The Circle & Polymarket partnership brings native USDC settlement to Polygon, eliminating bridged USDC.e dependency over the coming months. The collaboration strengthens Polymarket’s onchain financial markets infrastructure by removing cross-chain bridge reliance, which reduces settlement complexity and also enhances transaction reliability for the prediction market platform.

Also Read: Saylor Says Strategy Can Fund Bitcoin Dividends 67 Years Even If BTC Flatlines

Circle-Polymarket Partnership Brings Native USDC to Polygon PoS

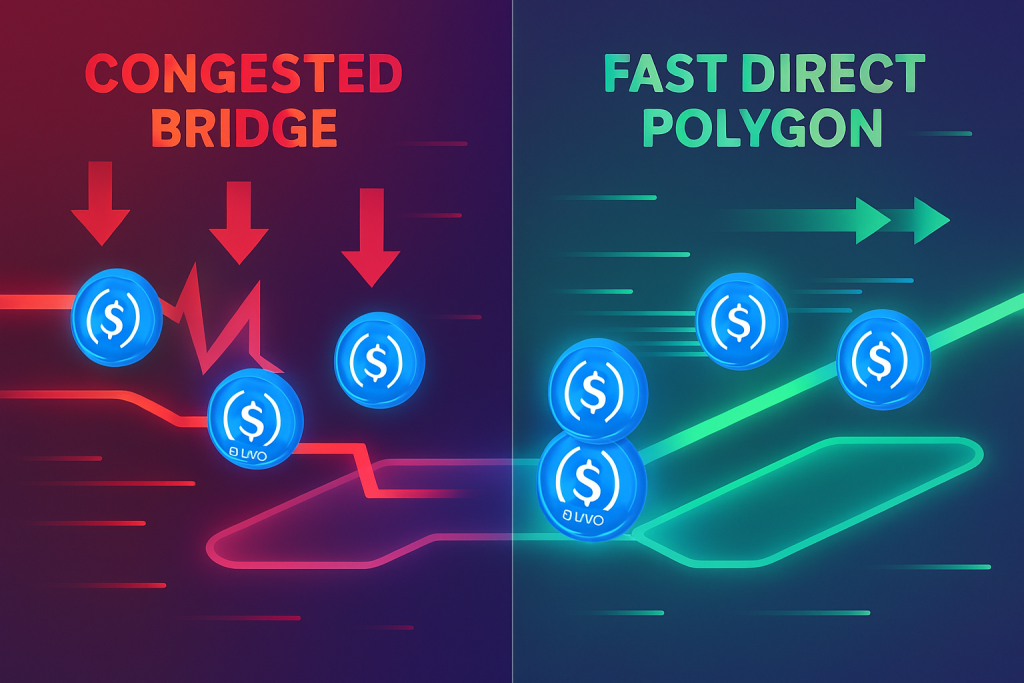

The Circle Polymarket partnership addresses critical infrastructure limitations in how the platform processes payments. Current operations rely on bridged USDC.e tokens, which require users to lock USDC on Ethereum before receiving equivalent tokens on Polygon. Native USDC settlement removes this intermediary step entirely.

Migration from Bridged to Native USDC

Polymarket native USDC implementation eliminates the bridging mechanism that has created technical complexity in settlement operations. The Circle & Polymarket partnership enables direct USDC issuance on Polygon’s Proof-of-Stake network, which processes transactions without cross-chain dependencies.

The migration timeline spans several months as existing liquidity transitions from USDC.e to native USDC. Circle native USDC operates with the same reserve backing and regulatory framework that supports the stablecoin on Ethereum, maintaining 1:1 redemption guarantees through independently audited reserves.

Also Read: Why is Bitcoin Dropping? New Federal Reserve Chair Perhaps?

Circle & Polymarket Partnership: Settlement Infrastructure Benefits

Native USDC settlement reduces transaction costs and also improves finality times for Polymarket users. Bridge-dependent systems face congestion during high network activity, which can delay withdrawals and create operational friction. The Circle Polymarket partnership removes these bottlenecks by processing all transactions within Polygon’s ecosystem.

Onchain financial markets benefit from enhanced capital efficiency as traders eliminate bridge withdrawal delays. Market makers and institutional participants gain faster capital rotation capabilities, which can increase platform liquidity and market depth across prediction markets.

Technical Implementation Details

Smart contract upgrades enable Polymarket native USDC compatibility while maintaining support for bridged USDC.e during the transition period. Existing user balances denominated in USDC.e will be converted to Circle native USDC through a systematic migration process that preserves account values.

The partnership positions Polymarket for potential expansion as Circle’s multi-chain USDC strategy includes deployments on several major blockchain networks. Native USDC settlement provides advantages over bridged alternatives by reducing the number of intermediaries involved in fund custody, which strengthens compliance infrastructure and also improves transparency for onchain financial markets.

Also Read: Meta Stock Price Could Tank 15%, Investors Warned

The Circle & Polymarket partnership represents a fundamental infrastructure upgrade that addresses settlement reliability concerns while reducing operational complexity for users trading on the platform.