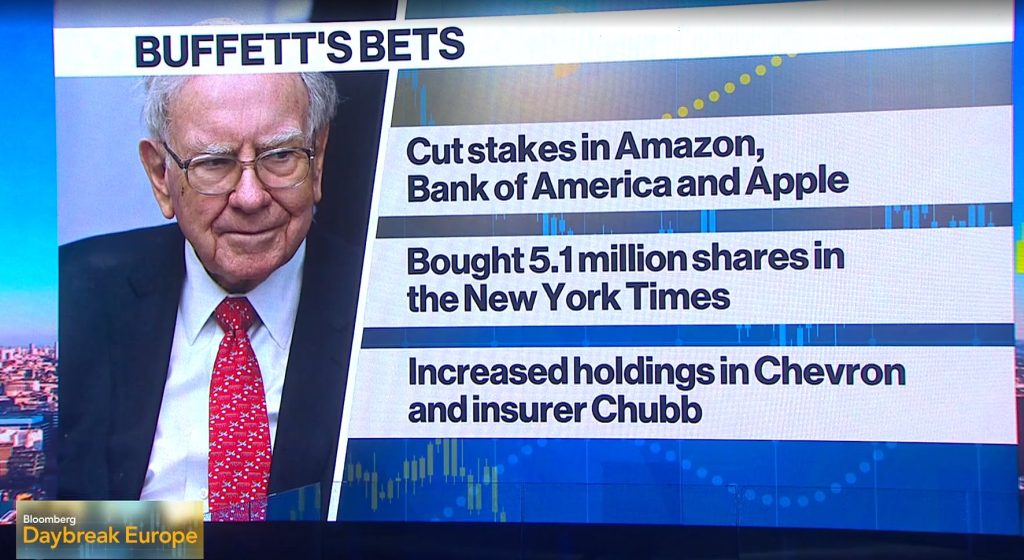

Buffett sells Amazon stock at a massive scale, with Berkshire Hathaway cutting its Amazon stake by roughly 75% in Q4 2025, bringing the position down to about 2.3 million shares. At the same time, Berkshire buys New York Times stock for the first time, picking up 5.1 million shares worth over $350 million, a roughly 3% stake in the company. The Berkshire portfolio changes also include further trimming of Apple and Bank of America, plus increased holdings in Chevron and Chubb, all detailed in the latest Buffett 13F filing.

Also Read: Robinhood Launches $1B SpaceX Pre-IPO Fund for Retail Investors

Inside Buffett’s Amazon Sale and New York Times Buy Strategy Shift

Dumping Amazon, Betting on Media

Buffett sells Amazon after entering the position back in 2019, a move he had famously admitted he delayed too long. Now, three-quarters of that stake is gone. The Berkshire cuts to Amazon stake came alongside reductions in Apple and Bank of America, all part of a broader rotation away from high-growth tech. Berkshire portfolio changes in this filing point clearly toward sectors with steadier cash flows, such as energy and insurance, with Chevron raised to 6.5% and Chubb to 8.7%.

Also Read: Banks Using XRP: Ex‑Ripple Insider Signals Shift as Wall Street Buys

Why New York Times?

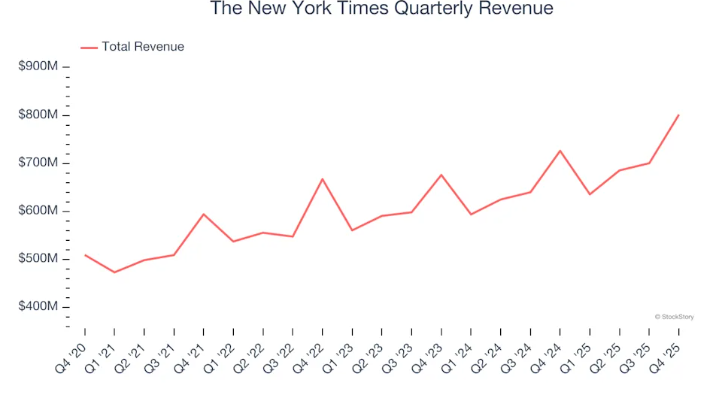

The New York Times reported strong Q4 numbers, with total revenue up 10.4% year over year to $802 million, digital-only subscription revenue up 13.9%, and digital advertising climbing 24.9%.

The company’s CFO, Will Bardeen, stated during the Q4 earnings call:

“As we’ve discussed, video in particular remains an important area of strategic investment being reflected in our guidance. We are confident in our ability to generate strong returns as we grow the amount and impact of video journalism in news and across our portfolio.”

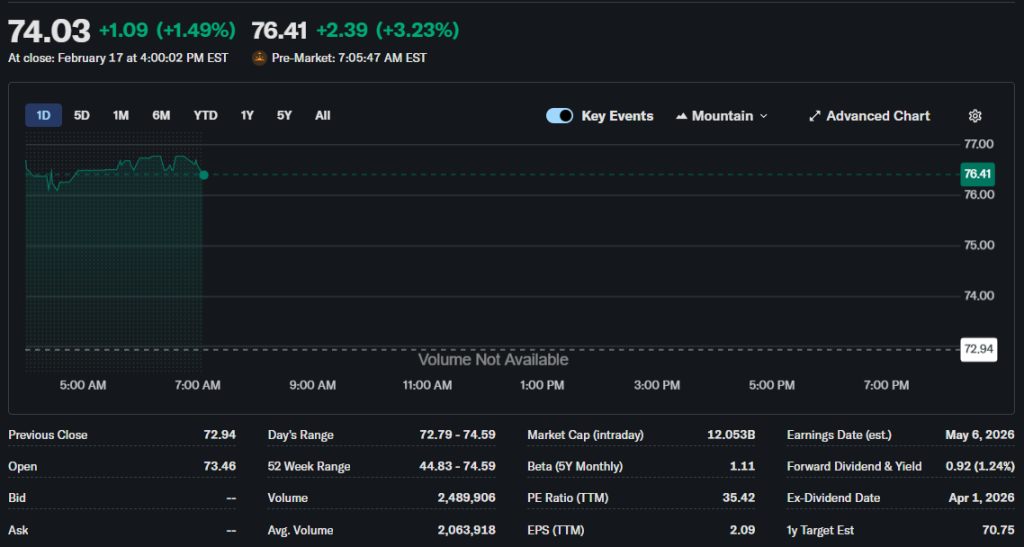

Berkshire may have bought in during Q4 when NYT shares traded in the fifties, well below current levels. Whether the Buffett 13F filing reflects a trade made by Buffett himself or by lieutenant Ted Weschler remains unclear, but the logic behind it ties to NYT’s growing digital dominance and its reputation as a trusted source in an AI-saturated media world.

Also Read: Italy’s Largest Bank Intesa Sanpaolo Discloses $100M Spot Bitcoin ETF Position