The earned income tax credit delay is affecting millions of taxpayers in 2026, with the IRS holding refunds until at least mid-February. Federal law requires this earned income tax credit delay for anyone claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC), meaning refunds won’t be issued before February 15.

The PATH Act of 2015 mandates this earned income tax credit delay to prevent fraud and give the IRS time to verify claims. At the time of writing, taxpayers who filed early are still waiting, and most won’t see their money until early March.

Also Read: Goldman Sachs Warns of Further Stock Losses as Crypto Faces Rising Risk

Earned Income Tax Credit Delay And IRS Refund Changes Explained For 2026

Understanding The February 15 Deadline

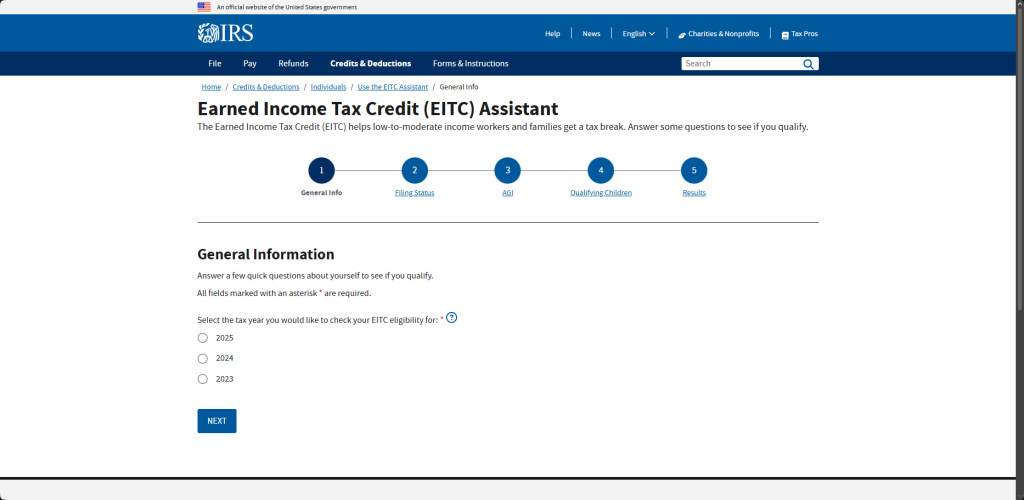

The earned income tax explained: it’s a refundable credit for working people with low to moderate monthly earnings. The earned income tax credit 2026 rules require the IRS to hold these refunds until February 15, regardless of when you file your return. This earned income credit calculator available on IRS.gov can help estimate your refund amount before filing.

The IRS stated that it expects “the earliest EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards starting the first week of March” for those who claim these credits and file electronically with direct deposit.

Who Is Affected By The Earned Income Tax Credit Delay

Roughly 31 million Americans claim these credits annually. The earned income tax credit delay impacts working families with children and some workers without children who meet income requirements. For 2026, single filers can earn up to approximately $18,000, while married couples with three or more children can earn around $63,000 and still qualify.

Also Read: 2026 Tax Refund Schedule: When to Expect Your Bigger Refund

IRS Tax Refunds And Direct Deposit Changes

A major change for IRS tax refunds in 2026: taxpayers can no longer split refunds among multiple accounts. The earned income credit calculatorshows potential refund amounts, but now that entire refund must go to one account. This change affects all taxpayers claiming IRS tax refunds, not just those with the earned income tax delay.

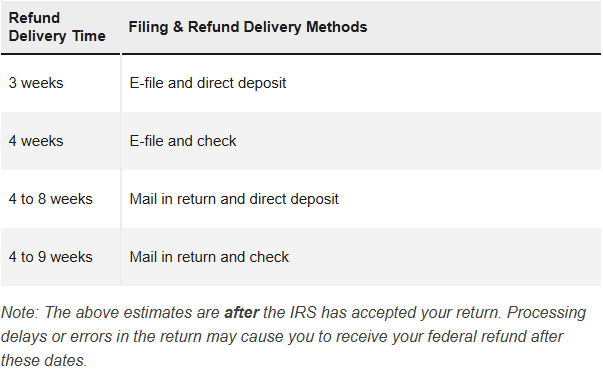

The Where’s My Refund? tool tracks IRS tax refunds starting 24 hours after the IRS receives your e-filed return. Filing early with direct deposit remains the fastest option once the earned income tax 2026 hold period ends.

What To Expect With Earned Income Tax Credit 2026

Paper returns take six to eight weeks to process, extending the earned income tax delay significantly. Electronic filing with direct deposit gets your earned income tax credit 2026 refund faster, typically by early March. The earned income credit calculator can’t speed up the process, but it helps you plan for the wait.

The IRS continues warning about scams targeting people expecting refunds. The agency never calls, texts, or emails demanding payment or personal information.

Also Read: Tether Gold Reserves Hit $23B as USDT Backing Surges