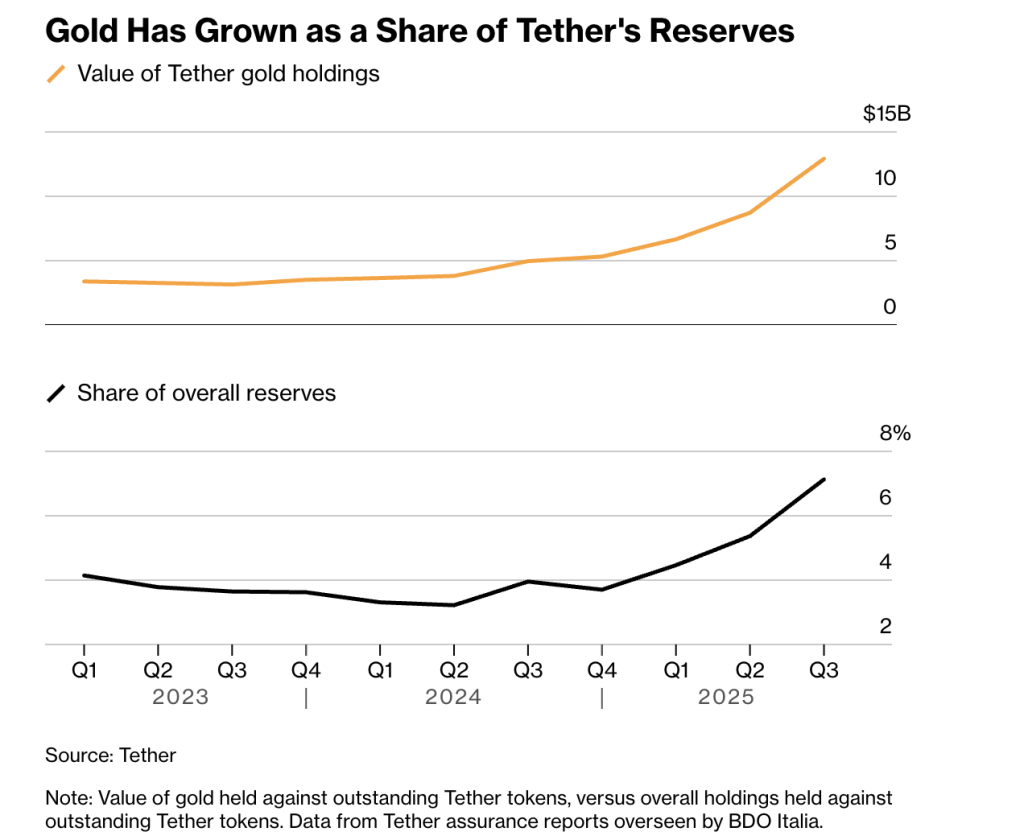

Straying slightly away from the cryptocurrency market, Tether, the firm behind the world’s largest stablecoin USDT, has been on a side quest. The stablecoin giant has been on a gold buying spree. In the past month, Tether’s gold reserves increased to a staggering 148 tonnes, worth about $23 billion.

According to a report by Wall Street investment bank Jefferies, the firm is currently holding its latest purchase as reserves backing its U.S. dollar-pegged stablecoin USDT as well as gold-backed crypto XUAT.

Also Read: Freedom Capital Puts Spotlight on Nebius (NBIS) as Stock Forecasts Grow

How Tether Gold Reserves Strengthen USDT Backing and Crypto Reserves

Tether is currently under the spotlight following its increased interest in gold. Another report by Societe Generale analysts highlights how the firm’s current holdings exceed those of several nations and banks. The report further reveals that during the last quarter, Tether’s gold reserves reached 126 tonnes, which pushed the firm to the 36th largest central bank based on the World Gold Council’s ranking of the top 100 gold holders.

Tether’s gold reserves will most likely continue growing. The firm’s chief executive, Paolo Ardoino, previously revealed that Tether will continue buying about one to two tons of gold every week for “definitely the next few months.”

He added:

“The way I see it is that there are foreign countries that are buying a lot of gold, and we believe that these countries will soon launch a tokenized version of gold as a competitive currency to the US dollar.”

Ardoino even confirmed that he intends to allocate about 10-15% of Tether’s investment portfolio to physical gold.

Also Read: China Orders Banks to Cut U.S. Treasury Holdings as De‑Dollarization Accelerates

Gold Holdings Surpass Several Nations

Tether’s gold reserves are currently higher than those of several prominent nations. This includes Australia, Qatar, South Korea, the United Arab Emirates, and Greece. Tether now stands as one among the world’s top 30 gold holders.

The stablecoin giant’s latest move coincides with the skyrocketing price of gold. In January 2026, the commodity reached an all-time high of $5608.35.

Also Read: China Misses Soybean Meal Reduction Target as US Deal Adds Pressure