Goldman Sachs has warned that Friday’s market rebound might be short-lived, with the equity market facing renewed selling pressure this week. This could have spillover effects into the crypto market, which is already reeling from heavy losses.

According to Goldman’s trading desk, Commodity Trading Advisers (CTAs) have already crossed the short-term sell triggers in the S&P 500 index, triggering sell orders. If the S&P 500 continues to decline, CTAs could dump $33 billion in equities before the end of this week. Additionally, the trading desk suggests that if key technical levels are breached, systematic selling could increase to $80 billion this month.

Also Read: Tether Gold Reserves Hit $23B as USDT Backing Surges

How the Goldman Sachs Crypto Warning Impacts Stock Selloff and Market Risk

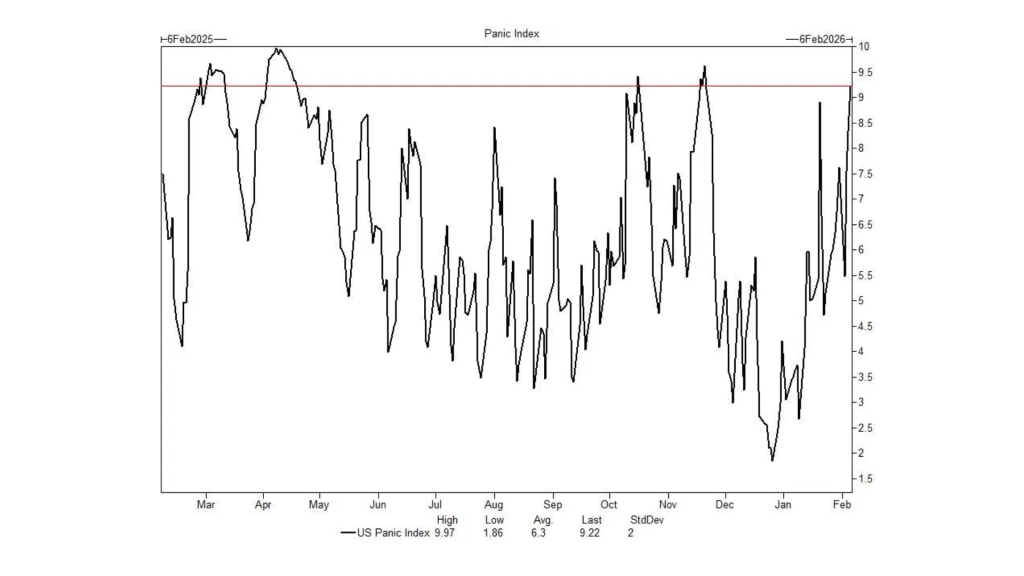

At the time of writing, Bloomberg’s US Panic Index stood at 9.22 on a scale of 1-10, while CNN’s Fear & Greed Index was at 45/100, highlighting heightened fear and anxiety in investor sentiments. With low liquidity, the equity market is expected to witness volatility.

According to Bloomberg, in an email to clients, Gail Hafif and Lee Coppersmith from Goldman’s trading desk wrote,

The inability to transfer risk quickly lends itself to a choppier intraday tape and delays stabilization in overall price action.

Also Read: Dubai Investor Dumps XRP in Major Shift Toward Shiba Inu

An industry expert, based on his assessment of the report, stated the following:

STOCK SELL-OFF NOT OVER, GOLDMAN TRADERS SAY

— *Walter Bloomberg (@DeItaone) February 8, 2026

Goldman Sachs warns that US stocks could face more selling this week, driven by trend-following funds known as CTAs, which have already hit sell triggers in the S&P 500.

The bank estimates CTAs could dump up to $33 billion this week…

Other systematic strategies, including risk-parity and volatility-control funds, also have room to reduce exposure if volatility stays elevated.

A bearish equity market has, in recent times, had a direct impact on crypto. For instance, last Friday, when the stock market bounced back, Bitcoin also reacted positively, with Bitcoin price outlook suggesting levels of $80,000 in 2026, according to CryptoRank.

CoinMarketCap’s Crypto Fear and Greed Index currently sits at 9 on a scale of 1-100. This indicates extreme fear in the crypto market.

Many also see it positively because when the fear is high, the prices go down, creating a perfect buying opportunity.

According to the sources mentioned above, bigger players are accumulating Bitcoin in massive numbers during the recent drop. Around 66,940 $BTC has moved into accumulator addresses. These are wallets that typically just buy Bitcoin and have no past history of selling.

The Goldman Sachs report on the stock selloff is a stark reminder of the volatility of the market and how it directly translates into crypto market risks. Investors in both these markets should stay cautious for now.