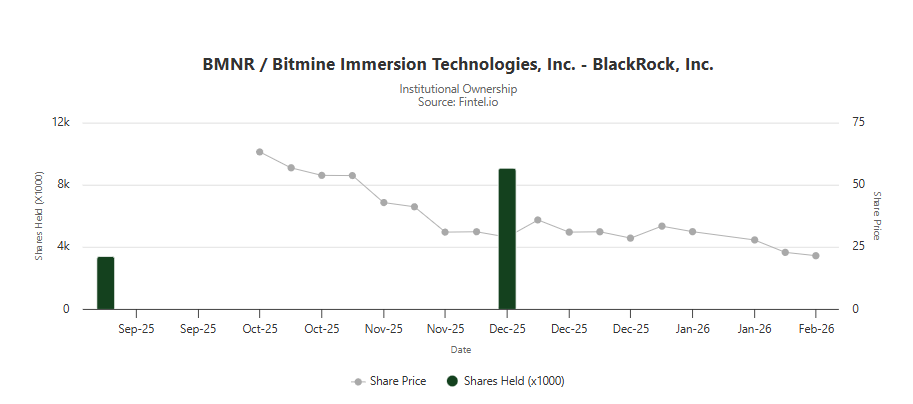

BlackRock’s BMNR stock surged after the world’s largest asset manager increased its stake in Bitmine Immersion Technologies by 165%, now holding approximately 9 million shares. The BlackRock Bitmine stake expansion to 9,049,912 shares, worth roughly $246 million, triggered a BMNR stock rebound and renewed investor interest in Bitcoin mining stocks. This strategic move signals growing institutional confidence in crypto mining infrastructure.

Also Read: Coinbase Q4 Earnings Miss Sparks COIN Stock Sell-Off

Why BlackRock’s 165% Bitmine Stake Increase Is Driving the BMNR Stock Rebound

The substantial increase in the BlackRock Bitmine stake was disclosed through a regulatory filing, revealing the asset manager’s position grew from approximately 3.4 million shares to over 9 million shares. This 165% jump represents one of the most significant institutional investments in Bitcoin mining stocks this year, and the filing indicated the total value stands at around $246 million based on recent prices.

Institutional Backing Drives BlackRock BMNR Stock Momentum

The BMNR stock rebound gained traction as institutional investors took notice of BlackRock’s commitment. According to reports, the $14 trillion asset manager’s increased position reinforces growing institutional conviction in crypto treasury strategies. Bitmine currently holds approximately 4.3 million in Ethereum worth around $10 billion, positioning itself as a diversified crypto infrastructure company.

Coin Bureau reported on the development, noting the significance of such a large institutional stake in the Bitcoin mining stocks sector.

🚨BLACKROCK LOADS UP ON BITMINE, LIFTS HOLDINGS TO 9M SHARES

— Coin Bureau (@coinbureau) February 13, 2026

$14T Asset manager BlackRock increased its $BMNR stake to 9,049,912 shares (up +165.6% QoQ) worth roughly $246M per its latest 13F filing, reinforcing growing institutional conviction in crypto treasury strategies. pic.twitter.com/Whqqz3W0IE

Also Read: Cathie Wood Says U.S. Inflation at 0.8% Could Turn Negative

Strategic Position in Crypto Mining Infrastructure

BlackRock’s expansion of its BlackRock BMNR stock holdings comes as the company focuses on immersion cooling technology, which offers more efficient mining operations. The BlackRock Bitmine stake reflects confidence in both the technology and the company’s multi-chain approach, with Bitmine holding significant Ethereum alongside its Bitcoin mining operations.

Huge if true-and it checks out! BlackRock stacking 9M+ $BMNR shares ($246M, +165% QoQ) while BitMine holds 4.3M+ $ETH (3.5%+ of supply) + $10B treasury shows institutions are ALL IN on crypto infra & ETH strategies, even with ETH dipping.

— BitcoinWorld Media (@ItsBitcoinWorld) February 13, 2026

Conviction play despite the volatility!…

The timing of the Bitmine stake 165% increase also aligns with renewed optimism around crypto adoption. As Bitcoin mining stocks face ongoing volatility from energy costs and regulatory pressures, institutional backing from players like BlackRock also provides stability and validation for the sector. The investment demonstrates that major financial institutions see value in owning the infrastructure supporting cryptocurrency networks.

Also Read: Bhutan Sells Another $6.7M in Bitcoin as Mining Plans Stall