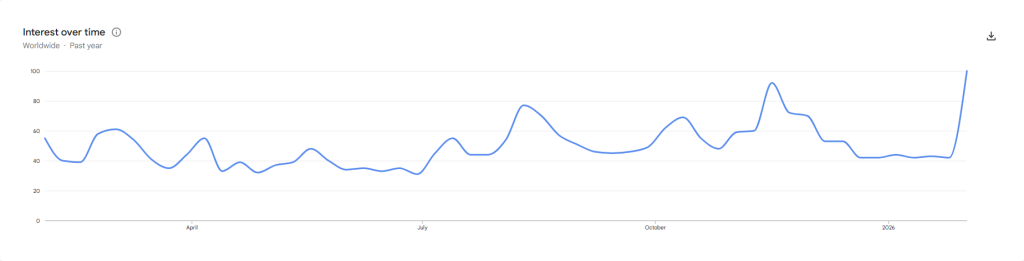

Online interest in Bitcoin spiked as the cryptocurrency recovers from one of the largest sell-offs in history. According to Google Trends, Bitcoin search volume reached its highest level in the last 12 months. Interest over time hit a score of 100 points for the first week of February. Despite Bitcoin falling to $60,000 for the first time since 2024, buyers appeared pushing prices to $70,000 on Feb. 7.

Bitcoin Search Volume Reaches Record Levels

Google Trends shows that Bitcoin search volume spiked last week. Interest in Bitcoin spiked as the virtual currency experienced a volatile price action, pushing its price to $60,000. This increase in Bitcoin search trend represents the highest level in over a year.

The sharp rise in Bitcoin search volume is a strong signal of renewed interest from retail investors. Bitcoin search trend data shows that searches typically surge when prices crash and rebound quickly. This brings in casual investors who follow media coverage and are searching for opportunities in the market. This is also consistent with the Crypto Fear & Greed Index, which is currently showing “Extreme Fear”

Bitcoin Volume Data Highlights Intense Trading During Rebound

It is worth mentioning that Bitcoin traded above $80,000 during the first days of February before the sharp correction began. Bitcoin volume data revealed a significant increase in trading activity as prices plunged and then rebounded. This elevated Bitcoin average volume in recent days fuelled volatility not only for Bitcoin but also across the cryptocurrency market.

For context, Ethereum (ETH) experienced severe pressure, dropping from $3,000 on January 29, to $1,820 on February 6. This represents a decline of approximately 40% in just one week for the second-largest cryptocurrency by market capitalization.

Bitcoin average volume remained well above seasonal norms last week, reflecting intense participation from both retail and institutional traders. Indeed, as shown by the Coinbase Bitcoin Premium Index, the price of Bitcoin was almost 0.28% lower in Coinbase compared to other exchanges such as Binance.

At the time of writing this article, Bitcoin is being traded at $67,900. This is close to $2,000 below yesterday’s highs above $70,000. Analysts still consider that Bitcoin prices could move lower despite the recent rebound. According to Markus Thelen, CEO of 10X Research, BTC could fall to $50,000 if selling pressure continues.