Binance’s Secure Asset Fund for Users (SAFU) Bitcoin purchase has officially taken the fund’s reserves to 15,000 BTC. This Bitcoin accumulation has further pushed the cryptocurrency exchange into the list of the largest institutional BTC holders across the globe.

The cryptocurrency firm concluded its planned conversion of stablecoin reserves into BTC in less than two weeks. Through this, Binance wrapped up a $1 billion Bitcoin allocation strategy. It should be noted that Binance’s Bitcoin buy was expected to take 30 days. But earlier today, the firm pocketed its final stash of 4,545 BTC worth about $300 million.

Also Read: BlackRock Says Asia’s 1% Crypto Allocation Could Unleash $2 Trillion in Market Inflows

How Binance SAFU Bitcoin Purchase Signals Major BTC Whale Activity

The Bitcoin market encountered increased volatility over the past couple of days. Binance started its big BTC buy when the king coin was trading close to $77,000. As the price moved towards the mid-$66,000 range, Binance continued the rest of its Bitcoin accumulation. The final batch was acquired at around $66,006 per coin. Data from Arkham Intelligence highlights the series of transactions.

Binance’s SAFU Bitcoin purchase stands out as it places the firm in whale territory. A single decision by Binance can change the flow of things in the cryptocurrency market. While retail investors were selling BTC out of panic, larger holders were seen accumulating.

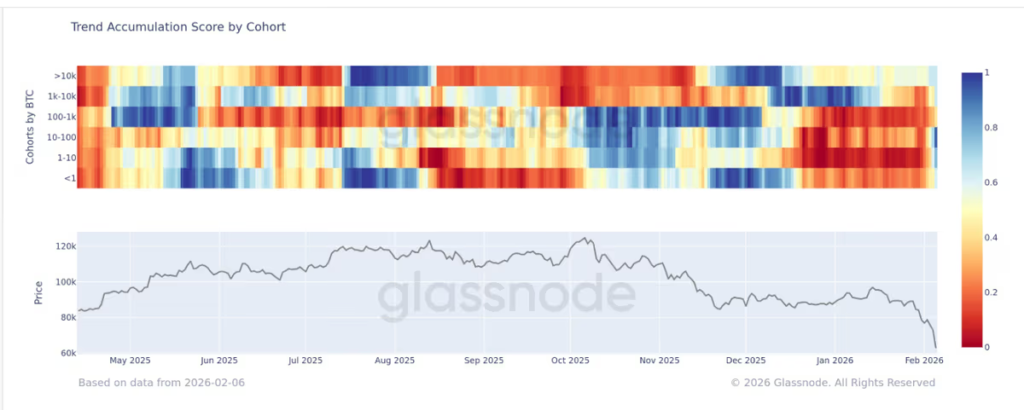

Data from Bloomberg revealed that Bitcoin whales were in aggressive accumulation mode. Wallets holding more than 1,000 BTC added a staggering 53,000 BTC in the past week alone. This further marked their largest buy since November.

Also Read: Russia Blocks WhatsApp After Moving to Restrict Telegram Nationwide

This shift is notable because the same large holders were seen offloading since mid-December. They collectively sold 170,000 BTC worth $11 billion. But the latest turnaround is certainly bullish for the entire market.

Glassnode’s Trend Accumulation Score highlights this shift. Whales were seen moving from heavy distribution in late 2025 to active accumulation in early February. Amidst this, the number of entities holding at least 1,000 BTC rose from 1,207 in October to 1,303. This highlights how large wallets are proactively accumulating Bitcoin during corrections.

15,000 BTC Places Binance Among Top Holders

Binance’s SAFU fund currently holds 15,000 BTC worth $1.01 billion. Through this, the cryptocurrency exchange has moved slightly ahead of Coinbase. The Brian Armstrong-led platform currently holds 14,548 BTC.

In addition, Binance’s BTC buy has also prompted the exchange to exceed the reserves of several mining firms and nations.

Also Read: Citigroup Just Tokenized Real Trade Finance on Solana