Brazil is weighing one of the most ambitious sovereign crypto proposals to date. A new bill was introduced in Congress that calls for the creation of a Brazilian Bitcoin reserve that would accumulate up to 1 million BTC over five years.

Also Read: Bitcoin Price Forecast: Standard Chartered Predicts a Drop to $50K

How Brazil’s Bitcoin Reserve Shapes Adoption and Government Purchase Strategy

The proposal, presented as a substitute for an earlier draft, outlines a “Strategic Sovereign Bitcoin Reserve” known as RESbit. Under the revised framework, the government would pursue a planned and gradual government Bitcoin purchase program aimed at building a sizable national holding.

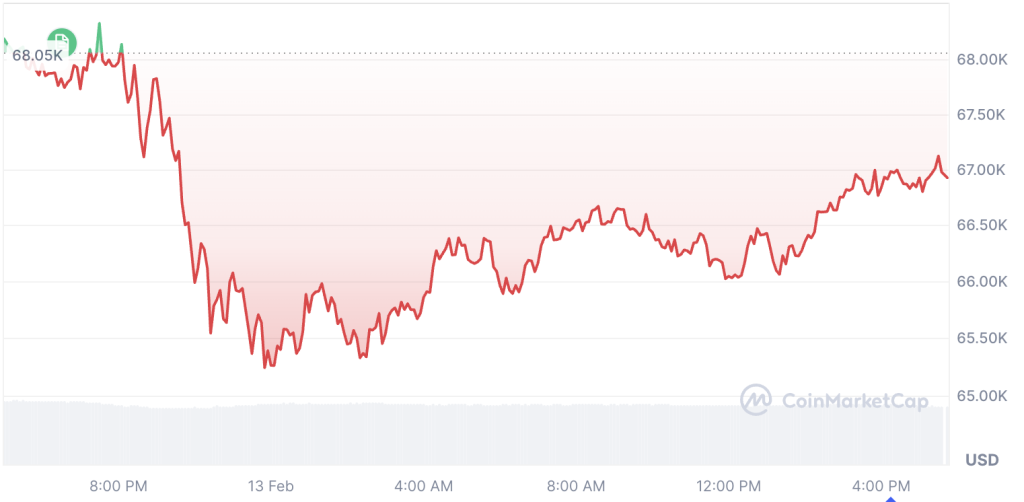

If completed at current prices, the acquisition could cost close to $68 billion. This could potentially make Brazil among the largest holders of Bitcoin globally.

The earlier version of the bill allowed the Treasury to allocate up to 5% of Brazil’s foreign reserves into Bitcoin. The idea was to diversify national assets and add exposure to a decentralized alternative.

Also Read: Coinbase Q4 Earnings Miss Sparks COIN Stock Sell-Off

The legislator responsible for the revised draft, Deputy Luis Gastão, emphasized that the plan goes well beyond creating a sovereign reserve. He added that it also seeks to protect fundamental rights related to the usage and storage of Bitcoin. Brazil might become one of the biggest state owners of the asset globally if the bill passes Congress.

The updated proposal goes further. It would block the sale of Bitcoin seized in criminal cases. It would also allow federal taxes to be paid in BTC. In addition, it offers incentives for companies that mine and hold Bitcoin.

Supporters argue these measures would boost Bitcoin adoption in Brazil by embedding crypto more directly into the economy.

Regulatory Hurdles Ahead

The proposal raises questions about Brazil’s crypto regulation. The central bank does not currently treat Bitcoin as an official reserve asset. Any formal BTC accumulation strategy would require alignment with monetary policy rules.

The bill must still pass committee reviews and win approval in Congress. But changes are possible before any final vote.

In addition, the discussion itself is significant. It shows Brazil exploring Bitcoin not just as a regulated asset class, but as part of its national financial strategy.

Also Read: Cathie Wood Says U.S. Inflation at 0.8% Could Turn Negative

Meanwhile, Bitcoin was trading at $66,902.20 following a 1.61% decline over the past 24 hours.