The silver supply crisis is reshaping how traders access precious metals in 2026. COMEX silver inventories have been falling sharply, with the March-to-May contract roll hitting 30 million ounces per day, a pace that analysts warn could clear current open interest entirely.

At the same time, Binance’s XAU/USDT and XAG/USDT perpetual futures crossed $70 billion in trading volume within weeks, signaling strong demand for 24/7 crypto-native exposure to gold and silver.

Tokenized gold adoption and gold-backed crypto products are drawing renewed attention as physical supply tightens and volatility climbs.

Also Read: Tether CEO Says 94 Tonnes of XAUT Moved Instantly at Near‑Zero Cost

How the Silver Supply Crisis and Binance’s Metals Boom Signal a Market Shift

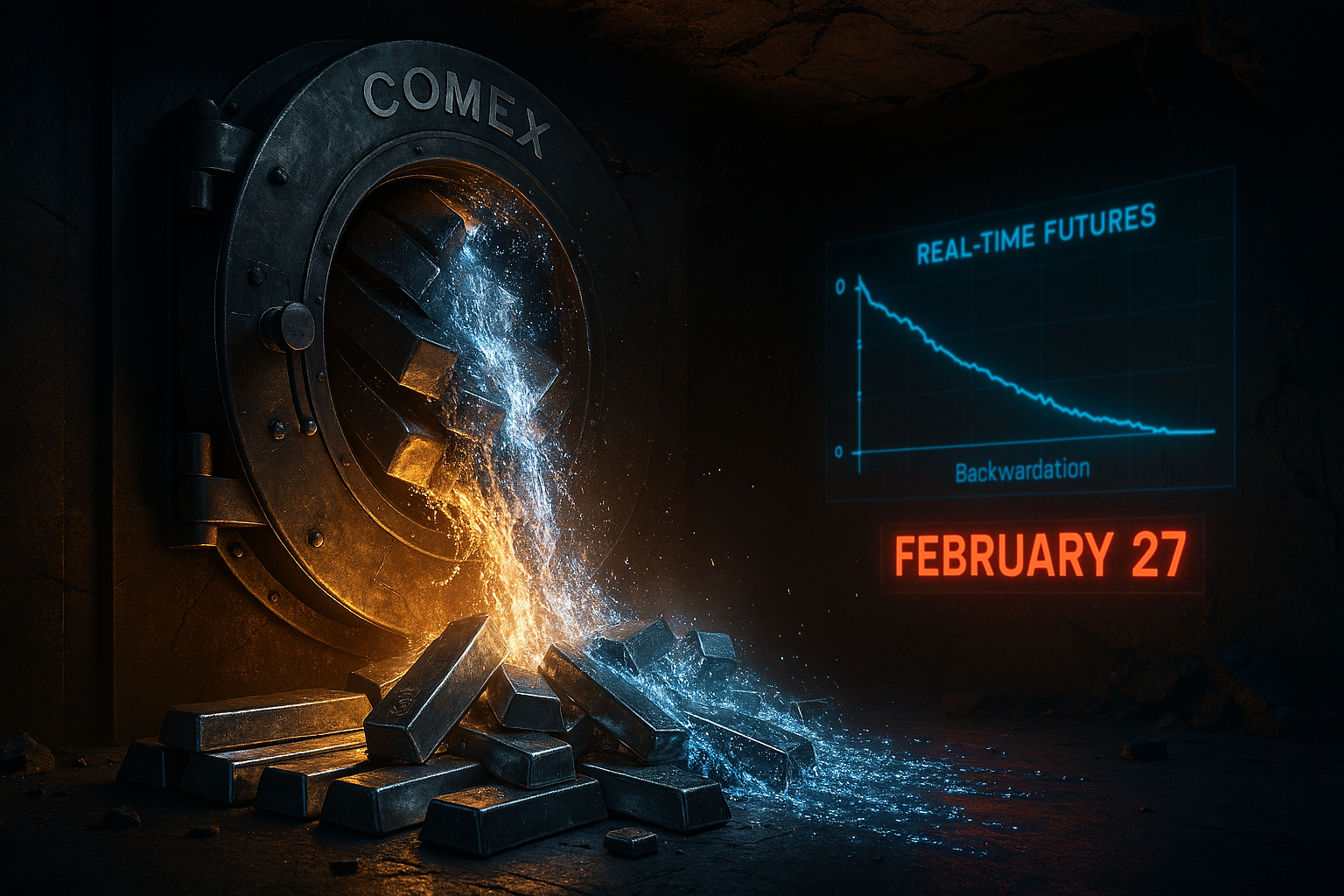

COMEX Silver Is Running Out Fast

Silver backing futures has dropped to 88.19 million ounces, and the silver supply crisis is being felt across the futures curve. The March-May spread is approaching backwardation when adjusted for SOFR and storage costs, meaning physical silver is valued more right now than at future delivery.

Karel Mercx stated:

“At that pace, COMEX is out of silver by February 27. March is no longer the bottleneck. From April onward, the market runs into a physical shortage unless COMEX sees meaningful inflows in the coming weeks.”

Silver backing futures keeps falling and is now 88.19M oz.

— Karel Mercx (@KarelMercx) February 20, 2026

Key takeaway from Thursday’s close:

The March to May roll is finally where it needs to be. It needs to be 30M oz per day and yesterday was 30M.

At that pace, COMEX is out of silver by February 27. March is no longer… https://t.co/qVTNKeAD7l pic.twitter.com/bJQMWkM7em

Mercx also added:

“Silver is the most interesting investment out there and the supply-demand setup is completely out of balance, so the price is going much higher. But it’s painful how many factual errors get repeated on X.”

The Silver drain continues aggressively… https://t.co/EzduPCdyS0

— Peter Spina ⚒ GoldSeek | SilverSeek (@goldseek) February 20, 2026

Also Read: SocGen Euro Stablecoin Launch on XRPL Fuels Analyst Calls for XRP to Reach $9

Binance’s $70B Volume and the Rise of 24/7 Metals Trading

Binance recorded over $70 billion across its gold and silver perpetual contracts, and tokenized gold adoption is a key driver behind that number. Traders are turning to gold-backed crypto products to get around traditional market-hour limitations. Binance’s metal trading seems to have exploded recently.

🔥BINANCE’S GOLD & SILVER DERIVATIVES SURPASS $70B IN WEEKS

— Coin Bureau (@coinbureau) February 20, 2026

Binance has recorded over $70BILLION in trading volume across its newly launched XAUUSDT and XAGUSDT perpetual futures, highlighting strong demand for 24/7 onchain exposure to gold and silver price movements. pic.twitter.com/hBl60xzoiX

CME Group is also moving in this direction, announcing 24/7 crypto futures trading on CME Globex starting May 29, pending regulatory review. CME reported a record $3 trillion in notional volume across crypto derivatives in 2025, with year-to-date 2026 ADV up 46% year-over-year.

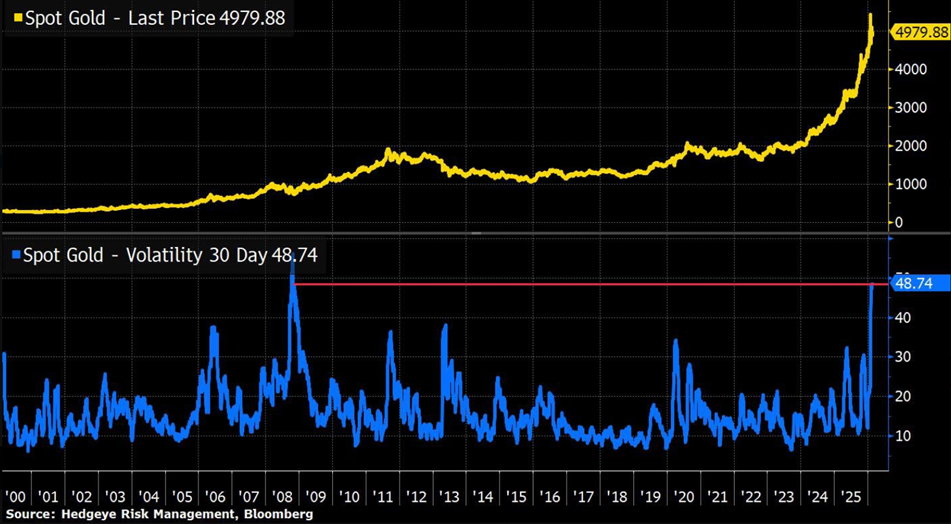

Gold Volatility Hits Levels Not Seen Since 2008

Gold’s 30-day volatility has surged to its highest point since 2008, with spot gold last priced at $4,979.88. The silver supply crisis is unfolding against this backdrop of macro uncertainty, and tokenized gold in 2026 markets are absorbing a significant share of that repositioning.

As physical supply tightens and derivatives demand grows, gold-backed crypto and tokenized gold adoption are no longer fringe solutions. They are becoming part of how institutional and retail traders alike are managing exposure to precious metals around the clock.

Also Read: PCE Inflation Forecast: Timiraos Warns of 0.37% Surge and Core PCE Hitting 3%