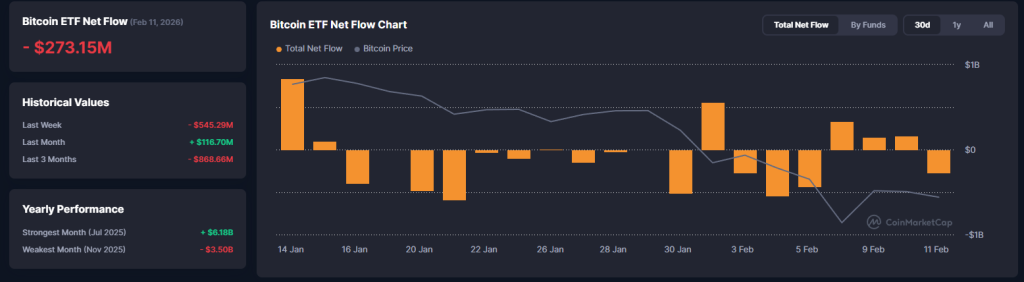

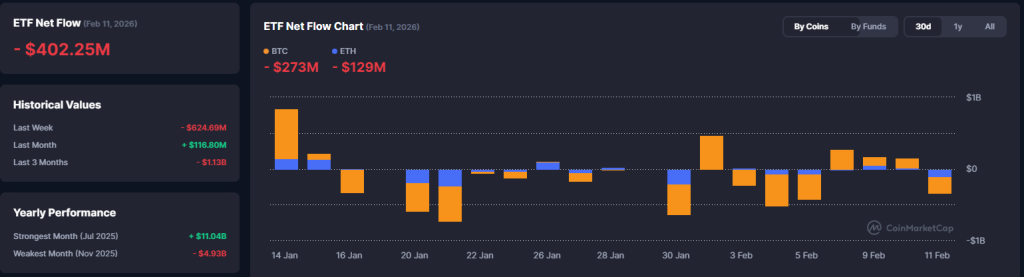

Bitcoin ETF outflows reached $276 million on February 11, marking a significant day of net redemptions across U.S. spot Bitcoin ETFs as investor caution persisted amid ongoing market volatility. Fidelity FBTC led the withdrawals with $92.6 million in outflows, representing the largest single-day redemption among spot Bitcoin ETFs during this trading session.

Also Read: Polymarket Bitcoin Feature Launches 5-Minute BTC Price Direction Predictions

How $276M Bitcoin ETF Outflows and Fidelity FBTC Redemptions Shift Market Sentiment

The wave of Bitcoin ETF outflows comes as investors reassess their exposure to cryptocurrency-linked products. Data from SoSoValue shows that these ETF redemptions were concentrated across several major funds, with Fidelity FBTC experiencing the most substantial withdrawals at $92.6 million.

Fidelity FBTC Leads Redemptions Despite Strong Historical Performance

Fidelity’s FBTC has accumulated $11.07 billion in total historical net inflows, which positions it as one of the largest spot Bitcoin ETFs in the market right now. The $92.6 million in Bitcoin ETF outflows on February 11 represents a fraction of the fund’s overall holdings, yet signals shifting Bitcoin market sentiment among investors.

Mixed Flows Show Selective Market Activity

Not all funds experienced withdrawals. WisdomTree’s BTCW posted the largest single-day inflow, adding $6.78 million to its holdings. BTCW’s historical cumulative net inflows now stand at $66.26 million, showing that some investors continue seeking Bitcoin exposure through these regulated products even as others pull back.

Also Read: Reddit Stock Analysis: How AI Data and Search Growth Drive RDDT Momentum

Total Market Footprint Remains Substantial

At the time of writing, the total net asset value of U.S. spot Bitcoin ETFs is $85.77 billion, which represents approximately 6.35% of Bitcoin’s total market capitalization. Cumulative net inflows across all spot Bitcoin ETFs have also reached $54.72 billion, even after recent ETF redemptions.

The mixed flows highlight a market in consolidation, with selective buying occurring alongside broader risk reduction as investors continue to reassess their positions. The contrast between Fidelity FBTC outflows and smaller fund inflows suggests that Bitcoin market sentiment is fragmenting rather than moving uniformly.

Also Read: Gold Price Forecast: Grayscale Challenges Bitcoin’s Digital Gold Role