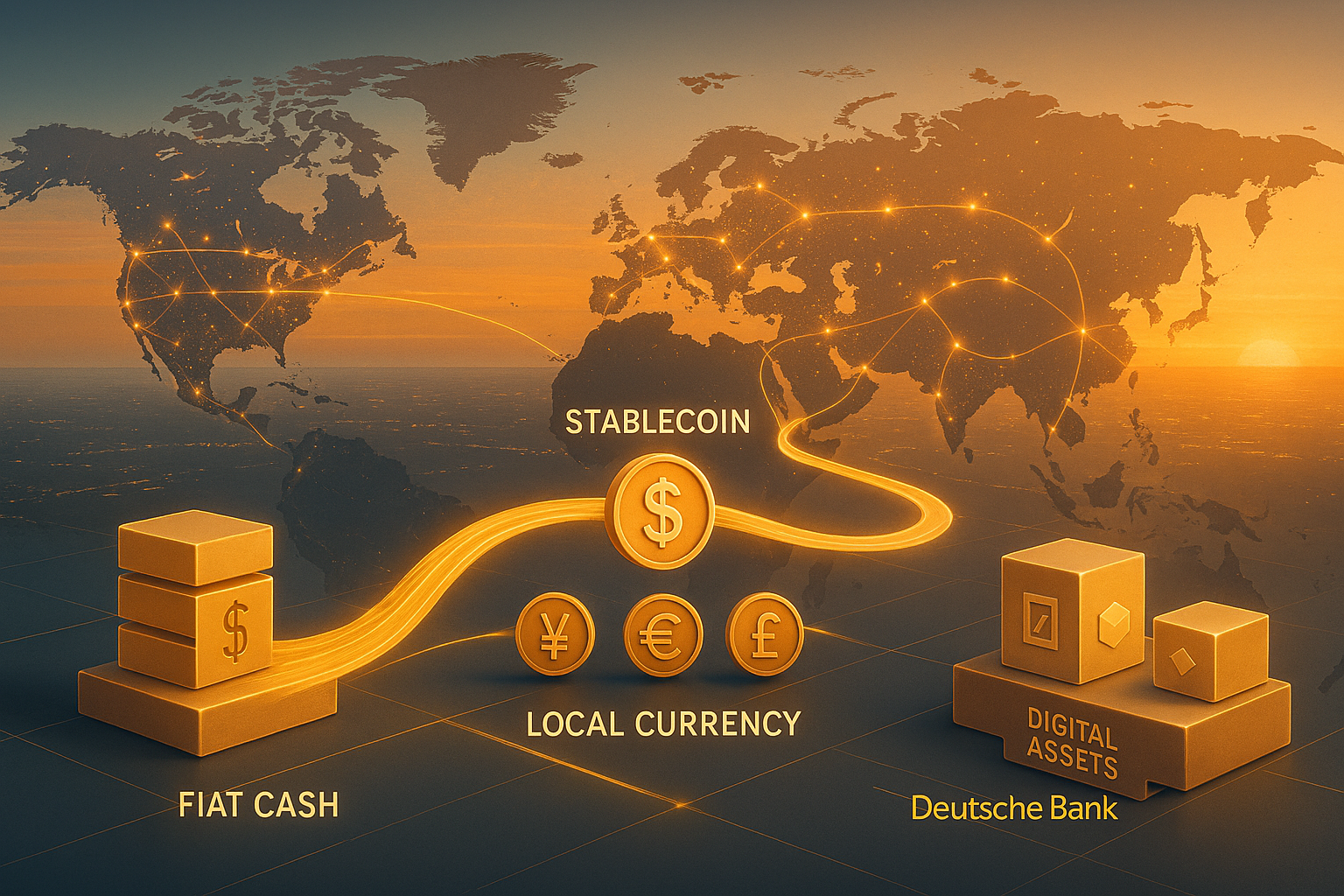

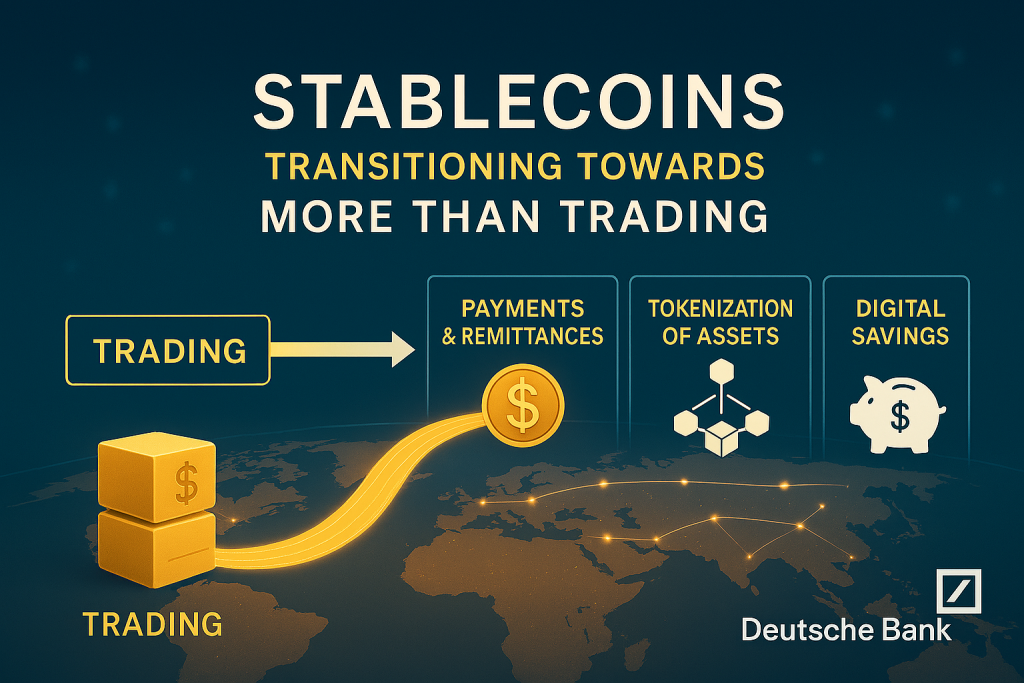

Deutsche Bank analysts predict that stablecoin use cases will expand significantly in 2026, shifting from crypto trading to mainstream finance. They highlight how regulations like the EU’s MiCA and the U.S. GENIUS Act will drive adoption. Meanwhile, B2B stablecoin payments and tokenised settlements emerge as key applications, enabling faster cross-border transactions. This evolution addresses inefficiencies in traditional systems, fostering global integration in Deutsche Bank digital assets strategies.

Also Read: XRP Ledger Tokenization Hits $5M in Dubai Properties

Deutsche Bank Maps 2026 Stablecoin Use Cases Beyond Crypto Trading

Deutsche Bank analysts forecast a pivotal shift in stablecoin use cases by 2026, moving far beyond their traditional role in crypto trading. Marion Laboure, Research Analyst at Deutsche Bank Research, and Sabih Behzad, Head of Digital Assets and Currencies Transformation, presented this outlook during a recent client webinar. They argue that stablecoins now function as a stable medium of exchange. Those stablecoins are pegged primarily to the US dollar and backed by high-quality assets such as cash and short-term Treasuries.

Regulatory clarity drives this transformation. The EU’s MiCA framework imposes strict reserve requirements and transaction caps on non-euro stablecoins to protect monetary sovereignty. In the United States, the GENIUS Act of 2025 establishes its own rules as well. This act permitted issuers, enforces 1:1 backing with liquid assets, and aligns stablecoins with full AML/KYC standards. These measures encourage institutional adoption while mitigating risks to financial stability.

Deutsche Bank digital assets experts highlight growing momentum in practical applications. Stablecoins already support faster, lower-cost cross-border flows, improved transparency, and streamlined reconciliation. Transaction volumes reached an estimated US$62 trillion in 2025, though real-economy payments remain a smaller but rapidly expanding segment.

Stablecoin regulation 2026 will likely accelerate this trend, fostering confidence among banks and corporates. As a result, stablecoins evolve into core infrastructure for modern finance, quietly integrating into global payment systems.

Also Read: SHIB Price Recovery Shows Strength After 6.5% Weekend Jump

How Stablecoin Use Cases Are Expanding Into Real-World Payments and B2B

Deutsche Bank experts see stablecoin use cases expanding rapidly into real-world stablecoin payments and B2B stablecoin payments by 2026. While crypto trading still dominates overall volumes, real-economy applications surge in sectors hampered by slow and costly traditional systems. Cross-border remittances and corporate transfers gain from near-instant settlement, lower FX expenses and better transparency. Sabih Behzad, Head of Digital Assets and Currencies Transformation at Deutsche Bank, emphasized this momentum in a client webinar.

“Unlocking further real-world use cases depends on advancing a few key areas. Stablecoins were needed for crypto trading because traders had large crypto positions that needed to be rebalanced on a 24/7 basis (bank money is not available in this way). Although this is still the main use case, others are emerging.”

B2B transactions lead growth, especially in emerging markets through the ‘stablecoin sandwich’: fiat on-ramp, swift blockchain transfer, and local off-ramp. Tokenised settlement advances as on-chain assets require 24/7 programmable cash. Deutsche Bank digital assets efforts, like G7-pegged stablecoin coalitions, help banks integrate these tools smoothly. Stablecoin regulation 2026 promises to clear hurdles, building corporate trust and embedding stablecoins deeper into treasury and payments infrastructure.

Also Read: Claude Code Security Debut Wipes $15 Billion from Cybersecurity Stocks