Nebius received a Buy rating from Freedom Capital, and analyst Paul Meeks also set a $108 price target for the AI infrastructure company at the time of writing. The coverage comes as Nebius prepares to release its fourth quarter and full year 2025 earnings on February 12, 2026, before the market opens.

Freedom Capital’s initiation marks a significant development for NBIS stock, which has grown over 160% in the past year. The firm characterized Nebius as a vertically integrated cloud platform purpose-built for artificial intelligence workloads, and positioning the company as a key player in next-generation cloud infrastructure right now.

Also Read: China Orders Banks to Cut U.S. Treasury Holdings as De‑Dollarization Accelerates

Nebius Stock Forecast, Earnings Insights, And What Nebius Group Does

Freedom Capital’s Rating and Price Target

Paul Meeks had this to say:

“By owning its data centers and eliminating hyperscaler-level markups, NBIS delivers cost-efficient, high-performance compute tailored to AI-native companies. Its focus on deep platform integration, flexible access to GPUs, and expansion across key global availability zones positions NBIS as a key player in next-generation cloud infrastructure. Continued investment in AI-focused product development and infrastructure supports a large and expanding addressable market, fast revenue growth, and operating leverage at least over the next several years included in our investment horizon.”

The latest Nebius stock forecast from Freedom Capital reflects optimism about the company’s growth trajectory, and analysts have set an initial target price of $108 per share over a 12-month horizon. This Nebius stock forecast represents about 25% above the current stock price. The analysts noted they intentionally use the word “initial” for this target price, and prefer to wait for the company and other sources to build confidence in projected performance before valuing Nebius primarily based on next year’s expected revenue.

Understanding What Nebius Group Does

Nebius Group operates as a technology company building full-stack infrastructure to service the global AI industry right now. The company has its headquarters in Amsterdam and also trades on Nasdaq, with operations across the Netherlands, Europe, North America, and Israel.

Roman Chernin, co-founder and chief business officer of Nebius, explained what Nebius Group does:

“The core business we built is actually the cloud. We build a multi-tenant cloud with a very sophisticated software platform with a lot of managed services, and we build it to serve a variety of customers, all the way from small start-ups to the large enterprises.”

Also Read: China Misses Soybean Meal Reduction Target as US Deal Adds Pressure

The company provides cost-efficient, high-performance computing for AI-native companies through its ownership of data centers, which eliminates hyperscaler-level markups traditionally common in the industry. Understanding what Nebius Group does helps clarify why analysts see value in the stock right now. Nebius offers scalable GPU infrastructure in the GPU-as-a-service market, with access to NVIDIA H100, H200, and other advanced GPUs connecting via InfiniBand for large-scale AI model training and inference.

NBIS Stock: Recent Performance & Earnings Outlook

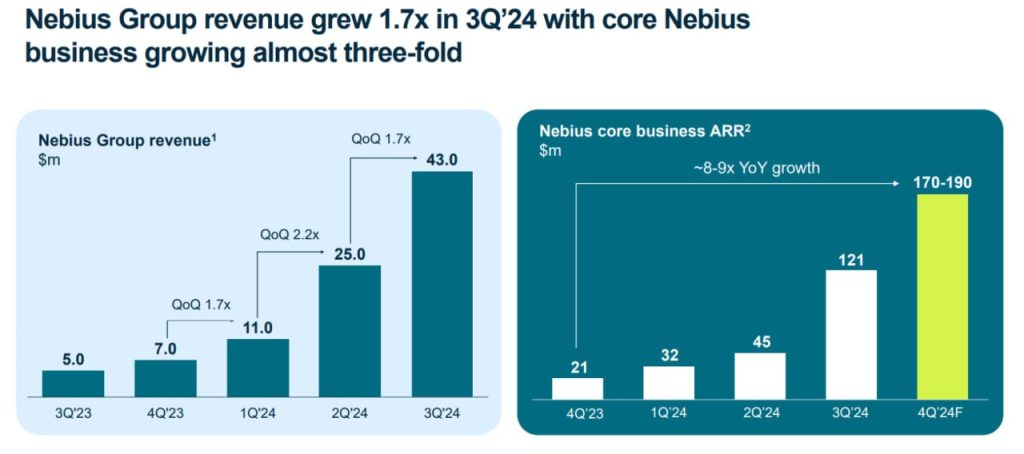

Nebius earnings reports have shown strong growth momentum in recent quarters. In the third quarter of 2024, the company posted revenue of $43 million, which represented 1.7x growth quarter-over-quarter, with the core Nebius business growing almost three-fold during that period. The core business ARR jumped from $45 million in Q2 2024 to $121 million in Q3 2024, demonstrating rapid acceleration. During the third quarter 2025 earnings call, the company reported Q3 group revenue of $146 million, marking a 355% increase year-over-year and also a 39% quarter-over-quarter growth from the previous year’s base. The core infrastructure business grew 400% year-over-year and 40% sequentially at the time of writing.

CEO Arkady Volozh stated:

“Nebius’s core AI cloud business, serving customers from AI startups to enterprises, is performing exceptionally well. We have also said that, in addition to our core business, we expect to secure significant long-term committed contracts with leading AI labs and big tech companies. I’m happy to announce the first of these contracts, and I believe there are more to come. The economics of the deal are attractive in their own right, but, significantly, the deal will also help us to accelerate the growth of our AI cloud business even further in 2026 and beyond.”

The company secured major contracts including a $3 billion deal with Meta and an agreement with Microsoft valued between $17.4 billion and $19.4 billion. Nebius aims for an annualized run rate revenue of $7 to $9 billion by the end of 2026, and these earnings projections show ambitious growth targets. The company tightened its full-year 2025 revenue guidance to between $500 million and $550 million at the time of writing.

Also Read: Nvidia Stock Back in Focus as Goldman Sachs Sees Billions in Upside

Different Analyst Perspectives

On January 15, Morgan Stanley weighed in on Nebius with an Equal Weight rating and a price target of $126, notably higher than Freedom Capital’s $108 target. The firm noted that the company’s vertically integrated AI cloud has received strong external validation and secured key reference customers. However, Morgan Stanley also expressed caution about the near-term targets, saying they appear aggressive given the substantial net new bookings the company needs to secure.

The differing analyst perspectives on the Nebius stock forecast reflects varying assessments of execution risk and market timing. Nearly 80% of Wall Street experts tracking Nebius have given it a Buy recommendation, with no analysts currently advising investors to sell the stock. The upcoming Nebius earnings report on February 12 will provide additional clarity on the company’s performance and future guidance, which could influence these forecasts further.