Apple stock forecast models are being revised upward after the company announced an aggressive push into AI-powered wearables, including smart glasses, a camera-equipped pendant, and new AI AirPods. At the time of writing, AAPL trades at $263.88, up 3.17% on the day, with pre-market showing $265.50.

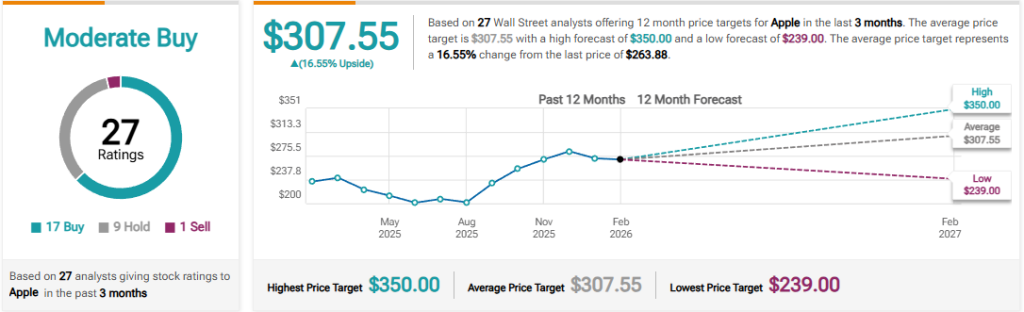

The average AAPL price target from 27 Wall Street analysts now stands at $307.55, implying a 16.55% upside from current levels. Apple AI hardware is at the center of this renewed bullishness, and the Apple smart glasses project, internally code-named N50, represents the company’s most direct answer yet to Meta’s Ray-Ban glasses.

Also Read: Shiba Inu Rolls Out ‘Shib Owes You’ NFT to Restore Trust

How Apple AI Hardware and Smart Glasses Shape the Apple Stock Forecast

The N50 Smart Glasses and What They Mean for AAPL

Apple is developing the N50 smart glasses without a traditional display, relying instead on a dual-camera system and speakers to deliver real-time visual assistance through Siri, such as identifying items or pulling calendar events from a poster. Production is said to begin as early as December, ahead of a 2027 release. Apple designed the frames in‑house instead of partnering with eyewear brands, a notable shift that shows how seriously the company is treating this product internally.

Also part of the push: camera-equipped AirPods that could arrive as early as late 2025, and an AirTag-sized AI pendant that clips to clothing or wears as a necklace. Apple is pushing its AI hardware well beyond the screen, and the market reacted immediately, sending shares up as much as 2.7% on the news.

Also Read: Ethereum RWA Market Surges 315% as Tokenized Assets Break $17 Billion

AAPL Price Targets and Analyst Consensus

Based on 27 analysts who have rated AAPL in the past three months, the consensus sits at “Moderate Buy.” The highest AAPL price target on the street is $350, the lowest is $239, and the average of $307.55 puts the stock more than $40 above where it currently trades. Much of that upside now depends directly on Apple’s AI hardware roadmap and what a successful smart‑glasses launch could mean for a new high‑margin product category.

Technical Signals and What to Watch

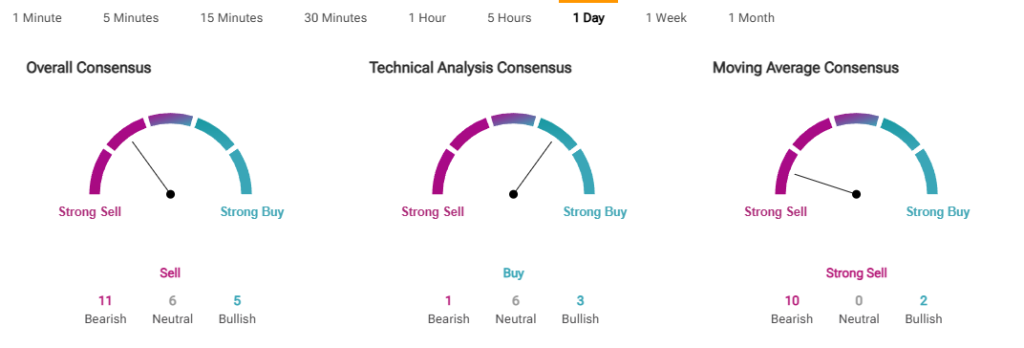

The AAPL stock analysis from a technical standpoint is more cautious. Out of 22 indicators, 11 are bearish and only 5 bullish, with moving averages also skewing even harder toward a Strong Sell rating. The 52-week range of $169.21 to $288.62 shows the stock has room to run but also a history of sharp pullbacks.

Apple will hold its next earnings call on April 30, 2026, and any update on smart‑glasses timelines or Siri’s AI overhaul in iOS 27 will likely drive the Apple stock forecast heading into the second half of the year.

Also Read:

> How will Apple smart glasses affect the Apple stock forecast?

AAPL jumped 2.7% the day the news broke, and the N50 is already being factored into longer-term AAPL price targets by analysts like Wedbush’s Dan Ives, who also holds the street-high $350 target. The smart‑glasses timeline and Siri’s iOS 27 overhaul now drive the two biggest variables in the Apple stock forecast for late 2026.

> What are Apple AI smart glasses and when are they coming out?

The N50 is a dual-camera wearable with no display that uses Siri to interpret your surroundings in real time. Production could start as early as December, with a 2027 consumer release targeted. Camera AirPods, part of the same Apple AI hardware push, could arrive sooner.

> What role does Siri play in Apple’s AI hardware strategy?

Siri powers all of it. The glasses, AirPods, and pendant all feed data to it, and Apple is also rebuilding it in iOS 27 with chatbot-style capabilities. For the Apple stock forecast, it’s simple: Siri delivers and the AAPL price target upside is real. It doesn’t, and the whole wearable bet stalls.