China’s gold ETF inflows have reached a staggering $6.2 billion, an all-time high and best annual performance in decades. According to the latest World Gold Council data, these fresh inflows coincided with physical gold demand remaining firm and boosted China’s gold reserves to 2,308 metric tons. As global market volatility persists, China is turning into the world’s most influential gold powerhouse.

Also Read: Trump Orders Pentagon Coal Shift, Driving Up Costs and Legal Fights

China Gold ETF Inflows Surge Amid Rising Demand and Central Bank Buying

In 2025, Chinese gold ETFs scored record annual inflows, surging 243%, with investors buying billions in RMB-denominated funds and driving assets under management up dramatically from prior periods. The spike in Chinese gold demand isn’t limited to paper gold.

Physical demand remains at multi-year highs as consumers view the metal as the ultimate hedge against currency fluctuations. This retail FOMO (fear of missing out) is fueling a cycle where high demand drives prices upward, subsequently attracting more institutional capital into ETFs.

Also Read: SoftBank’s $4.2 Billion OpenAI Gain Lifts Vision Fund to Major Profit Surge

Unlike previous cycles, the current trend is characterized by a generational shift where younger investors are leaning more toward gold-linked products.

Roland Wang, Regional CEO, World Gold Council in China stated:

“In China, gold jewellery consumption was down by 25% while gold investment was up nearly 28% in 2025. Consumers prioritised investment over adornment.“

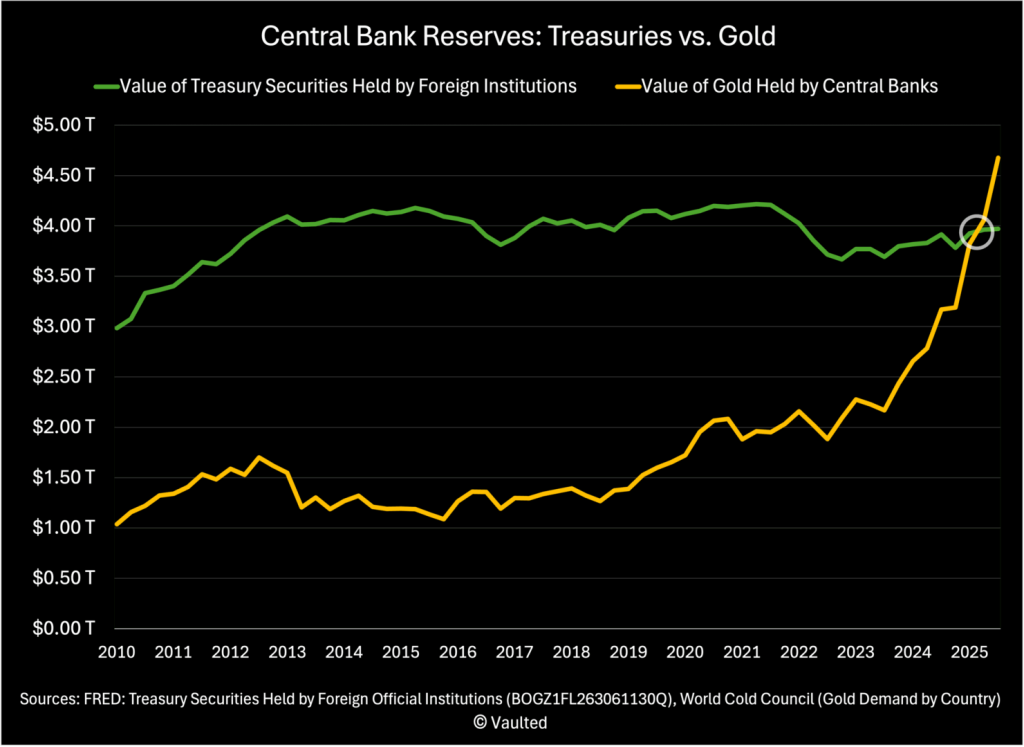

Large-scale institutions, like central banks, are also stocking up on gold reserves. The aim is diversify its traditional assets and achieve financial sovereignty. The plan is picking up the pace as China has increased its gold holdings to 9.6% of its total reserves.

What This Means for Investors

There have been a lot of Western sanctions and the inflationary pressures of the US dollar. By increasing its gold reserves, China is effectively building a monetary firewall. It is more than a temporary market trend, but rather an insulation technique to shield its financial system from external shocks, currency volatility, and geopolitical risk.

Also Read: Nuveen Schroders Acquisition: Inside the $13.5B Asset Management Deal

According to David Einhorn, this is a long-term diversification effort. In his statement, he said:

“The Chinese have decided they want to sort of want to compete on a currency basis. The central banks around the world are buying gold. Gold is becoming the reserve asset as opposed to Treasurys, or it’s kind of mostly even at this point.”

Presently, the synergy of central bank accumulation and massive ETF participation creates a price floor that is difficult to break.