In the grand scheme of physical vs digital assets, in this case, Bitcoin vs gold, JPMorgan (JPM) has struck a more optimistic tone on Bitcoin. According to JPMorgan’s quantitative strategist Nikolaos Panigirtzoglou, “Bitcoin now looks more appealing than gold for the long term.” And while others see the potential in Bitcoin’s long-term outlook, BlackRock (BLK) has trimmed its Bitcoin portfolio and sold it for roughly $175 million. This begs the question: Will the Bitcoin vs gold debate end soon?

BlackRock’s Bitcoin Sale

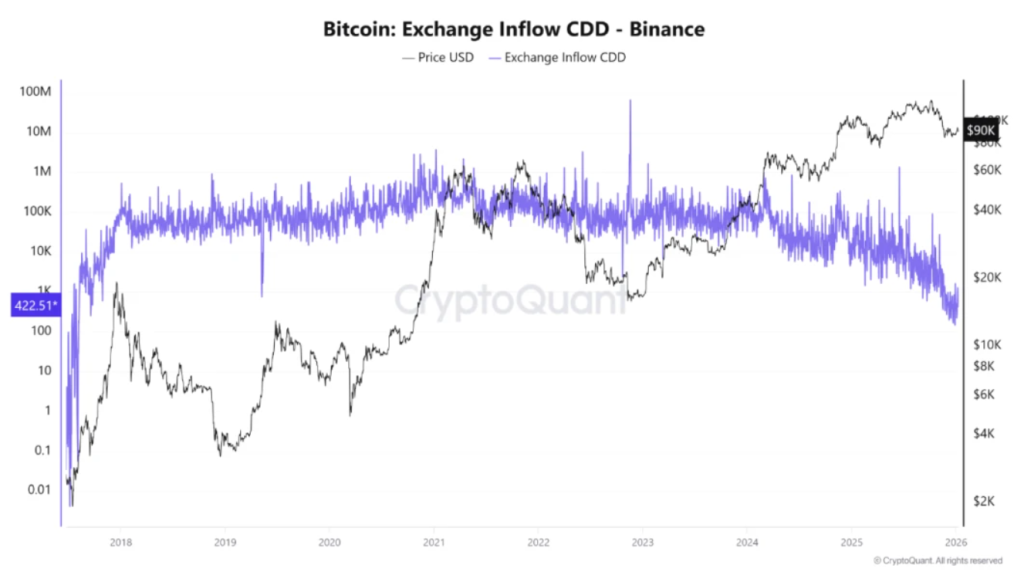

If you’ve been wondering why Bitcoin has been dropping, BlackRock’s sale is yet another trigger. This is not BlackRock’s first rodeo as it has been on a selling spree for quite a while.

The Bitcoin market is highly volatile at the moment. Reports point out more than $1 billion in outflows in a single session.

JPMorgan’s Bitcoin Prediction

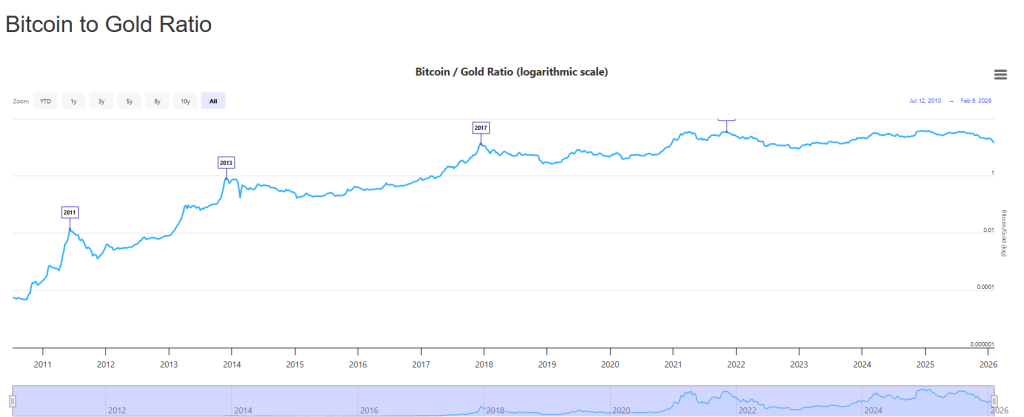

Despite the bloodbath in the cryptocurrency market, JPMorgan’s analysts’ Bitcoin prediction say the long-term outlook is intact. “Bitcoin could reach $266,000 “over the long term” as it increasingly looks more attractive than gold, even as crypto markets face near-term pressure from weak sentiment.“

Further, JPMorgan’s report reiterates, “…gold has outperformed bitcoin since last October, but with sharply higher volatility, which makes bitcoin “even more attractive compared to gold.”

In a Longterm Trends analysis, Bitcoin has been on a steady rise.

While gold may have edged Bitcoin in raw returns, the relative stability and risk-adjusted returns are prompting analysts to reconsider Bitcoin’s role in a diversified portfolio. In fact, JPMorgan believes that Bitcoin’s risk-adjusted returns are increasingly competitive with gold. “Bitcoin’s long-term risk-adjusted potential relative to gold has improved,” Nikolaos Panigirtzoglou remarked.

JPMorgan agrees that “What this low volatility does for bitcoin is that it highlights bitcoin’s future potential as a safe haven.” So its outlook may not be far-fetched. After all, the cryptomarket is unpredictable as it is, and anything goes.