China’s financial regulators are paying close attention to the nation’s financial institutions and are urging them to scale back on U.S. Treasuries. Beijing officials have cited concentration risks and increased market volatility as major concerns. China dumping U.S. Treasuries also aligns with China’s de-dollarization efforts. According to reports, several prominent banks were advised to limit purchases of U.S. government bonds to avoid excessive exposure.

Also Read: Nvidia Stock Back in Focus as Goldman Sachs Sees Billions in Upside

Is This Part Of China’s De-Dollarization Strategy?

Reports suggest that, similar to other market participants, China has begun viewing U.S. assets as less reliable. Donald Trump’s uncertain policy approach, along with the volatile market conditions, is slowly pushing U.S. assets out of the safe-haven bracket.

This, however, is limited to banks and other financial institutions of the country. It does not apply to the U.S. Treasury holdings of the Chinese state. China is reportedly the third-largest non-U.S. owner of treasuries after Japan and the UK.

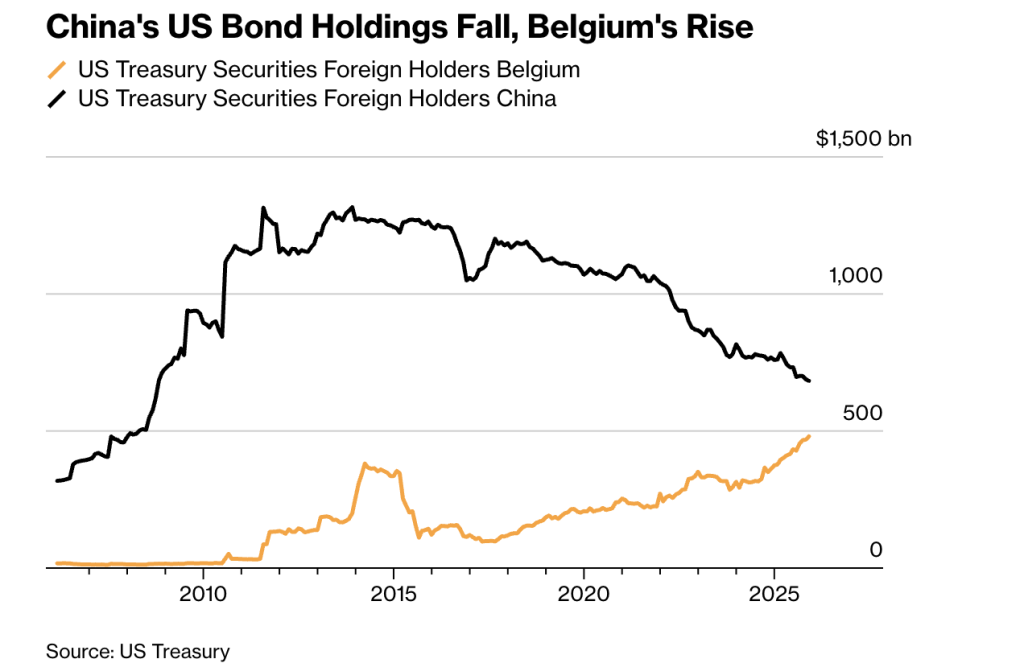

Despite this, China has been dumping U.S. Treasuries during the past year. The country’s holdings dropped to $682.6 billion in November 2025, the lowest since September 2008. During this time, the holdings dipped to a low of $618.2 billion. Back in January, Xi Junyang, a professor at the Shanghai University of Finance and Economics, addressed the latest shift and said,

“The decrease in China’s holdings of the U.S. treasuries is a result of increased optimization and diversification of holdings of foreign assets seen in recent years, which helps strengthen the overall safety and stability of the portfolio.”

China’s inclination towards reducing U.S. Treasury exposure follows several directions. This includes diversification of its foreign exchange reserves, decreased risks during volatile market conditions, and de-dollarization efforts. China has been one of the several BRICS nations leading the de-dollarization drive.

Also Read: AI.com Deal Shakes Tech World as AI Agent Service Goes Live

Evaluating Options

Similar to several of its counterparts, China seems to be exploring other options, including gold. Several believe that the People’s Bank of China (PBoC) will continue boosting its gold reserves. During the final quarter of 2025, the central bank’s gold reserves were at about 2,306.30 metric tonnes, the highest level on record.

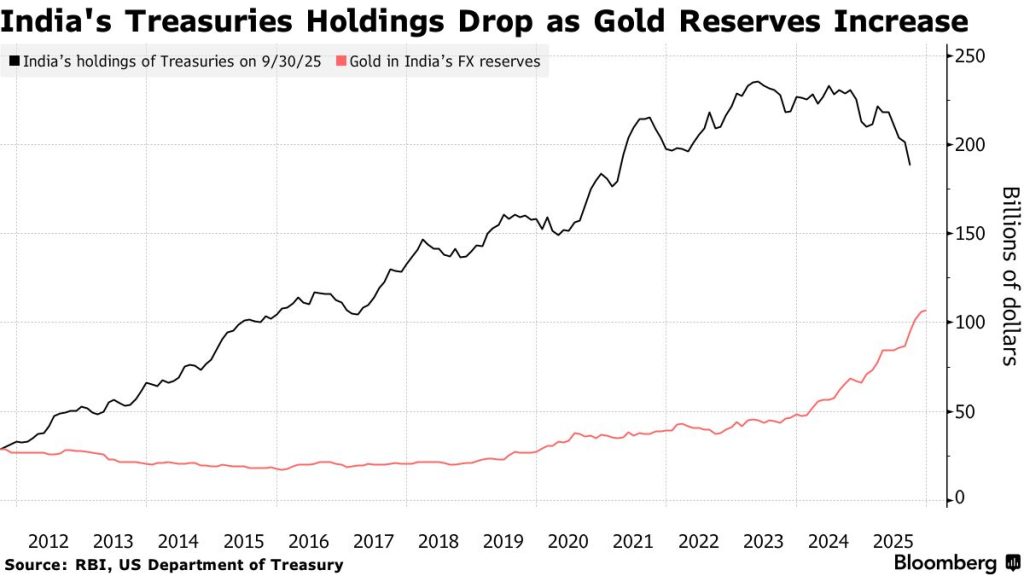

India seems to be moving along a path similar to China in its de-dollarization efforts. In January, the country reduced its holdings of U.S. Treasuries and increased gold purchases. Unlike China, India also saw a sharp drop in the value of the rupee. India is also among the BRICS countries that expressed interest in reducing reliance on the U.S. dollar through de-dollarization.

Also Read: Binance Supercharges Trump Stablecoin as USD1 Surges to $5B