In the upcoming global reset, Hedera (HBAR) is emerging as an invisible plumbing tool. Even though the HBAR crypto price today remains volatile, trading at $0.08–$0.14 and below 2021 highs, analysts front Hedera as the perfect candidate for real-world asset tokenization and cross-border payments. This transition could lead toward a fully digitized and tokenized global economy.

Also Read: Earned Income Tax Credit Delay Leaves Taxpayers Waiting

Hedera (HBAR) Network Adoption

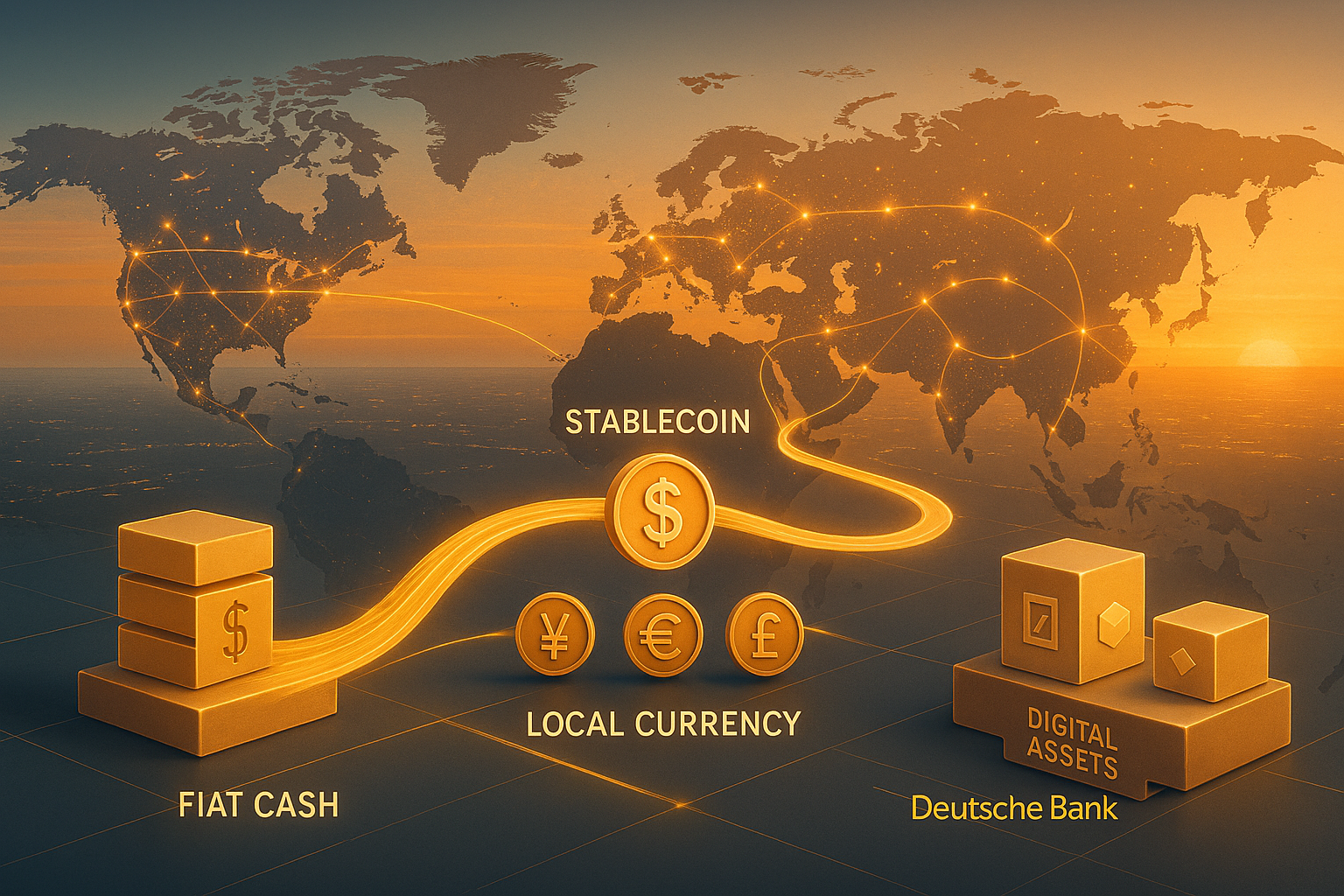

The crypto market is volatile at the moment, so any coin that is making waves has all the attention. HBAR is being pitched as the core infrastructure for a systemic overhaul of the financial sector. This isn’t just about retail trading; it is about blockchain infrastructure capable of handling the demands of global trade, supply chains, and government-level transactions.

Analysts even go ahead and say HBAR is bullish for its low fees, but in the grand scheme of things, it is meant for institutional use and not speculative crypto activities. So why Hedera over other crypto?

HBAR has carved out a niche through low-cost transactions and high-throughput capabilities. It is sustainable, secure and scalable. With over 10,000 transactions per second, it surpasses global standards.

Also Read: Goldman Sachs Warns of Further Stock Losses as Crypto Faces Rising Risk

HashGraph’s CEO, Eric Piscini, believes Hedera has a key role to play:

In the last few weeks, we’ve seen major strides across the Hedera ecosystem. The Reserve Bank of Australia and Digital Finance CRC’s Project Acacia is exploring digital currency interoperability on Hedera and HashSphere, EQTY Lab has deployed Verifiable Compute on NVIDIA’s Blackwell platform, Grayscale has added Hedera to its Smart Contract Platform Select Fund, and Kraken now supports HBAR funding and trading.

This momentum in both tokenization and AI isn’t isolated, it reflects a broader shift where DLT is becoming the trust layer for mission-critical applications. Hedera has a key role to play in this moment.

Long-term Price Forecasts

In the chart below, the long-term Hedera price forecast shows that it will rise, but steadily. And while the HBAR bullish case for current prices reflects a fundamental-first story, many analysts view the current range as a quiet accumulation phase. Network adoption is not a speculative catalyst; instead, it acts as a slow-building foundation for sustained value growth.

Further, the Hedera network adoption from Google and IBM, who are also part of the governing council, strengthens Hedera’s appeal as an enterprise-grade infrastructure. It just goes to show that HBAR is powering real-world applications in cbdc blockchain infrastructure.

Also Read: Binance SAFU Fund Buys 4,225 BTC, Total Holdings Hit 10,455 BTC

If Hedera truly becomes that invisible backbone of the next global financial era, you cannot say that it did not lay the groundwork.