Ethereum has seen its price drop below the $2,000 mark since May of 2025. This shouldn’t come as a surprise, as the past 48 hours have seen the cryptocurrency market plunge. According to Yahoo Finance, ‘Ethereum has lost more than 52% from its recent highs.” And while cryptocurrency price predictions can be faulty, Bitmine’s Tom Lee finds himself in an awkward position. His forecast promised highs of up to $9,000 and failed to anticipate the recent sharp ETH crash.

Why a Vitalik‑Linked $6M Transfer Is Fueling the Latest Ethereum Drop

While the broader crypto market is under immense pressure from macroeconomic factors, co-founder Vitalik Buterin’s actions are largely to blame for the Ethereum (ETH) drop. He has sold 2,961 Ether worth $6.6 million over the past 72 hours, reigniting market jitters at a time of already fragile sentiment.

This is also timely, as Vitalik had just declared the end of layer 2. Layer 2 handles most of Ethereum’s scaling so if the co-founder is selling, what is the long-term growth strategy of ETH?

However, ETH Daily reports that, “He withdrew 16,384 $ETH to personally fund open-source initiatives focused on creating a secure, verifiable, and open full stack of software and hardware. This includes areas like privacy-preserving technologies (e.g., ZK proofs, FHE, differential privacy), secure hardware, encrypted messaging apps, local-first software, operating systems, biotech (personal and public health), finance, communication, and governance tools.“

So, while at first glance it may seem like a panic sell, it is actually a structured sell meant to support the Ethereum ecosystem.

Ethereum’s Price Prediction

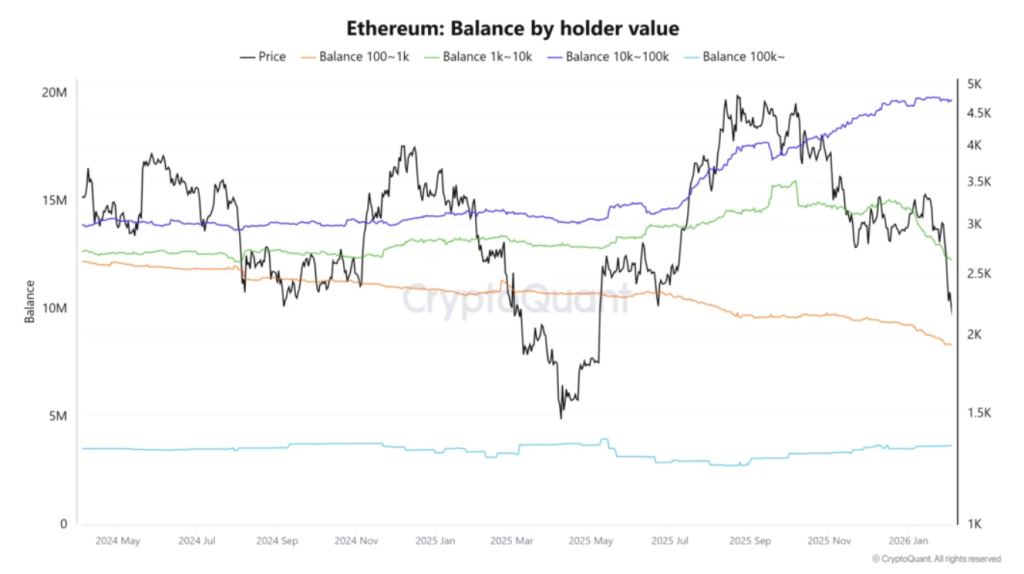

Whereas the price drop in Ethereum has spread like wildfire, it isn’t the end. Even though there are sharp drops across multiple holder cohorts, on-chain data shows that larger wallets have not engaged in sustained distribution.

There’s a pattern that points to selling during periods of weak liquidity but not an orchestrated exit by long-term or large holders.

So while Vitalik Buterin’s sale of Ethereum may not have been anticipated, it cannot be grouped as a loss of confidence in the market, especially as the co-founder.