China’s ambitious roadmap to overhaul its agricultural supply chain has hit a significant setback by failing to meet its soybean meal reduction targets. Despite aggressive government mandates to decrease reliance on foreign protein sources, it still stands at 80% foreign dependency. The shortfall comes at a critical time as a massive new China soybean deal with the United States floods the domestic market, complicating the nation’s pursuit of absolute food autonomy.

China Soybean Deal And Imports Undercut Meal Reduction Efforts

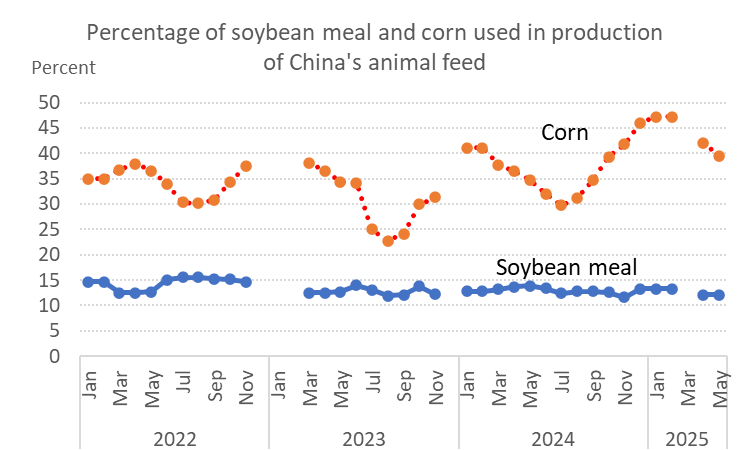

Industry data released by the China Feed Industry Association shows that last year’s soybean meal share in domestically produced feed remained at 13.4%, unchanged from the previous year. Agricultural authorities set a target to cut soybean meal use in feed to below 13%, aiming to reduce overall import dependence to 10% by 2030.

The deal is a paradox because on one hand, China is trying to wean its livestock industry off high-protein imported feed; on the other, ordering record quantities of soybeans of up to 6.9% YoY, including from the U.S., to satisfy raw material demand.

The Future of China Soybean Trade

China remains the world’s largest importer of soybeans, with total imports reaching more than 106 million tonnes in 2025. Although analysts project China’s overall soybean imports may slightly decline in the 2025-26 season, projections still show significant reliance on foreign supplies.

Due to immediate economic pressures, combined with obligations under recent trade agreements, China will continue to be tied to international markets for protein inputs. However, plans are underway to accelerate innovation in alternative feed sources by diversifying agricultural imports and “make China’s food system more secure.”

Trivium China’s director Even Rogers Pay, said:

“On soybeans, the plan shifts from consolidating expansion gains in 2025 to consolidating and enhancing production capacity, signalling a greater focus on yield and quality rather than planting area“

And even though China faces higher costs to bring in an additional 8 million metric tons, Rogers is optimistic that it will pay off:

“Is there a market logic at the moment for China procuring a bunch more U.S. soybeans, just as Brazil’s harvest comes in? No, but could it smooth the path for an even more productive and lucrative state visit by Trump in April? Perhaps.”