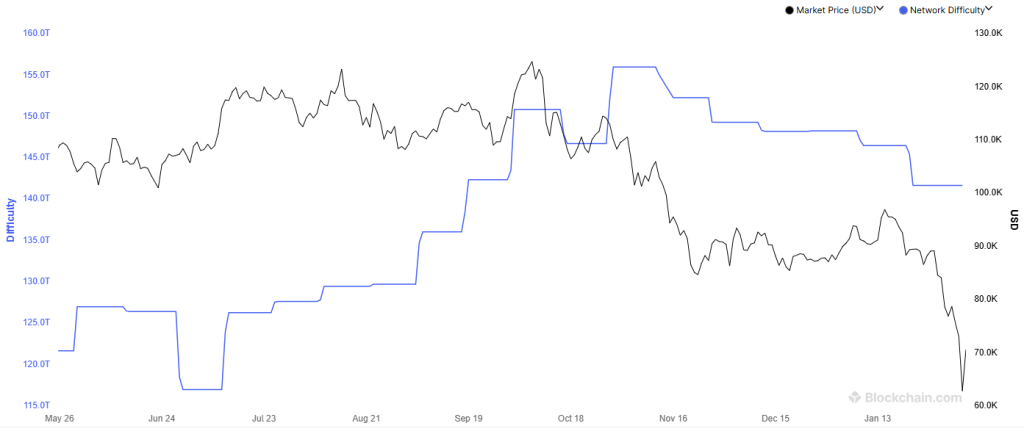

Bitcoin mining difficulty has reached its lowest point since mid-2025 amid bearish sentiment in the crypto market. Bitcoin’s difficulty dropped to 141T from 146T two weeks ago. The last time that the network difficulty reached those levels was in September 2025. These adjustments on how difficult it is to mine a new block help miners re-enter the market and protect the network.

Bitcoin Mining Difficulty Chart Shows Lowest Levels Since 2025

Bitcoin’s price has declined by approximately 50% since its peak in October 2025. This is significantly impacting miners’ profitability, as clearly visible on difficulty charts. The current Bitcoin mining difficulty chart measures how difficult it is to mine a block. The more difficult it is, the more computing power is needed to mine a block.

Source: Blockchain.com

Bitcoin difficulty has been steadily growing over the last few years as the largest virtual currency reached new highs. There were only short periods in Bitcoin’s history where network difficulty declined for prolonged periods. The largest drops in difficulty were typically preceded by strong market downturns such as those in 2021 and 2024.

The recent drop in difficulty represents the most significant negative adjustment since the 2021 China mining ban. This adjustment in the network allowed Bitcoin’s network hashrate to recover from recent lows.

How is Bitcoin Mining Difficulty Adjusted?

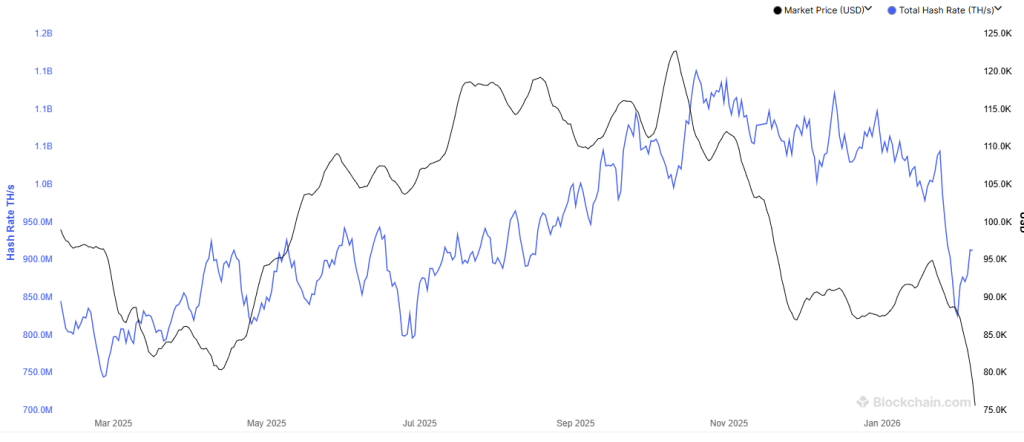

Bitcoin miners compete to solve complex cryptographic puzzles. The combined computing power of miners is represented by the total number of hashes processed per second. This is also known as hash rate and measured by different network trackers. Hash rate increases when new miners enter the market. The opposite happens when miners turn off their machines when they are unprofitable.

Therefore, how is Bitcoin mining difficulty adjusted exactly? The process takes place every 2016 blocks, roughly two weeks. Bitcoin nodes calculate the time taken to produce those blocks. If blocks are mined too quickly, the difficulty increases. Instead, if fewer blocks are mined, difficulty is adjusted downwards.

Source: Blockchain.com

The current Bitcoin mining difficulty adjustment shows that fewer blocks than normal were being produced. Thanks to this adjustment in the difficulty, hash rate increased and recovered from the lows registered the first days of the month.

Bitcoin’s hash rate reached an all-time high of 1.15B TH/s in October 2025, when Bitcoin hit an all-time high. When the price of the largest virtual currency started moving downwards, hash rate also dropped. This was followed by a similar drop in Bitcoin’s network difficulty. The strongest fall took place the first days of February when hash rate plummeted to 825M TH/s.