The US dollar (USD) has been under great pressure over the last few years, with the trend continuing in early 2026 amid a weakening dollar exchange rate. JPMorgan Asset Management is forecasting a further 3% decline in the US dollar rate by mid-2026. This weakness in the dollar is creating pressures on other currencies, which are becoming stronger against it.

Further USD devaluations could trigger responses from central banks around the world, increasing the likelihood of a full-scale currency war.

Also Read: What to Invest in 2026: The 14% Portfolio Gap No One Talks About

The Ongoing USD Devaluation: Drivers and Current Reality in Early 2026

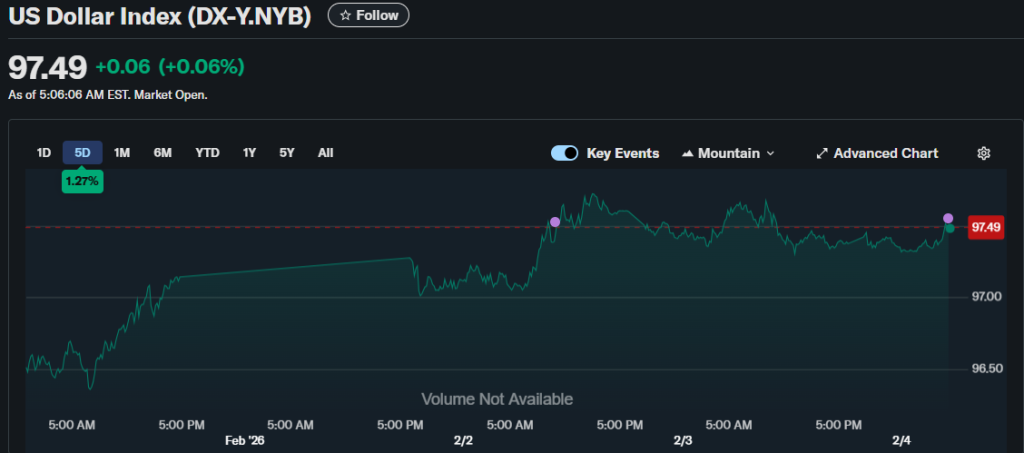

The US dollar rate continues to fall as we enter February. The DXY index, which measures the value of the US dollar against a basket of six currencies (EUR, SEK, GBP, JPY, CAD and CHF), has fallen below 96 points for the first time since 2022. The trend accelerated in 2025 by falling over 10% and starting 2026 with a further decline of almost 4%.

This decline in the DXY index is linked to several factors that have an impact on the US dollar rate. Some of these drivers include uncertainty in the tariff market between the United States and key partners such as European countries. Geopolitical tensions, including US claims on Greenland, have also played their role in eroding investor confidence, prompting capital outflows from US assets, and deepening the pressure on the dollar exchange rate.

Although small in scale, Danish pension fund AkademikerPension announced in January its decision to sell its roughly $100 million in US Treasuries. This political gesture has raised concerns among investors about possible contagion effects across other pension funds or large holders of US Treasuries that could, in combination, create further pressure on the US dollar rate.

While JPMorgan Asset Management still projects only a modest further 3% decline through mid-2026, aligning with many dollar forecasts for 2026, the real risk lies beyond that percentage. As the dollar exchange rate weakens further, it approaches key critical technical and psychological levels where other central banks could no longer tolerate excessive currency strength and might start interventions.

Note that widespread de-dollarization is not happening in any meaningful way yet, but accelerated weakness at these thresholds could fuel diversification pressures.

Level 1: The 96-95 Break – Early Warning for Intervention Risks

In the near term, investors should focus on the structural support built around 96, which was already tested in early February 2026. Although the index briefly fell below that mark, it recovered and moved back toward the 97.5 level.

A close below this support could signal accelerating bearish momentum, likely prompting verbal and written warnings from other central banks. These “threats” could manifest as FX interventions, references to United States economic policy, or even direct political commentary.

Ultimately, the sustainability of this floor depends on whether the Federal Reserve maintains its current easing cycle. If domestic data continues to soften, the “verbal warnings” from abroad may do little to stop a broader technical breakdown toward the 95 handle.

Level 2: Falling Below 94: Post-Pandemic Values

The 2020 COVID-19 pandemic had a significant impact on the DXY and the US dollar. Early volatility was followed by a clear downward trend that lasted for almost one and a half years.

During this period, the DXY fell below 90 for short stretches and generally traded between 90 and 94. At these levels, key central banks were already taking action to avoid further appreciation of their own currencies against the US dollar. The European Central Bank (ECB) maintained its deposit facility rate at -0.50%.

China also took action by managing its currency through various mechanisms, including currency swaps, to prevent the yuan from getting too strong too quickly. Additional measures included lowering reserve costs to make it cheaper for institutions to bet against the yuan and the temporary suspension of the counter-cyclical adjustment factor.

Therefore, a DXY index between 90 and 94 could be the point where real action starts, rather than just verbal threats. These actions include reducing interest rates and implementing mechanisms to ease upward pressure on local currencies as the US dollar depreciates further.

Level 3: Falling Below 90: Open FX interventions

A decisive, strong, and explosive move below 90 would send the US dollar rate into territory not sustained in more than ten years (with only fleeting echoes in 2021, the last prolonged sub-90 levels date back to the early 2010s). This would clearly signal a disorderly fall of the USD far beyond JPMorgan’s modest dollar forecast for 2026 of around 3% further softening through mid-year.

Central banks around the world could be forced into major and aggressive moves to defend their export competitiveness. Although a full-blown currency war would require these extreme levels to be sustained over time, real defensive actions by monetary authorities would likely commence swiftly to prevent excessive currency appreciation.

The ECB could resume large-scale quantitative easing (QE) measures and deliver surprise rate cuts, even if prior forecasts anticipated none, to intentionally weaken the euro amid disorderly dollar weakness. The Swiss National Bank (SNB) could intensify or reimpose FX floor/cap mechanisms through massive sales of Swiss francs (CHF) and foreign currency purchases, challenging its safe-haven status during such turbulent periods.

The PBOC in China could heavily intervene in the FX market by selling yuan and buying dollars aggressively. As demonstrated in past episodes, it could also adjust the daily fixing rate downward or deploy other tools to cap yuan strength and preserve competitiveness against the world’s major economy, the United States.

A different dynamic applies to the Bank of Japan (BOJ), which has a history of open interventions to weaken the yen when it appreciates too sharply. With Japan increasingly reliant on exports, authorities would likely act decisively, through direct yen sales or policy adjustments, to maintain relative stability in the yen and avoid severe export damage.

Why Should We Stay Calm and Cautious?

While the US dollar rate faces genuine downward pressures from Fed policy uncertainties and structural shifts, the path to a full-scale currency war remains far from inevitable as of today. JPMorgan’s baseline dollar forecast 2026 envisions only modest further softening, supported by resilient US growth and sticky inflation that could limit aggressive easing, as evidenced by the recent FOMC meeting’s decision to hold rates steady.

Many US dollar forecast next 5 years perspectives similarly point to a gradual trajectory rather than catastrophe. The worst-case scenario outlined above seems avoidable if stabilization remains a priority for policymakers. Caution remains necessary, but analysts say it’s still too early to panic.