Tether (USDT), the largest stablecoin in the market, has registered record numbers in the last quarter of 2025. According to their market report for the last quarter of 2025, USDT onchain transactions hit an all-time high. Additionally, the report highlights that Q4 saw the highest ever level of monthly active on-chain users.

USDT Onchain Transactions Hit New Records

USDT onchain transactions continue to grow. The USDT Q4 2025 Market Report shows the total value transferred on-chain reached $4.4 trillion. This marks the highest quarterly level ever recorded. The figure rose by $248.6 billion from the prior quarter.

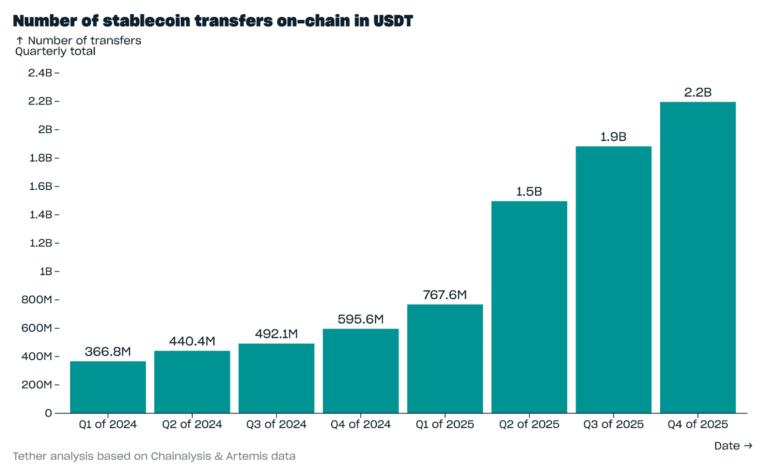

It is worth mentioning that most transfers were of small amounts. As per the report, 88.2% involved amounts under $1,000, reflecting broad retail and everyday use. Furthermore, the number of transfers hit 2.2 billion in total. This firmly establishes USDT as the dominant stablecoin for single-asset transfers, capturing 65.9% of the value transferred.

Source: USDT Q4 2025 Market Report

Tether’s market capitalization also increased by $12.4 billion to $187.3 billion. Compared to other stablecoins in the market, Tether continued with its market growth despite adverse conditions. At the time of writing this article, Tether’s market capitalization sits at $185.6 billion. This positions Tether as the third-largest cryptocurrency in the market just after Bitcoin (BTC) and Ethereum (ETH).

USDT Reserves Expand

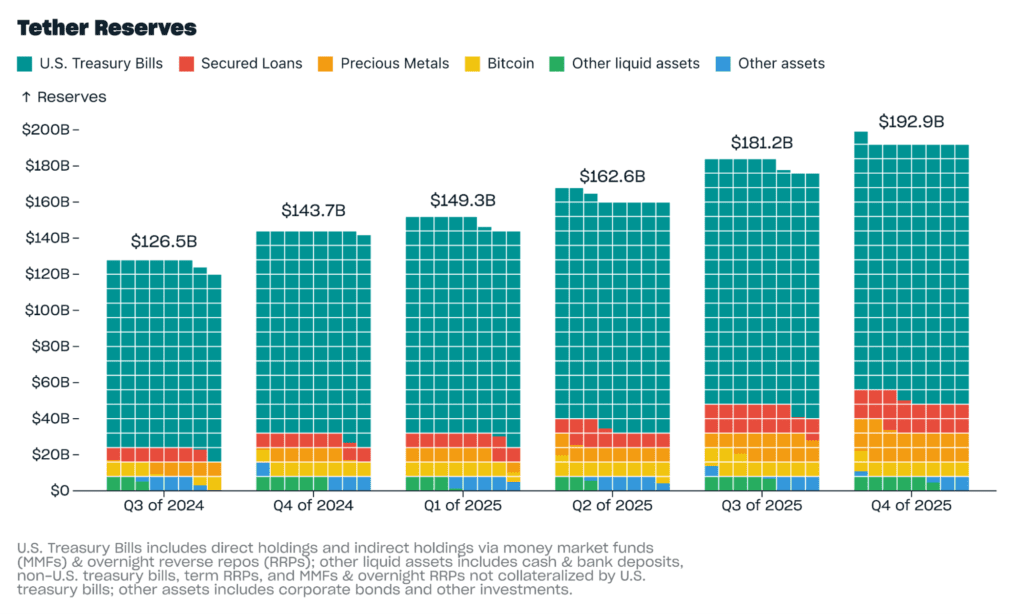

As per the report, Tether’s total reserves increased by $11.7 billion in the last quarter of 2025.

Source: USDT Q4 2025 Market Report

USDT Reserves have always been scrutinized by market participants. These include direct holdings and indirect holdings via money market funds, and overnight reverse repos. The company also holds other liquid assets such as cash and bank deposits, among others.

In addition, Tether is the 18th largest holder of US treasuries in the world after South Korea and ahead of Saudi Arabia and Germany.

The report says regarding the growth experienced last year:

“USDT hit many new highs in Q4 2025, although growth slowed after the crypto liquidation cascade of 10 October 2025. However, the data shows that the crypto market is not the only driver of USDT growth. Users prefer to save in USDT vs other stablecoins by a wide margin, providing a stable source of demand.”

Onchain USDT became very popular in different countries due to its fast USDT transaction times. Although this depends on the network used (Tron, Solana, BNB Smart Chain, Ethereum), transactions usually take seconds. Compared to other options in the market, onchain USDT remains the leading stablecoin.