highest that the altcoin has surged to is $3.65. This peak was attained back in July of 2025.

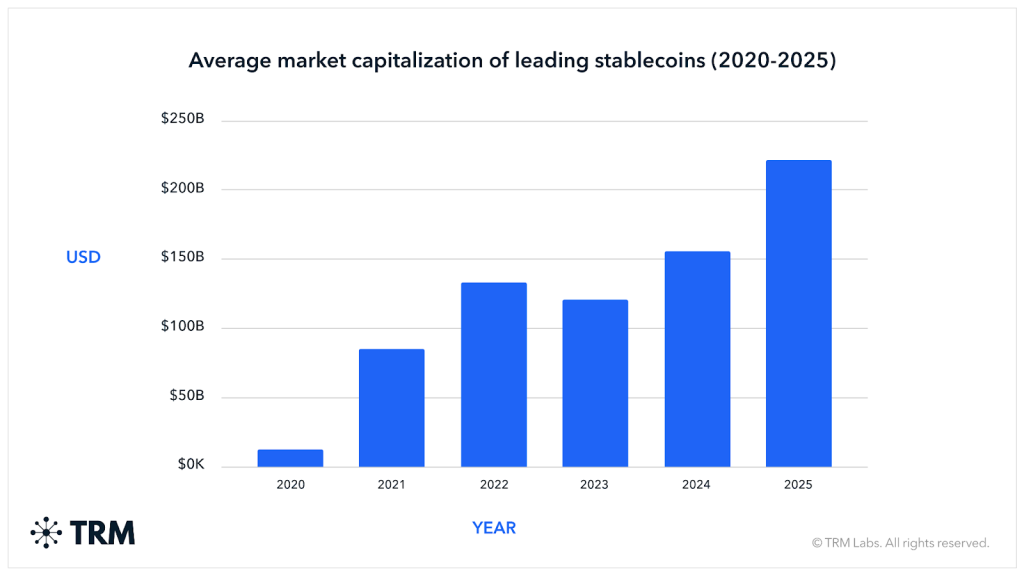

Even though this $9 XRP price prediction remains speculative, the steady rise in stablecoin activity isn’t. Stablecoins accounted for a significant share of blockchain transaction volume globally in 2025. According to data from TRM Labs, stablecoins accounted for about 30% of total crypto transaction volume between January and July 2025. During the same period, stablecoin transaction volume exceeded $4 trillion.

Even though the stablecoin launch itself doesn’t guarantee price gains, institutional adoption tends to build slowly. For Ripple and XRP, the bigger shift could already be underway. Banks are clearly moving past the testing phase and embracing adoption.

Also Read: $2.5B Bitcoin Options Expiry Looms as Huge $40K Put Signals Volatility Risk