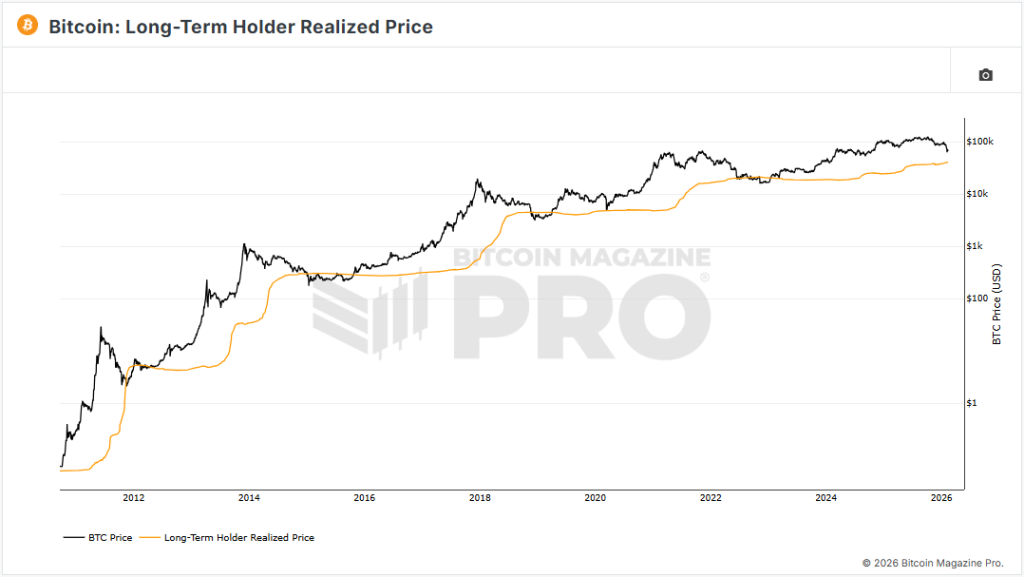

While Bitcoin’s price remains well above six figures, the Long-Term Holder Realized Cap Impulse has broken its three-year positive run. A negative reading is a red flag for Bitcoin’s capital structure as it implies long-term holders are easing back on aggressive demand.

Also Read: Crypto Panic Hits Its Breaking Point and That Is When Smart Money Strikes

Bitcoin Realized Cap and Long-Term Holder Demand Shift Explained

The Bitcoin realized cap is different from traditional market capitalization. Each BTC is valued at the price last paid on-chain. This offers a deeper look at the network’s health, and any temporary price fluctuations are filtered. When the focus is on genuine capital commitment, we can effectively gauge actual capital inflows.

Thence, a positive realized cap impulse indicates strong capital inflows and growing demand, as holders acquire or hold coins at rising valuations. Conversely, the recent negative reading reflects a net slowdown or reversal in capital inflows from long-term holders.

Also Read: Brazil’s Bitcoin Reserve Bill Seeks Government Purchase of 1M BTC

Long-term holders are seen as the backbone of Bitcoin (BTC), often providing stability during consolidation or corrective periods. The negative impulse suggests structural weakening in capital demand. If fresh capital, especially from large, patient investors, isn’t entering at the pace seen in earlier stages of the bullish cycle, overall BTC demand could tank.

This demand has not been sufficient to offset periods where Bitcoin supply continues to exceed effective capital inflows. Analyst, Alphractal founder, Joao Wedson, stated that:

“Even with ETFs accumulating and large institutions like Strategy increasing their positions, it is still not enough to offset the period when supply exceeds demand.”

Redefining Capital Inflows Will Determine Bitcoin’s Next Structural Move

If capital inflows continue to soften, the market may transition into a prolonged consolidation phase, with prices increasingly dependent on short-term liquidity rather than structural accumulation. Perhaps it’s set the stage for a healthier market reset.

Also Read: BMNR Stock Jumps as BlackRock Boosts Bitmine Stake by 165%

While the pullback from long-term holders signals a temporary cooling of BTC demand, it could also serve as a crucial time to adopt a new strategy. Bitcoin could find a more sustainable pathway for channelling fresh capital without relying solely on spot accumulation cycles.