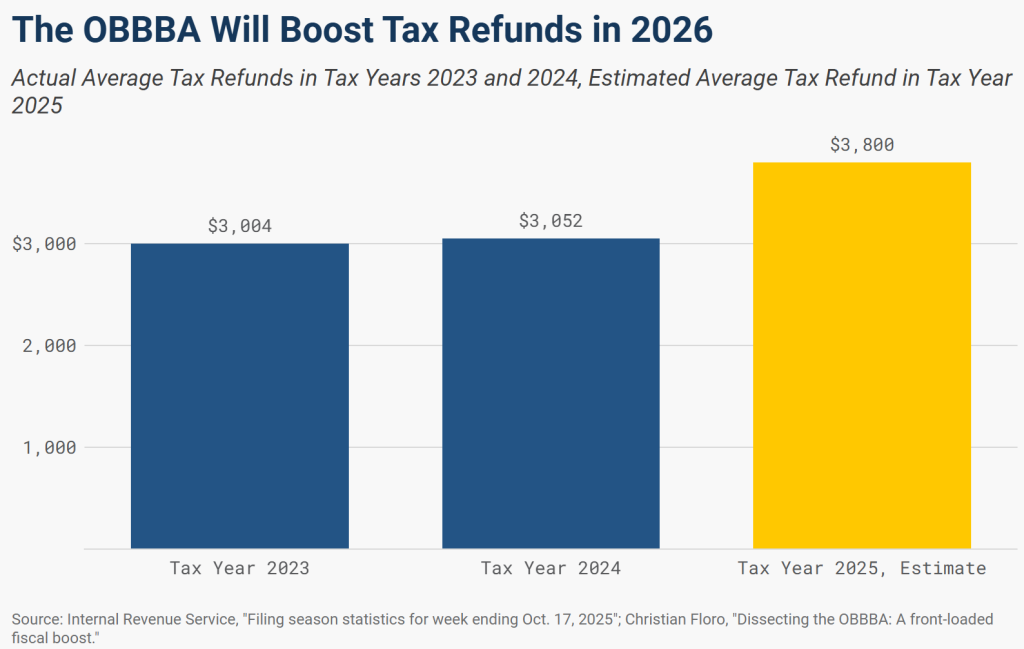

With tax filing season here, starting from January 26, 2026, to April 15, 2026, almost everyone is wondering about refunds and how Trump’s One Big Beautiful Bill Act (OBBBA), passed in July’25, will affect them. While the official White House press release suggests average refunds could increase by over $1,000, others put it in the $300–$1,000 range. But the figures are not absolute and depend on income and withholding.

According to experts, there are a lot of variables at play that decide your tax refunds in 2026, as well as when you can expect to receive them. Keep in mind that your refund is bigger in 2026, but timing follows strict IRS cycles based on filing date, PATH Act status, and return accuracy, and not refund amount.

Also Read: Earned Income Tax Credit Delay Leaves Taxpayers Waiting

What is the One Big Beautiful Bill Act (OBBBA)?

The One Big Beautiful Bill Act (OBBBA) introduces several changes to the taxation system that work in favor of taxpayers. Some of its provisions apply from January 1, 2026, while others are retroactive, i.e., they apply throughout the 2025 tax year.

One of the changes responsible for bigger tax refunds in 2026 is the increase in the standard deduction. According to the IRS, the standard deduction in 2026 stands $32,200 for married couples filing jointly and $16,100 for individuals and married couples filing separately. There are also provisions for deductions in tax on tips and overtime, which directly benefit the working class and will result in higher tax refunds in 2026 if more tax was paid in the past year.

When to Expect Your Refund in 2026?

Over 164 million individual tax returns are expected to be filed in 2026. As has been the case previously, not everyone will get their tax refunds on the same date. Here’s what the tax refund timing depends on:

- Filing date: Early filers will get refunds sooner.

- PATH Act status: Returns claiming EITC and ACTC are subject to a mid-February hold, even if filed early.

- Return accuracy: Discrepancies can delay refunds, while properly filed returns will result in quicker refunds.

If the tax returns are filed electronically, direct deposit is selected for refund, and no discrepancies are detected by the IRS, taxpayers expect a refund in 21 days from the date of filing. For paper returns or those requiring corrections, the timeline is 4-8 weeks. From a timeline standpoint, e-filing early will be a smart choice.

Early filers receive their refunds by mid-February, while later filers may face issues, delaying refunds to April or even May. As for those with returns claiming PATH credits, i.e., EITC (Earned Income Tax Credit) and ACTC (Additional Child Tax Credit), the refund cannot be processed before February, and should be issued by early March, according to the IRS.

| Filing date/type | Estimated Refund Timeline |

| Jan 26 – Feb 1 (e-file) | Mid-February |

| Feb 2 – Feb 15 (e-file) | Late Feb or early March |

| Feb 16 – Feb 28 (e-file) | March |

| March 1 – March 15 (e-file) | Late March |

| March 16 – March 31 (e-file) | April |

| April 1 – April 15 (e-file) | Late April |

| Early PATH Act filers | First week of March |

| Paper returns | 4–8 weeks |

How to Check the Tax Refund Status?

After filing the returns, taxpayers can check the refund status using the official IRS refund tracker, Where’s My Refund. They will need to enter their Social Security Number, tax year, filing status, and the refund amount. Alternatively, they can use the IRS2Go app, available on the Apple App Store and Google Play Store, to find out where the tax refund is.

Keep in mind that for returns filed electronically, the status should be updated in 24 hours, while for paper returns, it takes up to 4 weeks.

How to Calculate the Tax Refund?

After filing returns with the IRS via official channels, it shows the amount of refund you are owed. Keep in mind that it’s an estimate, and the actual refund depends on a number of factors and will be reflected after the return is accepted.

Taxpayers can also use popular tax preparation tools like TurboTax, TaxSlayer, or FreeTaxUSA. These tax refund calculators are widely used and include the OBBBA amendments. So, the estimates presented by these tools will take into consideration the latest changes.

Additionally, filers can use this simple methodology to get an estimate of 2026 tax refunds and how they’re impacted by OBBA:

- What affects your refund: Your total income (including W-2 wages, tips, and overtime), any deductions and tax credits (ACTC or EITC), and tax already paid.

- How the IRS calculates refunds: Taxes withheld − Tax owed (based on your total income after deductions and credits)

- The impact of OBBA: It increases standard deductions, reducing taxable income and ultimately the final tax owed. Additionally, eligible taxpayers can deduct upto $25,000 in tips and $12,500 in overtime.

What Triggers Delays on Larger Refund Amounts?

Larger refunds sometimes take longer because the process involves more stringent checks. The IRS is likely to verify whether the provided information is accurate and aligns with the available data. So, these refunds will take longer than others, even if filed early.

To minimize delays and receive tax refunds early, taxpayers should e-file their returns, select direct deposit, and ensure they provide the correct information, according to the IRS.

Tax Refunds Look Big in 2026 But That Won’t Last Forever

The tax refunds in 2026 are estimated to increase by over $1,000, but that doesn’t mean it will become a trend. You may be getting bigger refunds this year simply because many of the provisions under OBBBA were retroactive and applied to deductions made in 2025.

According to CNBC, many employers didn’t change payroll tax withholding mid-year, so deductions were made even on income that later became deductible, like tips and overtime. So, the additional taxes you paid over the financial year will be added to the refunds, increasing the total amount.

Keep in mind that it’s a one-time adjustment. Once the payroll integrates the changes made under OBBBA, future paychecks should reflect the same. This means fewer deductions over the year, and ultimately, a lower refund at the end.

The Tax Landscape Has Changed in 2026

With the One Big Beautiful Bill Act, the tax landscape has transformed, and it will impact taxpayers this season. Mistakes made during filing can delay the refunds. Taxpayers can use IRS.gov tools or approved tax software to estimate their refund. Don’t go by the headlines alone, because the numbers fluctuate, and it all comes down to individual returns.